The Top 11 Big Pharma Dividend Stocks Ranked By Total Return

Drug companies are often considered defensive in nature due to their stable earnings, through good economies and bad. People with illnesses or diseases will likely seek out treatments to improve their quality of life, regardless of the condition of the economy.

The high cost of life saving or improving medicines means that pharmaceutical companies often generate huge amounts of cash flow, which allows them to pay high dividend yields. Even in a recession, many of these companies are able to keep paying and raising dividends due to the large amount of cash on the balance sheet.

For all these reasons, pharmaceutical stocks are strong candidates for a dividend growth portfolio.This article examines 11 of the largest pharmaceutical stocks in detail. All 11 stocks pay dividends, and can be found on our list of 203 dividend-paying healthcare stocks.

The list is ranked by their total annual expected return over the next five years. Rankings are determined by expected annual return, based on the stock’s current yield, valuation changes, and earnings growth. All stocks can be found in the Sure Analysis Research Database.

Top Pharmaceutical Dividend Stock #11: Merck & Company (MRK)

With a market cap of nearly $170 billion, Merck & Company is one of the largest healthcare companies in the world. Merck develops, manufactures and markets medicines, vaccines, biologic therapies and animal health products. Merck has nearly 70,000 employees around the world and had sales north of $40 billion in 2017, 57% of which came from outside the U.S.

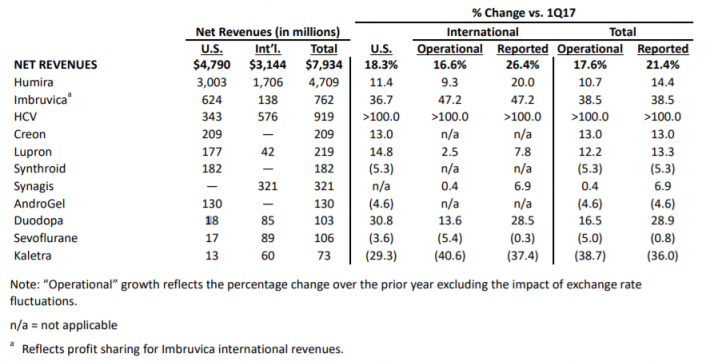

Merck reported first-quarter earnings on May 1st.

Source: Shareholder Meeting Presentation, slide 9.

Merck earned $1.05 per share in Q1, topping estimates by $0.05. Earnings grew 19% year-over-year. Revenue grew 6.5% to $10 billion, though this missed estimates by $60 million. Pharmaceutical revenue grew 9% to $8.9 billion and Animal Health sales increased 13.4% to $1.1 billion.

Merck’s Keytruda was the company’s top-grossing pharmaceutical product, at $1.5 billion during the quarter. It was announced during the quarter that Keytruda, which treats cancers such as melanoma that cannot be removed by surgery and non-small cell lung cancer, was found to show a longer survival rate for lung cancer patients. This should help to cement this drug as a great option to treat this type of cancer.

Also of note was Januvia, which treats diabetes, and increased sales by 7% year over year. Januvia is Merck’s second best-selling drug at $1.4 billion. Though on the small side compared to these top sellers, Merck’s Gardasil, a treatment for HPV, saw revenue increase 24% from the previous year.

While Merck’s earnings per share have grown less than 1% over the last decade, Merck saw solid improvement in sales in the most recent quarter for its largest pharmaceuticals. Add to that the increases in Merck’s smaller, but promising products, and we feel that Merck can see 3% annual EPS growth through 2023. Merck is expected to earn $4.22 per share in 2018.

Merck paused its dividend growth from 2005-2011 but has increased its payment every year since. Over the last 5 years, Merck has increased its dividend at a compound annual growth rate, or CAGR, of 2.7% per year. Shares of Merck currently yield 3.1%, above the yields of both the S&P 500 and the 10-Year Treasury Bond.

Shares of Merck have an average price to earnings multiple of 12.6 over the last decade. Based off of Merck’s current price ($62.02) and expected 2018 EPS, the stock has a forward multiple of 14.7. If shares were to revert to its historical valuation, the multiple could contract 3% per year.

Based off expected earnings growth (3%), dividend yield (3.1%) and multiple reversion (3%), we expect shares of Merck to have a total return of 3.1% per year through 2023.

Top Pharmaceutical Dividend Stock #10: Eli Lilly and Company (LLY )

Eli Lilly develops, manufactures and sells pharmaceuticals and animal healthcare products. Pharmaceuticals make up approximately 87% of sales. The company has a market cap of $95 billion and had revenue of $23 billion in 2017.

