The Best Casino Stocks: Where To Place Your Bets

There is an old saying that when it comes to casinos, the house always wins. Most people do not stand a chance to beat casinos on a regular basis, as casinos earn a guaranteed, almost fixed profit from the sum of the bets they receive.

Shareholders are rewarded for this, through earnings growth and dividends. The 4 major publicly-traded casino stocks all pay dividends to shareholders.

On the other hand, casino stocks are highly cyclical. It is not accidental that the four major casino stocks saw their earnings collapse by more than 90% in the Great Recession. Moreover, the four major casino stocks generate a significant portion of their revenues in Macau, which is the largest gaming market in the world and the only market in China where casinos are legal. Consequently, they saw their revenues and their earnings plunge in 2014, when China initiated an anti-corruption regulatory crackdown, which greatly reduced the gaming activity in Macau.

Fortunately for the companies, the gaming activity in Macau has rebounded and has now grown for 22 consecutive months. Nevertheless, the high sensitivity of casino stocks to any policy change in Macau and their pronounced cyclicality means investors should pick casino stocks carefully.

In this article, we will compare the expected 5-year returns of the four biggest casino stocks.

Top Casino Stock #4: MGM Resorts (MGM)

MGM Resorts owns and operates casinos, hotels and conference halls in the U.S. and China. It generates 81% of its revenues in the domestic market and 19% in Macau.

The company has by far the least exposure to Macau in this group of stocks. While it outperformed its peers during the two-year downturn in the region, Macau is currently in recovery, meaning MGM Resorts is poised to benefit much less than its competitors. On the bright side, the company opened its MGM Cotai resort in the first quarter. This resort has ample room to grow in the upcoming years.

MGM Resorts has a poor performance record, as it has posted losses for seven consecutive years in the last decade. Moreover, it has a weak balance sheet, with net debt around $20.0 B, while its interest expense takes up half of its operating income. Consequently, the company is vulnerable to any unforeseen downturn.

MGM Resorts has been rumored to be interested in acquiring Wynn Resorts (WYNN). However, the latter has refuted the rumors. In addition, MGM has a weak balance sheet, with a considerable amount of debt. As a result, this takeover is unlikely.

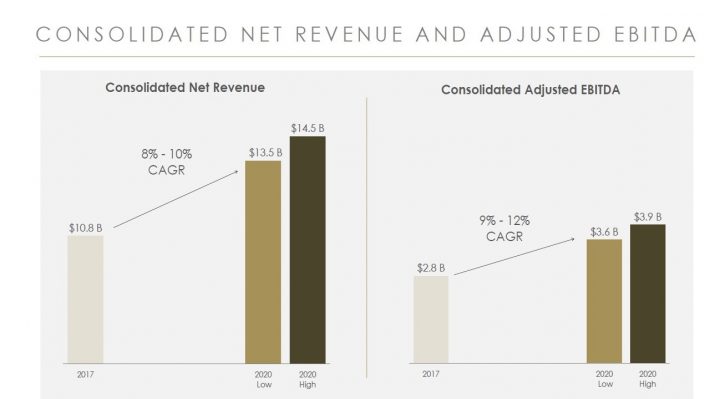

Thanks to its positive outlook for conventions and sports betting in the domestic market, the sustained recovery in Macau and the ramp-up in the activity in the new-built MGM Cotai resort, the company expects approximate 9% annual revenue growth and 10% annual EBITDA growth until 2020.

Source: Investor Presentation

However, given the poor performance record and the lack of consistency of the company, it is prudent to assume 5.0% annual earnings-per-share growth over the next five years.

Moreover, the stock is now trading at a price-to-earnings ratio of 20.1. As the company has reported losses in seven of the past 10 years, its price-to-earnings history is not reliable. Nevertheless, it is reasonable to expect the stock to maintain its current valuation in five years from now. Therefore, given its 1.7% dividend yield and 5% annual earnings growth forecast, the stock is likely to offer a 6.7% average annual return over the next five years.

