Teva: Is Another Dividend Cut In The Cards?

Teva's (TEVA) is facing pricing pressure in its core generics business, while the company is laden with debt. After disappointing Q2 results in which the company's gross margins declined from 57% to 50%, Teva cut its dividend 75% to 8.5 cents:

Generic drugmaker Teva Pharmaceutical Industries took a pounding from investors after it slashed its dividend by 75%. It also missed earnings estimates and cut forward guidance for the second time this year ... The new dividend of 8.5 cents a quarter is down from 34 cents. It gives the stock a 1.43% yield at the current share price.

The reduction will allow the company to reduce cash burn by about $260 million per quarter. If Teva's aim is to strike a balance between paring debt and returning capital to shareholders then another dividend cut could be in the cards.

Teva's Cash Flow Is In Free Fall

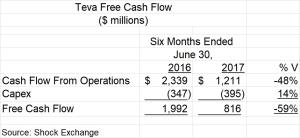

In the first half of 2017 Teva's earnings and cash flow diverged to the downside.

Cash flow from operations was $1.2 billion, down 48% Y/Y. Its capital expenditures actually increased by 14% which caused free cash flow ("FCF") to fall 59%. On a dollar basis free cash flow fell by about $1.2 billion or that time frame. In the first half of 2017 the company paid out dividends of $691 million. The company had to cut the dividend, lest run the risk of draining its cash flow even further.

Teva now has a debt load of $35 billion at 5.0x run-rate EBITDA. The main priority of new CEO Kare Schultz is to pare debt. Last month the company engaged in asset sales of over $1 billion. The CEO's next priority could be to better manage its working capital. It currently has accounts receivable and inventory of $12.5 billion. Reducing those balances could also be a boon to cash flow.

Generic Copaxone Could Punish Free Cash Flow

Earlier this month Mylan (MYL) received approval to offer a generic version of Copaxone, Teva's blockbuster multiple scleroris drug. In Q2 Copaxone represented 17% of total revenue and an estimated 47% of EBITDA. I previously estimated Teva's Copaxone sales could fall by 70% in year one of generic Copaxone's arrival:

That could imply Copaxone revenue could fall by 51% just on price reductions alone. Wells Fargo (WFC) analyst David Maris assumes Mylan discounts Teva's pricing by 40% in the 40 mg dosage market, and captures 40% market share. A 51% decline in price and a 40% decline in volume would equate to a revenue decline of approximately 70%.

If Copaxone's estimated quarterly EBITDA of $829 million also fell by 70% (assumes margins are constant) then its EBITDA could fall to $249 million. That would represent a quarterly decline of $580 million in EBITDA and an after-tax decline of approximately $481 million (assumes a 17% tax rate). Such an event could actually cause Teva's total free cash flow to turn negative. That said, it might be prudent for the company to eliminate the dividend until it can maintain consistent positive cash flow.