Starbucks: How The Company Can Deliver 16.7%+ Total Returns

Luxury businesses can be good sources of shareholder returns.

By selling goods or services well above the cost of production, luxury businesses benefit from high profit margins. They also benefit from higher-than-average consumer loyalty.

In the hot beverage industry, no brand says “luxury” like Starbucks does.

Starbucks benefits from the traits I mentioned earlier – they have high profit margins for their industry, fantastic consumer loyalty, and a tremendous record of creating value for shareholders. For dividend investors, their yield might be lowered than desired, but their dividend is growing at a rapid rate.

Starbucks has also increased its dividend very consistently. Dividends have grown every year since the company started paying them in 2010. If the company continues increasing dividends every year (which is very likely), the company will become a Dividend Achiever in 2020.

The Dividend Achievers are a select group of stocks that have paid increasing dividends for 10+ consecutive years.You can see the full list of all 273 Dividend Achievers here.

This article examines the investment prospects of Starbucks in detail.

Business Overview

Starbucks was founded in 1971 with the intent of delivering ethically-sourced coffee to the masses. Their first store was located at 1912 Pike Place, and this heritage is commemorated by Starbucks’ Pike Roast, one of their most popular blends of coffee.

Early Starbucks locations were very different form the locations we see today. The company initially sold only roasted coffee beans, not brewed coffee sold to drink immediately.

However, once Howard Schultz (the company’s current CEO) joined the company, he was captivated by a transformational trip to Italy. He wanted to emulate the Italian coffee shop’s ability to create a sense of community and belonging among their customers.

Today, Starbucks is a very large player in the food and restaurant business, second only in market capitalization to McDonald’s (MCD). With sales of $21 billion in fiscal 2016, the company is a globally diversified provider of premium coffee.

Growth Prospects

Historically, Starbucks has done a tremendous job of growing their business. They have compounded earning-per-share at a phenomenal 17.9% rate over the past decade.

This has resulted in tremendous total returns for investors.

Source: Starbucks 2016 10-K

As a large corporation with a market cap of ~$80 billion, it might not be obvious that Starbucks still has fantastic forward-looking growth prospects.

Starbucks is facing the beginning of a new era, making management changes and strategic investment to ensure the company’s future growth.

It was announced earlier in December that Starbucks’ tenured CEO Howard Schultz will be succeeded by Kevin Johnson.

Mr. Johnson has been on the Starbucks Board of Directors since 2009 and joined the company’s executive team in 2015 as President and Chief Operating Officer.

This change was positively received by investors, as Johnson’s technology background (he is a former Microsoft executive) will serve him well in building Starbucks’ brand as not just a coffee provider but a social area where customers enjoy a sense of community and belonging.

Meanwhile, Schultz (a Starbucks founder and long-time executive) will be taking on a reduced role as Executive Chairman and Chairman of the Board of Directors. This will shift his focus to the innovation, design and development of Starbucks Reserve® Roasteries around the world and the expansion of the Starbucks Reserve® retail store format.

These locations will serve coffee in the $10-$12 range, and will be far less numerous than the traditional Starbucks locations.

The first Starbucks Reserve location was opened in Seattle two years ago amid much positive response from consumers. The company is on pace to rollout new locations in Tokyo, New York City, and Shanghai over the next two years.

With Schultz’s track record, investors can be confident that Starbucks Reserve will be an additional driver of growth for this company.

Another growth driver for Starbucks is their focus on expansion into international markets. Namely, Starbucks is targeting China as an area for future growth, both in same stores sales and by opening new locations.

Source: Starbucks Investor Presentation

Over the next five years, Starbucks is aiming to open an additional 5,000 stores in China. This will allow them to double their store count and triple both their revenue and operating income in one of their largest markets.

Source: Starbuck Investor Presentation

With the company’s focus on technology under new leadership in Kevin Johnson, the introduction of Starbucks Reserve, and their focus on expanding their operation in China, the company is well-positioned to continue growing in the years to come.

Competitive Advantage & Recession Performance

Starbucks’ competitive advantage comes from three components – their brand, their consistency, and their focus on technology.

The Starbucks brand is well-known. The Starbucks logo with its iconic siren is one of the most recognized images in the world. Consumers around the world are highly likely to seek out a Starbucks to satisfy their coffee cravings, simply because of the company’s brand familiarity.

Starbucks also has a fantastic degree of consistency across their global operations. This comes from both their service and their product.

Starbucks employees demonstrate an incredible amount of consistency when it comes to polite service, timely order fulfillment, and the ability to create a positive social environment. Their products also have a great degree of consistency which is appreciated by their customers.

Anecdotally, I’ve seen this consistency first-hand. I’ve tasted Starbucks coffee in multiple cities across Canada and its always taste the same (delicious). The service is also pleasantly consistent.

Starbucks also enjoys a distinct competitive advantage from their investments in technology, which will pay them dividends in the years to come.

