Starbucks: Brewing Up A Solid Third Quarter Earnings Report

Starbucks has been a solid dividend growth stock since it paid its first dividend in 2010.

Over the past 7 years, Starbucks has compounded its per-share dividend at a rate of 25.8% per year.

Source: YCharts

Starbucks’ short dividend history means that it does not qualify to be a Dividend Aristocrat (stocks with 25+ years of consecutive dividend increases) or a Dividend Achiever (stocks with 10+ years of consecutive dividend increases).

However, we continue to like this stock because we believe its future dividend growth will be well-supported by its long international growth runway, particularly in China.

On July 27, Starbucks gave us an update on their business progress in their third quarter earnings release, which covered the 13- and 39-week period ending July 2.

This article will analyze that earnings release in detail, and provide an update on the company’s valuation and dividend growth prospects.

Business Overview and Financial Performance Summary

Starbucks is the leading producer and retailer of premium coffee in the world.

The company was founded in Seattle, Washington, and has a current market capitalization of ~$80 billion. Starbucks is known worldwide for its consistency and excellent store ambience; the company often refers to its locations as the ‘third place’ for individuals, behind the home and the workplace.

There was a lot to like about the company’s third quarter earnings release.

Starbucks saw consolidated net revenues grow 8% from the same period a year ago, to a quarterly record of $5.7 billion. After excluding for $53.7 million of unfavorable currency effects, Starbucks’ revenue increased by 9% (one additional percent).

The company saw robust, broad-based growth in comparable store sales (or ‘comps’, for short). Here’s a summary:

- 5% comp growth in the United States

- 7% comp growth in China

- 4% comp growth across the global Starbucks enterprise

Growth in comparable store sales is very important for a large, entrenched restaurant company like Starbucks. Since Starbucks already has 26,736 stores, any uptick in existing store sales can be a meaningful driver in company-wide revenue growth.

Starbucks also continued their rapid pace of store expansions. Net of store closures, the company added 575 new stores globally.

This brings Starbucks’ global store count to 26,736 across 75 countries. Some quick math shows that Starbucks boosted their store count by 2.2% during the quarter, equivalent to an annualized growth rate of 9.1%.

Thus, even if Starbucks’ same store sales are held constant, the company is on pace for nearly double-digit revenue growth. After accounting for same store sales growth, Starbucks has the distinct opportunity to realize double-digit revenue growth until its new store additions realize a meaningful slowdown.

While revenue growth was very strong, Starbucks also made meaningful progress in improving its operating efficiency.

After backing out one-time charges, Starbucks’ third-quarter non-GAAP operating margin expanded by 100 basis points from the same period a year ago. Non-GAAP operating margin currently sits at 20.8%, up from 19.8% in last year’s quarter.

Starbucks’ robust revenue growth, improved operating margin, and share repurchases led to a bottom line growth rate that is significantly higher than the company’s rate of revenue growth.

Starbucks reported adjusted earnings-per-share of $0.55, a 12% increase from the same period a year ago. This is slightly above what I would expect from Starbucks over the long-run; however, I believe the company’s likelihood to compound earnings at an 8%-10% rate is quite high.

Starbucks also noted two significant strategic transactions that were completed in the quarter.

First, Starbucks has agreed to acquire the 50% of the Shanghai Starbucks Coffee Corporation that it did not already own. Previously, the other half of this joint venture was owned by Uni-President Enterprises Corporation and President Chain Store Corporation.

This transaction bolsters Starbucks’ presence in China and means that Starbucks will assume 100% ownership of 1,300 Starbucks locations across 25 cities in three Chinese provinces.

The second major strategic transaction announced in Starbucks’ third quarter earnings release is the closure of all 379 Teavana locations, which have been persistent underperformers.

In many ways, this decision to close the primarily mall-based Teavana locations should not be surprising given management’s comments on the second quarter conference call (~3 months ago):

…while the Teavana brand continues to be highly accretive to our tea business in Starbucks stores and is now being further leveraged with the introduction of Teavana branded ready-to-drink tea sold into CPG channels, many of our mall-based Teavana stores are continuing to have a negative impact on our overall result. We have launched a review process and intend to take clear action to improve the performance of our Teavana mall store portfolio.

– Starbucks’ CEO Kevin Johnson on the company’s 2Q17 conference call

In the short-term, the closure of the Teavana locations will have a negative effect on Starbucks’ financial performance as the business incurs Teavana-related impairment charges.

With that said, Starbucks is confident that ‘removing the ongoing operating loss and associated overhead will result in a fairly rapid payback of our exit costs’ (full quote below).