Top Casino Stock #3: Wynn Resorts

Wynn Resorts owns and operates Wynn Macau and the Wynn Palace in Macau, as well as Wynn Las Vegas and Encore in Las Vegas. It generates 73% of its revenues in Macau.

As Wynn Resorts is highly leveraged to the gaming activity in Macau, it greatly suffered during the recent downturn in the area. On the other hand, as Macau is now strongly recovering, Wynn Resorts is growing at a fast pace. In Q1, the company exceeded the analysts’ estimates by a wide margin thanks to its 12% revenue growth in Wynn Macau and its 47% revenue growth in Wynn Palace. As the latter opened just two years ago, it is growing at a fast pace and has ample room to keep growing for years. Wynn Palace currently generates 39% of the total revenue of the company.

Source: Investor Presentation

Wynn Resorts has grown its earnings per share at a 5.3% average annual rate during the last decade. As the gaming revenue in Macau is expected to continue to grow at a fast pace in the upcoming years, the company can be reasonably expected to continue to grow at its historical pace.

The stock is now trading at a price-to-earnings ratio of 18.4, which is much lower than its historical average of 30.1. However, the stock traded at abnormally high ratios in some years due to its depressed earnings in those years. Overall, as the stock is likely to remain in growth mode over the next five years, it can be reasonably expected to trade at a price-to-earnings ratio around 21.0 in 2023. If this occurs, the stock will enjoy a 2.7% annualized gain thanks to the expansion of its valuation level. Including its 1.8% dividend, the stock is likely to offer a 9.8% average annual return over the next five years.

Top Casino Stock #2: Las Vegas Sands (LVS)

Las Vegas Sands is a leading developer and operator of integrated resorts in the U.S. and Asia. It generates about 60% of its revenues and 53% of its adjusted EBITDA in Macau.

Due to its high dependence on Macau activity, Las Vegas Sands saw its revenues and earnings plunge during the recent downturn in the area but the company has recovered thanks to the revival of Macau. As the gaming revenue in Macau is expected to continue to grow in the upcoming years, Las Vegas Sands is likely to grow its earnings per share at an approximate 5.0% average annual rate, which is very close to its 5-year average growth rate.

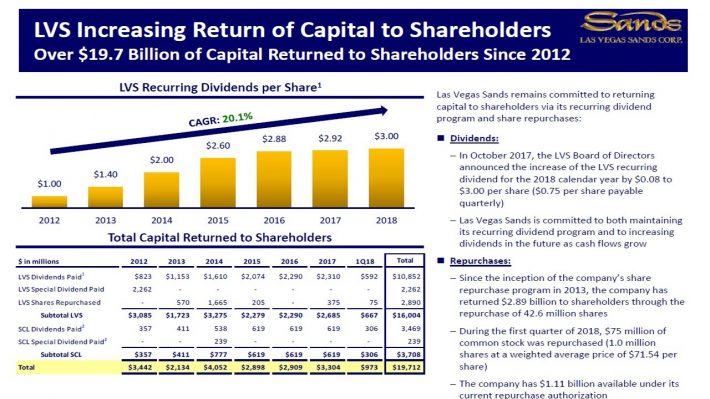

Las Vegas Sands stock has a 4.3% dividend yield, which is more than twice as much as the yield of its peers. Due to the recent downturn in Macau, the free cash flows of the company were insufficient to cover the dividend in the last three years. Even this year, the payout ratio is markedly high, at 82.4%. Moreover, the company has been repurchasing its shares in recent years. Overall, it has returned $9.1 B to its shareholders in the last three years whereas it has earned only $5.9 B and hence it has covered this deficit via the issuance of new debt.

Source: Investor Presentation

However, as interest rates are on the rise and the company has a heavy debt maturity schedule during 2021-2025, this strategy is not likely to enhance shareholder value. Moreover, due to the high payout ratio, investors should not expect meaningful dividend hikes going forward.