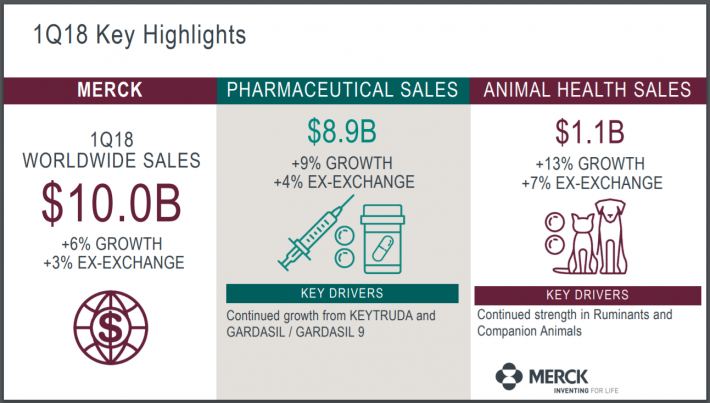

Eli Lilly reported first-quarter earnings on April 24th.

Source: Earnings Presentation, page 8.

Eli Lilly earned $1.34 in the first quarter, up 36.7% from Q1 2017. Revenue grew 9% to $5.7 billion, coming in $210 million ahead of estimates. Pharma sales grew 11% year over year, while Animal Health declined 1%. In Established Pharmaceuticals, Humalog, a fast-acting insulin drug, saw sales increase 12% to $792 million in the quarter. Humalog is Eli Lilly’s #1 selling drug. These gains were offset by declines in several products, most notably Cialis, as volumes declined due to weak demand.

While Established drugs saw pockets of strength, it is Eli Lilly’s New Pharmaceuticals that will drive future growth for the company. Trulicity is a single-dose pen that helps a patient’s body release its own insulin, and it grew sales by 82% from the same quarter a year ago. Sales of $678 million last quarter made it the second best-selling pharmaceutical product for Eli Lilly. Trulicity has 40% of the U.S. market share, and that should rise in coming quarters. Jardiance, which helps lower blood sugar in adults with type 2 diabetes, doubled sales from last year. These and other New Pharmaceuticals accounted for 25% of total revenue and drove 11% volume growth.

Due to the strength of the company’s new pharmaceuticals, we feel that Eli Lilly can grow earnings per share at a rate of 4% per year for the next 5 years. On the conference call, management raised its 2018 guidance for both earnings per share and revenue above the high ends of its previous guidance. The new midpoint of Eli Lilly’s EPS for 2018 is $5.15.

Eli Lilly elected to pause its dividend growth from 2009-2014, a very prudent move given the company’s struggling financial performance. The company’s dividend has grown with a CAGR of just 1.2% annually over the last 5 years. Shares currently yield 2.6%, above that of the S&P 500, but below that of the 10-year Treasury Bond. This is also the lowest yield on our list of top drug companies.

Eli Lilly’s stock has a 10-year average P/E multiple of 14.7. Based off 2018’s expected EPS and a current price of $87.39, Eli Lilly shares have a multiple of 17. If shares were to revert to their average P/E, shareholders would see a multiple reversion of 2.9% per year through 2023.

Combining earnings growth (4%), dividends (2.6%) and a multiple contraction (-2.9%), we estimate that Eli Lilly can offer shareholders a 3.7% annual return over the next five years.

Top Pharmaceutical Dividend Stock #9: AstraZeneca Group (AZN)

AstraZeneca develops and markets prescription medicines that treat cardiovascular, respiratory, inflammation and oncology diseases. The company has a market cap of $89 billion. AZN generated $22.5 billion in revenue in 2017.

AZN is based in the United Kingdom, but U.S. investors have access to the company through an American Depositary Receipt, or ADR.

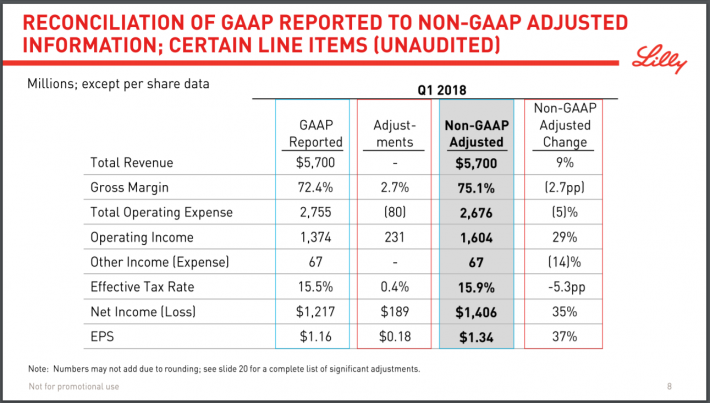

AstraZeneca released first-quarter earnings on May 18th. The company earned $0.48 per share, which beat estimates by $0.13, but declined 52% from the same quarter a year ago. Revenue declined 4.3% to $5.18 billion, and missed estimates by $60 million.

The major reason the company missed analyst estimates, is largely due to a sharp decline in the company’s Externalization Revenue. AZN has entered into several joint-ventures with other drug companies in order to gain access to markets and patients it doesn’t currently have access to. AZN’s Externalization Revenue declined 66% in the first quarter. AZN’s product sales, which make up the bulk of the company’s total sales, grew 2.9% during the quarter.

Below is a breakdown detailing how AZN’s different product lines performed during Q1.

