Tech Stocks Are Dominating The S&P 500

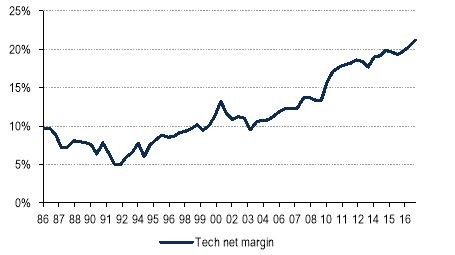

I think the technology sector is the most interesting sector because most of the top firms are in it and because it is driving earnings growth. We will look at some charts which show the direction of the sector. The chart below shows the secular upward trend in net margins. The sector has a few firms within it with monopolies such as AAPL with expensive phones, Facebook FB with social media, and Alphabet with search. Since tech is the most profitable sector, it drives overall profit margins higher. Usually profit margins regress to the mean, but that might not be the case anymore if tech is able to keep this trend going. There will definitely be a ceiling which will be reached at some point, but that’s an issue we’ll see in the next five years. Obviously, margins will fall during recessions, but the question is whether they will rebound to higher peaks afterwards like we’ve seen in the past 20 years.

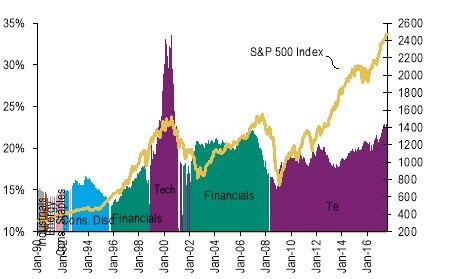

Technology is nearing 25% of the S&P 500. The characterization of the sector is confusing because it’s arguable that every sector uses technology. Wal-Mart, which is one of the biggest retailers in the world, bought Jet.com to get into online sales. Virtually every company has a website and social media presence. Most companies deploy some sort of artificial intelligence in their manufacturing processes. The line of what is and isn’t a technology company is blurred; it will only get more difficult to distinguish them as technology advances. Sector definitions are important because they determine multiples. That’s not to say that all tech firms get high multiples. Software companies get higher multiples than hardware firms. Besides valuations, sector determination effects ETFs which are quickly becoming drivers of equity prices.

The chart below shows the sectors which have had the largest representation in the S&P 500. As I said, the tech sector is nearing 25%. That is near the peak of the financials before the financial crisis, but it’s about 10% shy of the tech peak in the early 2000's. Since 1990, when a sector gets above a 20% representation, it starts to underperform. This cycle appears to be different from the others because tech profits are diverse and more sustainable than in the 1990's and financials in the 2000's. That’s a subjective claim, but my reasoning is that there’s not one guiding theme that can change and bring the sector down. In the 1990's, the internet was in its infancy. Companies back then didn’t reach the scale or importance of firms today. Their stocks were boosted on hype instead of earnings. Financials in the 2000's were helped by the housing bubble.

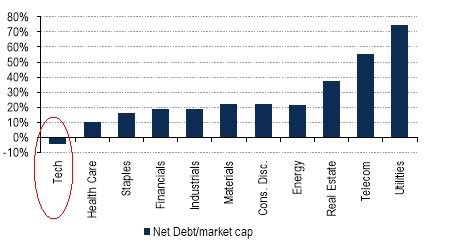

The kryptonite to technology stocks is inflation. The low inflation environment has helped them this cycle. Regulation and inflation would be the two most obvious problems which could bring the sector down in the medium term. For now, life is great for the sector because people use technology for most of their lives. It has increased people’s ability to work and connect. It’s even become addictive to the point of being a problem for some people. This expansion has led to technology firms having the best balance sheet out of any sector. As you can see, tech is the only sector with a negative net debt to market cap ratio because firms have a positive cash position.

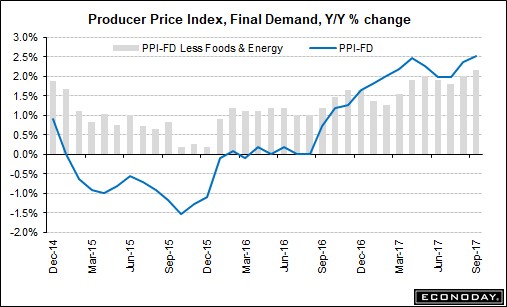

Producer Price Index

As I mentioned, inflation would be bad for tech stocks and what’s bad for tech can bring down the whole market. The producer price index was released on Thursday. This gives us an updated look at how inflation is tracking. The final delivery PPI was up 0.4% on a month over month basis which met expectations. It was up 2.6% on a year over basis which was 0.2% higher than last month. Less food and energy, the index was up 0.4% month over month which doubled the consensus. On a year over year basis the index increased by 2.2% which was up from 2.0%. The chart below shows the numbers I mentioned. There has been an acceleration in this index since late 2016.

Prices were obviously impacted by the hurricanes. The biggest commodity impacted was energy; it was up 3.4% in September after being up 3.3% in August. The labor department called the August effect hurricane related, so I wouldn’t expect this month to have a different cause since Irma hit in early September. Overall, this report is a positive sign for inflation, but doesn’t signal a trend change.

Jobless Claims

As I expected, the jobless claims fell back to normal last week. The report showed 243,000 jobless claims which was 8,000 below expectations. It was a 15,000 drop from the prior week which had its result revised down by 2,000 claims. Before the spike from the hurricanes, the report had 236,000 jobless claims showing how the labor market is back to its strong state. This implies the nonfarm payrolls report will get back to showing above 100,000 jobs created in October.

Powell Slips

After peaking at 66% during the day on Wednesday, Powell’s odds of being the next Fed chair slipped to closing at 39% on Thursday. When his odds drop, it’s bad for stocks. However, the stock market might be ignoring vacillations if they aren’t based on any news. Some people in the trading market may have wanted to take profits on their gains, which means stocks and bonds shouldn’t react to this double digit drop.

AAPL Trade

As a reminder, I said that buying AAPL made sense after there was too much pessimism about iPhone 8 sales. Since then, it’s up 3.6%. I think it makes sense to sell it within the next two weeks as the iPhone X is about to go on sale later this month. I would sell it unless you have a good feeling about the consumer’s willingness to spend $1,000 on a phone and Apple’s ability to produce as many phones as it needs.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more