As Kevin mentioned, today, we announced the decision to close all of our Teavana stores. As a result of this decision, we took an asset impairment and goodwill charges of approximately $100 million in Q3. The charges are specifically called out in a separate line item on our income statement where we will also include various charges related to streamlining our operations over the coming quarters. Closure of the Teavana stores will occur over the next several quarters and additional related charges are likely to be incurred over the same periods. While resulting in near-term costs, removing the ongoing operating loss and associated overhead will result in a fairly rapid payback of our exit costs.

– Starbucks’ CFO Scott Maw on the company’s third quarter earnings release

The last major observation from Starbucks’ earnings release is its revision of 2017 financial expectations.

Starbucks revised full-year EPS expectations to $2.05-$2.06, down slightly from the consensus EPS estimate of $2.10. The stock is down about 7% as I write this, even though EPS has only been revised downwards by ~2.4%. Given the company’s compelling long-term growth prospects, I believe the current stock price is an opportunity to purchase Starbucks stock at a better valuation for long-term investors.

Dividend, Valuation, and Expected Total Return

Starbucks’ rapidly-growing dividend is one of the primary reasons why dividend growth investors would take an interest in this stock.

The company’s dividend growth helps to compensate for its paltry dividend yield; Starbucks trades with a dividend yield of 1.7% right now, which is below the average yield in the S&P 500 Index.

Importantly, dividend payments are not the only way that Starbucks returns capital to its shareholders. The company is also a frequent repurchaser of shares.

Starbucks’ third quarter earnings release noted that the company had repurchased 3.5 million common shares during the quarter. Approximately 95 million additional shares can be repurchased under existing share repurchase authorizations.

While share repurchases are usually beneficial for investors, I’m not so sure that stock buybacks are in the best interest of Starbucks’ shareholders right now.

This is because of the company’s high valuation.

Share repurchase only builds shareholder value when they are done at attractive prices.

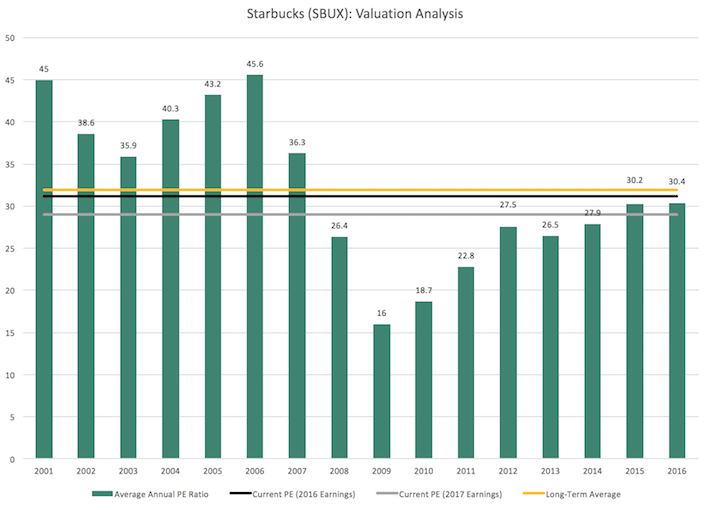

Many would argue that Starbucks’ stock is not attractively priced right now. The company’s current valuation is compared to its long-term average below.

Source: Value Line

Because of Starbucks’ high valuation, I would rather see the company devote cash to funding its expansion in China or growing its dividend instead of share repurchases.

With that said, the company still looks like a fantastic long-term investment at today’s levels, at least for those that can stomach its current valuation. I believe Starbucks is well-positioned to deliver double-digit total returns thanks to the following conservative estimates:

- 6%-8% revenue growth (this may be faster if comps and new store additions continue at their current trajectory)

- ~1% margin expansion

- ~2% share repurchases

- 1.7% dividend yield

For an estimate of 10.7%-12.7% total returns before the impact of valuations changes. Over the long-term, Starbucks valuation is likely to contract (hurting shareholder returns), but long-term total return expectations remain solid.

Final Thoughts

Normally, we look to companies with long periods of steadily increasing dividend payments as a source of dividend investment ideas. That’s why we provide extensive research on the Dividend Aristocrats and Dividend Achievers; a company must have a strong and durable competitive advantage to increase its dividend for 25 or 10 years.

However, looking exclusively at companies with long dividend histories can introduce errors of omission.

Just because the Aristocrats and Achievers are good dividend stocks does not mean that companies that are not Aristocrats or Achievers are bad dividend stocks.

Starbucks is a fantastic example of this. Despite having a relatively short dividend history, this company has compounded its dividend-per-share at a 25.8% rate over the past seven years. Moreover, Starbucks has a long growth runway through its rapid expansion in China and other international markets.

While the stock’s valuation leaves much to be desired, its third quarter shows that Starbucks’ underlying business continues to grow at a rapid pace. This company could be a solid, long-term buy-and-hold investment for those that believe in the Starbucks growth story.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more