Source: Earnings Presentation, slide 12.

AZN’s Crestor franchise has seen strong levels of competition throughout the world. The cholesterol drug saw sales decline 38% year over year, largely due to generic offerings in Europe and Japan. The company’s respiratory drug Symbicort also faced generic competition that led to a 6% worldwide decline in revenue. Symbicort, which accounts for about 12% of total sales, dropped 28% in the U.S. These two drugs together make up about 20% of revenues.

With declines in AZN’s best selling drugs, it is no surprise that the company has seen sharp drops in earnings. In fact, EPS declines have become the norm with AZN, as the company has seen earnings per share decline at a rate of 7.8% per year from 2008-2017. That being said, the company shouldn’t be completely ignored by investors.

Tagrisso, which is used to treat tumors that have a specific genetic marker, nearly doubled its sales totals in Q1 to $338 million. This drug was just approved in the U.S. in April. Lynparza, which helps those cells damaged by cancer repair themselves, grew revenue 109% to $119 million. There are several other new drugs that grew sales during the quarter, but more will be needed to counteract the loses from AZN’s two largest contributor to sales. New drugs contributed $400 million in additional sales compared to the previous year, a 66% growth rate. In addition, AZN’s revenue increased 31% in China, totaling more than $1 billion during the first quarter.

With the positive news from AZN’s newer drugs and sales growth in China, we think the company can grow earnings at 4% per year through 2023. AZN is expected to earn $1.69 in 2018, well above last year.

AZN grew dividends from 2003-2012, but has issued the same payment since 2013. Investors should be aware that AZN pays its dividend twice during the year, first in March and then again in September. Shares currently yield 4%.

Quality drug companies tend to trade with a price to earnings ratio of about 18. Based off the current share price of $35.18 and forecasted EPS of $1.69, AZN has a current multiple of 20.6. If shares of AZN were to meet our target P/E by 2023, then the stock would experience a multiple contraction of 2.7% per year.

Altogether, we expect shares of AZN to offer a total return of 5.3% per year over the next 5 years. The dividend is attractive, but the lack of growth is concerning.

Top Pharmaceutical Dividend Stock #8: Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb traces its roots back to 1887. Today, it is a leading drug maker of cardiovascular and anti-cancer therapeutics. The company has a market cap of more than $90 billion, and generated $21 billion in sales in 2017.

BMY released its first-quarter earnings report on April 26th. Earnings-per-share increased 12% year over year. The company grew revenue by 5.3%, to $5.2 billion. BMY projects earnings-per-share of approximately $3.40 in 2018.

Several of the company’s drugs showed growth last quarter. Eliquis, used to prevent blood clots, had sales of $1.5 billion, a nearly 37% increase. Opdivo, used to treat skin, lung and kidney cancers, grew sales by 34% to $1.5 billion. Opdivo was approved during the quarter for use in U.S. patients at risk for advanced renal carcinoma, which is responsible for up to 95% of all kidney cancer cases. This drug is also up for approval to treat several types of lung cancer. Both Eliquis and Opdivo are expected to see sales growth throughout the year. On the other hand, several of BMY’s drugs saw steep sales decline. Baraclude, which treats hepatitis B, and Reyataz, treatment for HIV, declined 20% and 30%, respectively.

While BMY managed to grow earnings during and after the last recession, the company’s earnings growth has fluctuated since 2010. Overall, the company has grown earnings at a rate of 6.6% annually over the last decade. To account for the somewhat unpredictable nature of BMY’s financial results, we feel comfortable in projecting annual earnings growth of 4% over the next five years.

BMY has increased its dividend at a CAGR of 2.2% per year over the last 5 years. For the past couple of years, BMY has given shareholders a $0.04 yearly raise. We expect that this trend will continue. The company has increased its dividend each of the past nine years.

BMY’s stock has an average multiple of 16.5 over the last ten years. The company’s recent share price is $56.56, meaning shares have a forward P/E of 16.6. If BMY maintains its average valuation, then the stock will have a 0.1% reversion per year through 2023.

We feel that shares of BMY can offer shareholders an average annual return of 6.8%. This is based off earnings growth (4%), dividend yield (2.9%) and a slight multiple reversion (0.1%).

Top Pharmaceutical Dividend Stock #7: Gilead Sciences (GILD)

Gilead researches develops and markets medicines with a focus on antivirals. The biotech company’s main product portfolio includes treatments for HIV and Hepatitis B and C, also known as HBV and HCV, respectively. Gilead has a market cap of almost $98 billion.

Gilead reported first-quarter results on May 1st.

Source: Earnings Presentation, slide 27.

Gilead earned $1.48 per share in the quarter, a 34% year-over-year decline. Earnings per share missed the average analyst estimate by $0.19. Revenue declined 21.5% year-over-year, to $5.1 billion. This result was $300 million below analyst estimates.

