Super Bowl LII Market Neutral Portfolios

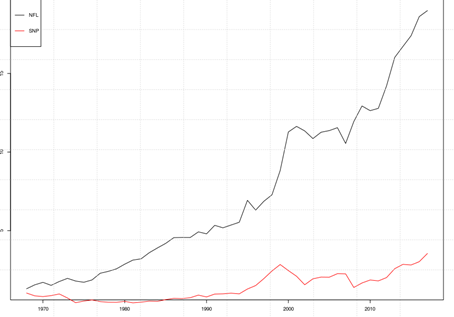

Super Bowl 52 is right around the corner. Many of the students that I work with at Rensselaer Polytechnic Institute are from outside of the United States and do not fully understand the history and economic impact of this uniquely American event. To better understand this, I offered a small prize to the first of our doctoral students to compare NFL and S&P 500 returns. One of our best students (and a former James Student Managed Fund manager), Majeed Simaan, answered the call. The results show that NFL ownership has been an outstanding private investment. Using the annual cost of a Super Bowl 30-second advertisement from 1967 to 2017 as a proxy for NFL franchise value, NFL investment earned an inflation-adjusted return of 6%. This compares to an S&P 500 return of only 4%. Risk-adjusted annual returns are also superior: the Sharpe ratio for NFL is 0.70 compared to just 0.24 for the S&P 500.

Cumulative Real Return for a $1 Investment in the NFL versus S&P 500 (Sources: AdAge, Quandl)

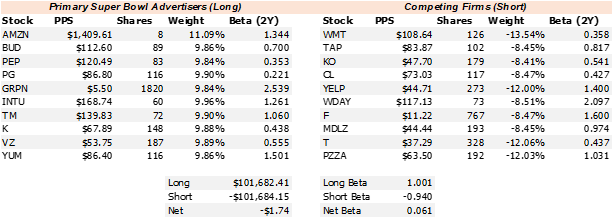

Even most large investors, however, do not have access to a large, private investment like the NFL. Most of us are simply consumers of the product. If one believes this trend is to continue, a potential tangential strategy is to buy a portfolio of this year’s Super Bowl advertisers. If declining NFL ratings and controversial protests are more of a concern, a portfolio of competitors may be more suitable. In this theme, consider a long (short) portfolio of Super Bowl advertisers (competing firms).

Both prices and CAPM beta calculations are from S&P Capital IQ. While Coca-Cola (KO) is a Super Bowl advertiser, Pepsi (PEP) has allocated more advertising expense to the NFL and is expected to do so again during the Super Bowl. Not surprisingly, one of the competing firms is Papa John’s (PZZA), a firm whose CEO resigned following criticism of NFL leadership.

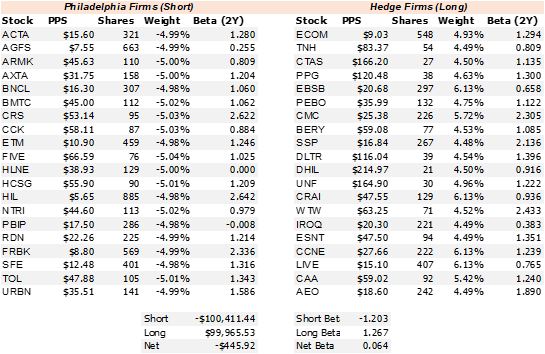

The advertising portfolio above does require a view on the current and future expectations about ongoing NFL success. Perhaps a more game-specific trade is more compelling to a serious NFL fan. This year’s big game features one of the most successful teams (New England Patriots) against one of the least successful (Philadelphia Eagles). Like Mohamed El-Erian and many other unfortunate souls, I’m a New York Jets fan. The Jets have not one the super bowl in nearly 50 years and are division rivals of the Patriots, of course, I would prefer to see the Eagles win but it’s difficult to see the seasoned Patriots losing in this scenario. The Eagles, like the Vikings whom they beat in the NFC Championship game, have never won the Super Bowl. A wait of over 50 years and a steady flow of alcohol could make things a bit crazy for Eagles fans.

Eagles fans are notorious for poor behavior. They threw snowballs at Santa Claus, for example. “Riots and chaos” were expected following the NFC Championship game. Light poles were greased in Philadelphia to prevent fans from climbing them. Fans were yelling obscenities about a 99-year old Minnesota Vikings fan. What happens when a championship-starved city with crazed football fans sees its team in the biggest game of the year? Potential insanity. Based on this, another NFL oriented portfolio is the “Philly Anarchy” portfolio.

This portfolio is made up of 20 firms based in the Philadelphia area and hedge firms from similar industries. Like the advertising portfolio, the net portfolio has near zero systematic risk but has the potential earn a quick profit from the fanaticism of the City of Brotherly Love.

Enjoy the game. E-A-G-L-E-S Eagles!

Disclosure: The author does not have positions in any of the mentioned securities at the time of this writing.