Source: Starbucks Investor Presentation

Starbucks markets their technology channel as the “Digital Flywheel,” which is composed of three major components:

- Rewards: By offering customers Star Points for making purchases at Starbucks locations, there is incentive for the consumers to return

- Payments: Starbucks customers are capable of placing and paying for orders using only their cell phones, which reduces labor costs and payment processing fees

- Personalization: Customers who use the Starbucks app receive personalized offers with the goal of increasing sales and improving the customers experience.

The best part?

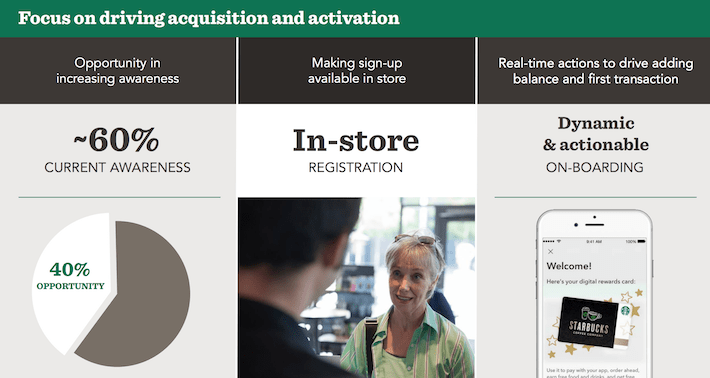

Source: Starbucks Investor Presentation

There is still a sizeable opportunity for Starbucks to increase their mobile engagement with their customers. Only 60% of their customers are aware of the benefits of using Starbucks’ mobile applications.

This kind of mobile engagement is rare in the restaurant industry, and provides Starbucks with a distinct competitive advantage moving forwards.

Valuation & Expected Returns

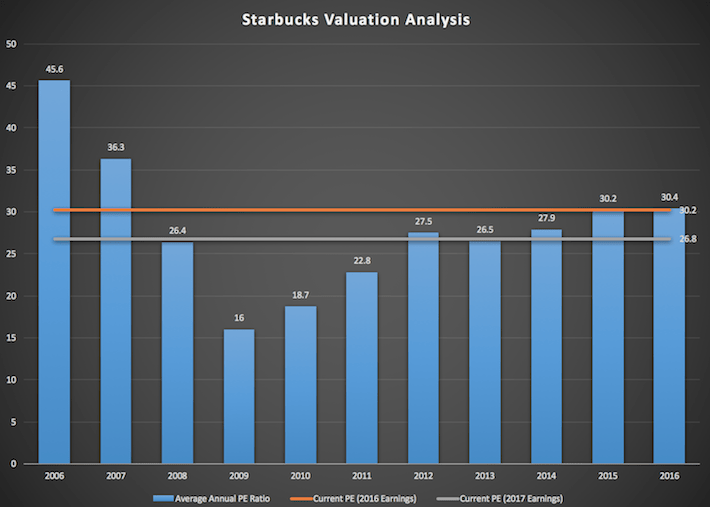

Based on 2016’s earnings per share of $1.91 and Starbucks’ current stock price of ~$57.65 (as of December 19), the company’s stock currently trades at a multiple of 30.2 times last year’s earnings.

Analyst consensus for fiscal 2017 earnings per share for Starbucks is $2.15. This means that Starbucks trades at a multiple of 26.8 times next year’s expected earnings.

Source: Value Line

Starbucks’ recent valuation is higher than at any point since before the financial crisis. This is justified given their attractive growth prospects and promising total return opportunities.

On December 7, Starbucks presented its “Five-Year Plan for Strong Global Growth Fueled by a Robust Pipeline of Innovation” at the Biennial Investor Conference.

In the presentation, the company announced their performance goals for the next five years:

- Opening 12,000 new stores globally (to a total of 37,000)

- 10% annual revenue growth

- 15-20% EPS growth

- Mid-single-digit annual growth in same store sales

If management fulfills their guidance outlined in their five-year strategic plan, then Starbucks expected returns will be composed of:

- Current dividend yield of 1.7%

- EPS growth of 15%-20%

Which means total returns of 16.7%-21.7%.

Keep in mind that the company currently trades at a premium relative to the S&P 500 (which trades at 26 times earnings).

As Starbucks grows, the growth premium associated with their stock will likely disappear, resulting in a valuation reduction. Further, if management has difficulty in reaching their 15%-20% EPS growth guidance, this will take away from Starbucks’ returns.

Thus the 16.7%-21.7% annual returns are likely a best case scenario, and returns have the potential to be lower than that in reality.

Final Thoughts

Starbucks is a fantastic business with a strong brand that provides a distinct competitive advantage.

The company also has attractive growth prospects, mostly from its new Starbucks Reserve initiative and its focus on opening new locations in unpenetrated worldwide markets. They also have a unique technology platform that is unlike any of their peers.

While the company trades at a premium relative to the overall market, this is likely justified because of the businesses strong growth prospects.

Starbucks is trading around fair value right now, but the company’s earnings growth will likely outpace their share price growth – resulting in valuation contractions.

With all this in mind, I expect the total return of Starbucks to outpace the overall market over the long-term (5+ years). This makes Starbucks a compelling addition for dividend investors focused more on future growth than current income.

Disclosure:

Sure Dividend is published as an information service.It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of ...

more