Sales and earnings declines were mainly the result of a steep decline in revenue of HCV drugs Sovaldi and Harvoni. These drugs have driven Gilead’s earnings per share up to dramatic heights starting in 2014. Earnings per share quadrupled from 2013 to 2014, as HCV treatments received incredible demand. Profit margins for these treatments were very high.

The issue with these HCV drugs is that they not only treat the patient, they cure them. While this is fantastic for the patient, it is not so great for the company. Eventually, the patient pool declined, leading to lower demand and lower growth. EPS for Gilead for 2018 is expected to be almost half of what it was at its peak in 2015.

Even with this bad news, HCV makes up a substantially lower amount of total sales today than it did just a few years ago. Going forward, declines likely won’t be as dramatic. Meanwhile, the HIV portfolio looks promising. For example, Genvoya, which prevents HIV from multiplying within a patient’s body, generated sales exceeding $1 billion in the first quarter. Sales increased 41% from the same quarter a year ago.

Gilead used $12 billion of its cash on hand to purchase Kite Pharma, giving the company access to the CAR-T drug Yescarta. This drug was approved in the fall of 2017 to treat patients with a certain type of B-cell lymphoma. Given the recent approval, it will take Yescarta some time to ramp up sales.

There are other drugs in the company’s portfolio that have a good chance of success as we in the coming years. Gilead has the rights for Galapagos’ Filgotinib, which is likely to see approval for use in patients with rheumatoid arthritis, Crohn’s disease and ulcerative colitis. Gilead’s nonalcoholic steatohepatitis drugs, or NASH, could be a winner for the company as it is believed that this market will be more than $20 billion as we enter the next decade.

On the backs of its HCV drugs, Gilead has seen earnings per share grow at a rate of almost 24% per year over the last 10 years. We have more modest expectations for the future. We forecast that Gilead will have EPS of $6.45 in 2018, and 5% annual growth through 2023.

Gilead has only paid a dividend since 2015. Since initiating the dividend, Gilead has rewarded shareholders with increases in the 10% range each year. The company may not have the dividend growth track record as some of the other companies on our list, but Gilead has plenty of cash and a secure 3% yield.

Gilead has a current price to earnings multiple of 11.7 using 2018 earnings estimates. We place a 2023 target multiple of 11 on the stock, meanings shares could suffer a slight multiple contraction of 1.2% per year if Gilead trades at our target valuation.

Altogether, we expect Gilead to return 6.8% per year for the next five years. This is a combination of our expected earnings growth (5%), dividend yield (3%) and multiple contraction (1.2%). While the sales and earnings decline from the company’s HCV products should become less going forward, Gilead will still need new drugs to return to growth.

Top Pharmaceutical Dividend Stock #6: Amgen (AMGN )

With a market cap of $126 billion, Amgen is the largest independent biotech company in the world. The company discovers, develops, manufactures and sells medicines to treat serious illnesses in the areas of cardiovascular disease, oncology, bone health, neuroscience, nephrology, and inflammation. Since beginning with just three employees in 1980, Amgen has grown to employ more than 19,000 people around the world. Amgen generated almost $23 billion in revenue last year.

Amgen reported first-quarter earnings on April 24th. The company earned $3.47 per share, coming in $0.22 ahead of estimates. Earnings-per-share increased 10.1% year-over-year. Revenue grew 2.6% from the same quarter last year to $5.6 billion, topping expectations by $160 million.

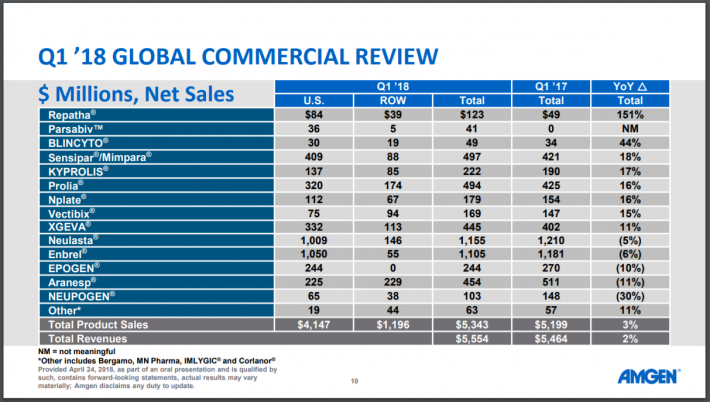

The following image shows the performance of Amgen’s product portfolio for the 2018 first quarter.

Source: Earnings Presentation, slide 10

While Amgen’s headline numbers were solid, the company saw sales decrease for some of its key products. Sales of Neulasta, a treatment for infections, declined 4.5% from the same period last year, due to increased competition. Enbrel, which treats rheumatoid arthritis, had a sales decline of 6.4%, largely due to a lower selling price. Enbrel’s selling price is expected to be lower this year as well. This is troubling, as these two products accounted for almost 41% of Amgen’s total sales in the first quarter.