The stock is currently trading at a price-to-earnings ratio of 19.4, which is lower than its historical average of 23.0. If the stock reverts to its average valuation level within the next five years, it will enjoy a 3.5% annualized gain thanks to the expansion of its price-to-earnings ratio. Overall, given also its 5.0% annual earnings-per-share growth and its 4.3% dividend, the stock is likely to offer a 12.8% average annual return over the next five years.

Top Casino Stock #1: Melco Resorts (MLCO)

Melco Resorts owns and operates casino gaming and entertainment casino resort facilities in Asia. It generates 87% of its revenue in Macau and 13% in Philippines.

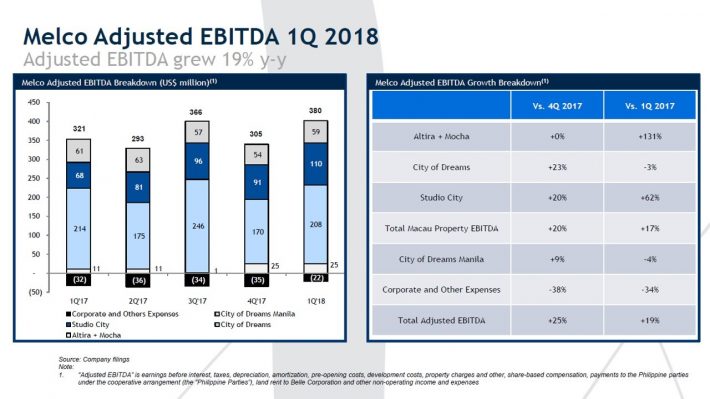

As Melco Resorts is the most leveraged to the gaming activity in Macau in this group of stocks, it is the one that benefits the most from the sustained recovery in the area. This is evident in its results, as the company is poised to almost double its earnings per share for a third year in a row this year. In the first quarter, the company exhibited strong performance in almost all its segments.

Source: Investor Presentation

Moreover, the company just opened the doors of its new Morpheus hotel in Macau, which cost $1.1.B and is one of the most luxurious hotels in the world. Thanks to this hotel and the strong momentum in Macau, Melco Resorts is likely to grow its earnings per share from $1.30 this year to approximately $1.90 in 2023 for a 7.9% average annual growth rate.

It is also worth noting that the long-anticipated Hong Kong – Zhuhai – Macau bridge will become operative shortly and will greatly facilitate the access of visitors to Macau. This is likely to be another tailwind for the gaming activity in the area.

Furthermore, the stock is trading at a price-to-earnings ratio of 18.9, which is much lower than its historical average of 27.6. However, if we exclude the last two years, which were characterized by depressed earnings and thus abnormally high price-to-earnings ratios, the historical average becomes 22.9. If the stock reverts to its average valuation level within the next five years, it will enjoy a 3.9% annualized expansion of its valuation level. Therefore, given also its 2.2% dividend yield, the stock is likely to offer an 14.0% average annual return over the next five years.

It is remarkable that Melco Resorts has posted positive free cash flows for 8 consecutive years and strong free cash flows in 6 out of the last 7 years, with the exception of 2015 due to the downturn in Macau. Given its healthy balance sheet and its low payout ratio, the company is likely to meaningfully grow its dividend in the upcoming years. On the other hand, income-oriented investors should remain cautious, as the company is highly vulnerable to economic downturns and is very sensitive to any casino-related policy change in China.

Final Thoughts

Thanks to the strong recovery in the gaming activity in Macau, Melco Resorts has the highest expected 5-year return. On the contrary, MGM Resorts, which has the lowest exposure to Macau, has the lowest expected 5-year return. Of course, investors should always check whether the market has priced too much future growth in the stock prices but Melco Resorts seems to be the most promising choice in this group right now.

On the other hand, investors should not forget that these stocks are very sensitive to any policy change in China that may affect the gaming activity in Macau. As political decisions are unpredictable, this is a risk factor to keep in mind. Moreover, the three stocks are very sensitive to any news related to the escalation of the ongoing trade war between the U.S. and China.

Although the end result of this trade war is unknown, it is not likely to have a long-term effect on the stocks. Overall, the four major U.S. casino stocks have promising growth prospects and positive expected returns over the next five years.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more