Fortunately, Amgen has other products with strong growth potential. Sensipar had revenue growth of 18% due to strong demand. Sensipar,Amgen’s third bestselling drug, treats overactive parathyroid glands in patients on long-term dialysis for kidney disease. Prolia, which treats osteoporosis and is the company’s fourth-highest grossing drug, grew 16.2% for the quarter. Elsewhere, Repatha had revenue growth of 151%. Repatha helps to control cholesterol and is only available in the U.S. presently, though the company is waiting on test results to bring it to international markets. Overall, product sales were up 3% in the first quarter, which shows the depth of Amgen’s product portfolio.

Separately, Amgen has an agreement in place with AbbVie (ABBV) to begin producing a biosimilar for the blockbuster drug Humira, which is the top-selling drug in the world. Amgen will pay AbbVie a royalty and will market the biosimilar to most countries in the European Union beginning this October. In addition, Amgen will not be able to market its biosimilar in the U.S. until 2023.

Amgen saw earnings grow during the last recession and has increased EPS every year since 2008. Part of this growth is due to Amgen’s aggressive share repurchases. The company retired 31% of outstanding shares between 2008-2017. We target an annual earnings growth rate of 9% going forward. Amgen updated guidance on the most recent conference call and raised its EPS midpoint to $13.25 from $13.15.

Amgen has only paid a dividend to shareholders since 2011. But what the company lacks in length of its dividend growth history, it more than makes up for with sizeable dividend increases. Over the past 5 years, Amgen has increased its dividend at an average rate of 26.1% per year. Today, shares yield almost 2.8%.

Using updated 2018 guidance and a $191.01 share price, Amgen sports a price to earnings multiple of 14.4. This is above the company’s decade long average P/E of 12.9. If shares were to revert to their average multiple by 2023, the stock would face multiple contraction of 2.2% per year.

Amgen shares are expected to return 9.6% annually over the next five years. We estimate this total return based on 9% earnings growth, the 2.8% dividend yield, and a 2.2% annual decline from multiple reversion.

Top Pharmaceutical Dividend Stock #5: Pfizer (PFE)

Pfizer is one of the world’s largest pharmaceutical companies in the world, with a market capitalization of $217 billion. Pfizer researches, develops, manufactures, and markets medicines primarily in internal medicine, oncology, immunology, inflammation, and rare diseases. The company’s portfolio also included vaccines. Approximately 60% of sales come from its Innovative Health division, with Essential Health contributing the remaining 40% of sales.

Pfizer reported first-quarter earnings results on May 1st.

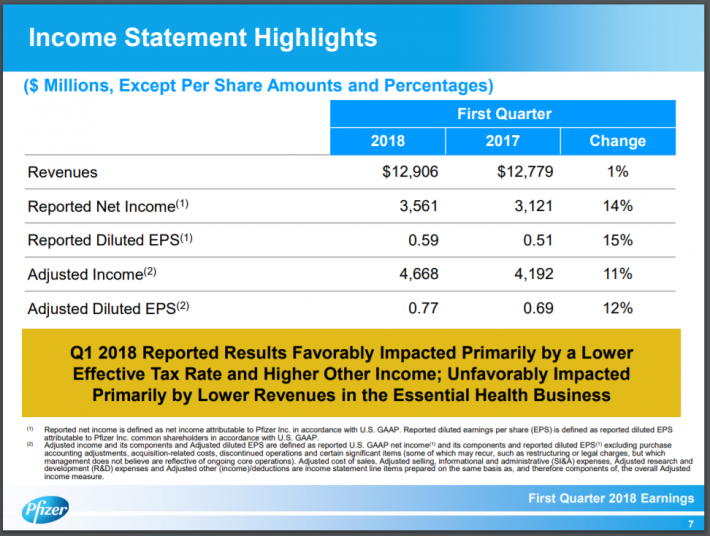

Source: Earnings Presentation, slide 7.

Pfizer earned $0.77 per share in the first quarter, coming in $0.02 ahead of analyst estimates. This was a 12% increase from the previous year. Revenue improved 1% to $12.91 billion, though this was $240 million below what analyst expectations. Innovation Health had revenue growth of 6% year over year while Essential Health declined 5%.

Eliquis, which we discussed earlier, saw solid growth, while breast cancer treatment Ibrance grew sales by 35%. Revenue for Pfizer’s rheumatoid arthritis treatment, Xeljanz, rose by 29% in the first quarter. These gains were partially offset by the loss of exclusivity of Viagra at the end of 2017 in the U.S., and beginning of 2018 in Canada.

In Essential Health, revenue declines were driven by a 15% drop in Sterile Injectable Pharmaceuticals. These declines were partially offset by 12% growth in emerging market revenue, and 53% growth from Pfizer’s line of biosimilars, particularly from arthritis drug Inflectra.

Pfizer has a large research and development budget, which has led to a plethora of approvals and potential blockbuster drugs. The company has had 22 approvals since 2011 and expects to receive regulatory approval on as many as 30 new products over the next five years. Because of these new products, we expect 5% annual earnings growth over the next five years.

Pfizer cut its dividend by 38% in 2009, in order to purchase Wyeth for $68 billion in cash and stock. Since 2011, Pfizer has been increasing its dividend by 6% per year. Shares offer a 3.7% yield, which is above both the S&P 500 and the 10-year Treasury Bond.

Pfizer shares recently trade at a price of $37.11. Using the company’s guidance, the stock has a forward multiple of 12.6. Shares have trade with a P/E of 13.5 over the last 10 years, meaning shares have potential to add 1.4% in multiple expansion to the total return through 2023.

Add it all up, and we expect total returns of 10.1% per year over the next five years. This is based on 5% earnings growth, the 3.7% dividend yield, and positive returns of 1.4% from multiple expansion.

Top Pharmaceutical Dividend Stock #4: Novartis AG (NVS)

Novartis, incorporated in Switzerland, researches, develops and markets products designed to improve the health of patients. The company has two core segments: Pharmaceuticals, which offers treatment for oncology, cardiovascular and respiratory illnesses, and Sandoz, its generics arm. Alcon, which provides products related to eye care, is being spun off into its own separate company. Novartis generated almost $50 billion in sales in 2017, and has a market cap of $175 billion.

Novartis announced first-quarter earnings results on April 19th.

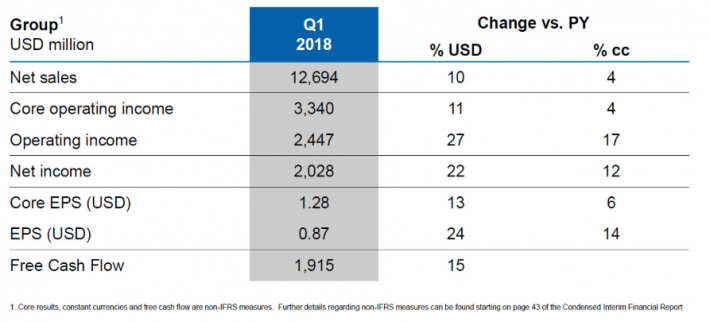

Source: Earnings Presentation, slide 5.

The company had EPS of $1.28 in the first quarter, a 13% improvement from Q1 2017 and $0.03 ahead of analysts’ estimates. Novartis grew revenues 10% to $12.7 billion, topping estimates by $120 million.

Cosentyx, a treatment for plaque psoriasis, grew sales by 35% in constant currency. Entresto, used to treat chronic heart failure, saw sales grow 126% year over year. Novartis’s top selling drug Gilenya saw 8% growth from Q1 2017 to $821 million. Sales of these drugs and others helped to offset a 2% decline in Novartis’s generics business.

Like other drug companies on our list, Novartis will be bringing to market its own biosimilar for AbbVie’s Humira. Novartis’s biosimilar Adalimumab has received a favorable recommendation from regulators in Europe. While there will be other competitors that bring their own biosimilar to market, even a small piece of this large market will be a boast to earnings results.

In a deal just completed with GlaskoSmithKline (GSK), Novartis sold its 36.5% share of the two company’s Consumer Healthcare joint venture for $13 billion. This capital will be reinvested in the business.

Novartis has increased earnings at a rate of 3.1% per year over the last decade. It also grew earnings during the Great Recession. Analysts expect that the company will see earnings per share of $5.27 in 2018, with mid-single-digit growth going forward. We expect 3% annual earnings growth through 2023.

Novartis has an annual dividend policy, usually paid in March of each year. Unlike many ADRs on our list, Novartis has increased its dividend in most years over the last decade. The dividend was reduced slightly in 2015, though it was increased in 2016. Shares yield 3.9%, but investors will have to wait until next year to receive the company’s annual dividend.

Using earnings per share guidance for 2018, Novartis shares have a multiple of 14.6. Due to strength of product line, we assign a 2023 target multiple of 18. If the valuation were to rise to meet this target, then the stock would experience multiple expansion of 4.3% per year over the next 5 years. We expect Novartis stock to generate returns of 11.2% annually, over the next five years.

Top Pharmaceutical Dividend Stock #3: GlaxoSmithKline

GlaxoSmithKline, which is incorporated in the United Kingdom, develops, manufactures and markets healthcare products in the areas of pharmaceuticals, vaccines, and consumer products. GSK’s pharmaceutical offerings address diseases in the areas of central nervous system, cardiovascular, respiratory, immune-inflation and others. GSK has a market cap of more than $100 billion.

GSK reported first-quarter results on April 25th. The company earned $0.31 per share, a 42.6% drop in earnings from a year ago. Revenue increased 8.8% to $10 billion USD.

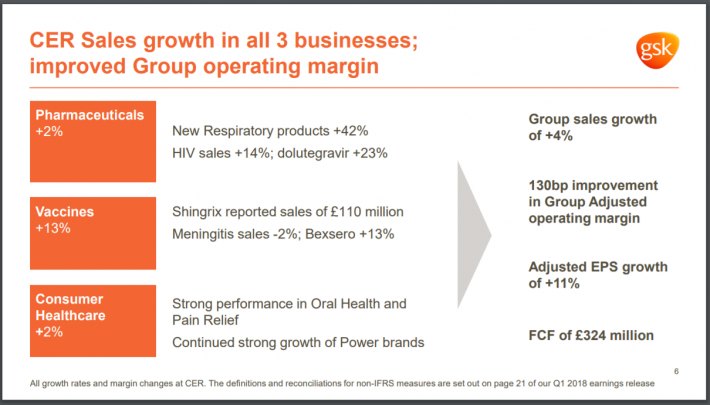

Source: Earnings Presentation, slide 6.

Sales for each division of the company were up during the quarter, with pharmaceuticals growing 7%, vaccines up 12%, and consumer healthcare up 8%. GSK’s shingles vaccine Shingrix, which launched in the first quarter, generated sales of $153 million, which was well above expectations. Shingrix has been recommended by the Central for Disease Control for use in patients 50 years and older. The vaccine has received the necessary approvals in Japan and Europe, so sales growth should continue.

While sales of the company’s respiratory drug Advair face pricing pressure due to generic competition, Ellipta respiratory products grew 25%. Sales of Ellipta are impressive but they haven’t made up for the declines in Advair, which grossed more than $2 billion in 2017. The company’s HIV drug saw sales increase by 3% in the U.S.

As stated above, GSK recently closed on its $13 billion purchase of Novartis’s stake in the two company’s consumer healthcare joint venture. Products include Sensodyne toothpaste, muscle gel Voltaren and Nicotinell patches. While over the counter consumer products have low margins compared to prescription drugs, they are well known to consumers and offer a steady source of revenue.

We expect GSK to earn $2.92 per share this year and forecast 3% earnings growth through 2023. GSK’s dividend has varied from year to year, but the stock has an average dividend yield above 5% for the last decade. Currently yielding 5.3%, GSK has one of the higher dividend yields on our list.

GSK currently trade at $42.48, giving the stock a forward P/E of 13.9 based off of expected earnings per share for this year. We feel that shares should trade with a P/E of 18, offering a potential multiple expansion of 5.3% per year through 2023.

In total, we foresee shares of generating total returns of 13.6% per year over the next five years. We arrive at this projection based off of growth in earnings (3%), dividends (5.3%) and multiple expansion (5.3%).

Top Pharmaceutical Dividend Stock #2: Sanofi (SNY )

Sanofi, incorporated in France, is a global pharmaceutical leader. The company develops therapeutic treatments and vaccines. Pharmaceuticals account for 85% of sales, with vaccines generating 15%. Sanofi is a globally diverse company, receiving a third of sales from the United States, a quarter from Western Europe and the remainder coming from emerging markets and the rest of the world. The company operates in more than 170 countries around the world.

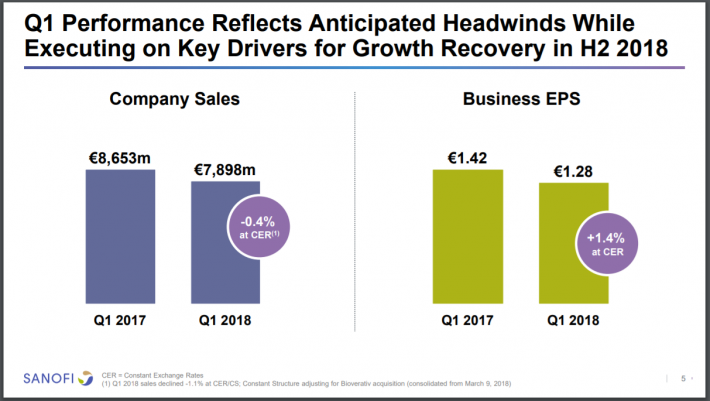

Sanofi released its first-quarter earnings report on April 27th.

Source: Earnings Presentation, slide 5.

Sanofi earned $0.79 per ADR share or 1.4% growth in constant currency. Revenue declined 0.4% to $9.71 billion. Sales declined 8.2% in the U.S. and 3.4% in its “rest of the world” segment. Emerging market growth was strong at 8.3% and Europe saw sales inch up 0.5% year over year.

Lantus, used to improve blood sugar control in adults and children with diabetes, declined 31% in the U.S. due to lower prices. The drug faced steep competition due to a biosimilar in Europe that caused sales to drop 9%. Lantus accounts for about 10% of Sanofi’s total sales.

On the positive side, Sanofi’s Dupixent, a treatment for moderate to severe eczema, is forecasted to see peak sales of $3 billion. The drug is also being tested for additional possible treatments, such as asthma.

Sanofi has also been active on the acquisition front. The company paid $11.6 billion for Bioverativ, and $4.8 billion for Ablynx. These acquisitions give the company access to the rare blood disorder market, which could be a high-growth category moving forward. Sanofi’s two purchases expands its reach in emerging markets and adds new diabetes and skin cancer drugs to the company’s portfolio.

Sanofi’s earnings have been up and down over the last 10 years, but that isn’t unusual for ADRs given fluctuations in currency exchange rates. The company expects to earn $3.28 per ADR share in 2018, which would be Sanofi’s best performance in the last decade. We expect earnings to grow at a 4% rate through 2023.

Sanofi’s dividend has also varied over the last decade, but that is due again to currency exchange. The company has increased its dividend for the last 24 years in its local currency. The company pays an annual dividend every June, so investors would have to wait until next year to capture the payment. Shares have a recent yield of 4.2%.

Over the last decade, Sanofi shares have traded with an average P/E of 18.3. At a current price of $42.48, the stock has a current multiple of just 13. If Sanofi’s stock were to reach its target multiple by 2023, shares could be looking at multiple expansion of 7.1%. This is the highest possible valuation expansion on our list. We forecast that Sanofi can offer a total return of 15.3% per year over the next five years.

Top Pharmaceutical Dividend Stock #1: AbbVie

AbbVie is a biotech company that specializes in developing and selling drugs in the areas of immunology, oncology, and virology. The company used to be part of Abbott Laboratories (ABT), but AbbVie was spun off into a standalone entity in 2013. AbbVie has a market cap of nearly $154 billion and generated $28 billion in sales in 2017.

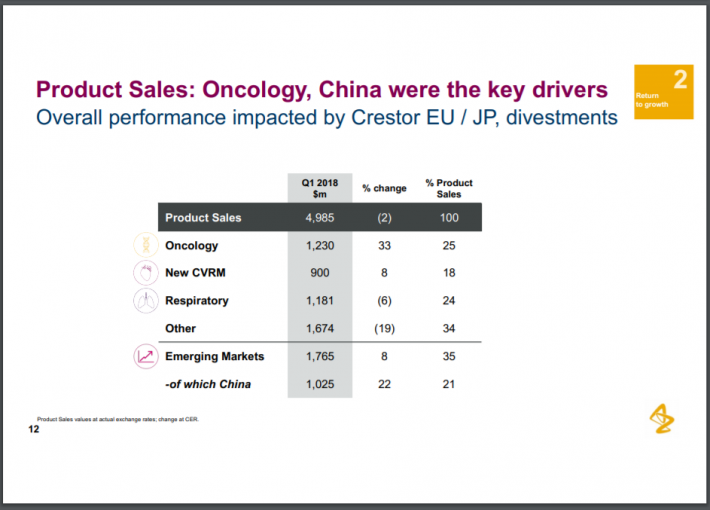

AbbVie reported first-quarter earnings on April 26th. The company saw earnings grow 46% from the prior year, to $1.87. This topped estimates by $0.08. Revenue grew 21% to $7.93 billion, a record for the standalone company. Due to the strong first quarter, the company also raised the midpoint of its earnings guidance, to $7.71 from $7.38. The following image shows the performance of AbbVie’s product portfolio during the quarter.

Source: Earnings Release, page 7.

As discussed, Humira is the top selling pharmaceutical in the world. AbbVie expects that the drug will reach $21 billion in sales by 2020. Sales rose 20% worldwide and 11.4% in the U.S. in the first quarter. Though AbbVie losses exclusivity for the drug in Europe this October, it will be paid a royalty by Amgen. AbbVie maintains its Humira rights in the U.S. through 2023.

Though Humira sales dwarf its other products, AbbVie has a strong portfolio. Imbruvica saw sales grow 47% during the first quarter. Imbruvica treats certain types of leukemia. AbbVie’s Hep C drug more than doubled year over year. While both of these drugs had revenues that are just a fraction of what Humira produced, they do show that AbbVie is showing growth in other areas. The company has some breathing room before they lose exclusivity for Humira in the U.S. to continue to grow these and other drugs.

AbbVie has grown earnings per share at a rate of more than 12% annually since the 2013 spinoff. Due to some possible slowdown in Humirainternationally, we forecast that the company can grow earnings at a 10% annual clip over the next five years.

AbbVie has increased its dividend at CAGR of 26% since 2013. The company gave shareholders a dividend raise twice in 2018, first by 11% for the February payment and then 35.2% for the May payment. 2018’s dividend stands to be some 40% higher than the total for 2017. Shares yield 4% at current prices.

In addition to a generous dividend growth policy, AbbVie bought back ~$7.5 billion of its own stock during a cash tender offer in May. This reduced the share count by about 4.5%.

AbbVie’s has an average price to earnings multiple of 14 since 2013. Based off of updated guidance, AbbVie has a current multiple of 12.6. If AbbVie were to trade at a valuation more in line with its historical average, then shares would experience a multiple expansion of 2.1% per year for the next five years.

Even with future losses for Humira, we still feel AbbVie can offer a very attractive return as the company’s other drugs should continue to see growth in the coming years. In total, we expect AbbVie to return 16.1% annually through 2023, due to 10% annual earnings growth, the 4% dividend yield, and 2.1% returns from multiple expansion.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure Dividend ...

more