SO: Dividend Achiever Nearing A 5% Yield

Investors who buy utility stocks are typically looking for stability and income. There is arguably no stock that better epitomizes these qualities than Southern Company (SO).

Southern has a solid 4.8% current dividend yield and a consistent track record of dividend growth. It has gone 276 consecutive quarters, going all the way back to 1948, having paid a dividend to its shareholders that is equal to or greater than the previous quarter.

And, Southern has raised its dividend each year for the past 15 years. This qualifies it as a Dividend Achiever.

The NASDAQ Dividend Achievers Index is made up of 273 stocks with 10+ consecutive years of dividend increases that meet certain minimum size and liquidity requirements.

You can see the entire list of all 273 Dividend Achievers here.

Read on to see why Southern is an ideal stock pick for income investors.

Business Overview

Southern is a large utility company. It serves 9 million electric and gas utility customers through its subsidiaries, predominantly in the southeast U.S.

Southern operates almost entirely on the regulated side of the industry. But that is poised to change moving forward. Over the next five years, it plans to reduce its exposure to state-regulated utilities.

Source: 2016 Analyst Day presentation, page 8

Earlier this year, Southern merged with AGL Resources in an $8 billion acquisition. The merger expands Southern’s natural gas capacity, and diversifies its geographic footprint. Southern will have a greater presence in the Midwest as a result of the deal.

The company’s fundamentals are very solid. Southern displays remarkable consistency, largely because of its stable business model.

Source: 2015 Annual Report, page 3

The bump in the road over the past five years was due to Southern’s massive Kemper project. The Kemper facility is a project that involved the use of lignite coal, which once held promise as a clean-coal technology.

However, Southern has absorbed significant cost overruns since starting the project. Higher-than-expected construction costs at Kemper have amounted to significant charges over the past three years:

- 2013 one-time charges of $729 million

- 2014 one-time charges of $536 million

- 2015 one-time charges of $226 million

Fortunately, the extra costs have wound down over time. And, Southern’s core operations have performed smoothly. Earnings-per-share excluding Kemper-related charges and other one-time items have grown consistently.

The good news is that the company has steadily improved more recently. In 2015, Southern’s earnings-per-share increased 19%.

Over the first nine months of 2016, earnings-per-share rose 7.8% from the same period last year. Management expects 2017 to be another year of modest growth.

Source: 2016 Analyst Day presentation, page 73

Moving forward, Southern forecasts mid-single digit earnings-per-share growth on an annual basis. This should be more than enough growth to continue increasing the dividend each year.

Growth Prospects

Admittedly, there are not many growth opportunities for large utility companies like Southern. Electricity is nation-wide, which essentially limits Southern’s revenue growth to U.S. GDP growth.

However, there is one significant growth opportunity for Southern—renewable energy. Southern is investing aggressively in its Southern Power, a clean wholesale energy provider.

Southern Power owns no coal or nuclear facilities. Instead, it owns 36 clean natural gas, solar, wind, and biomass generators totaling over 10,000 megawatts of capacity.

It is solidly profitable, and is generating impressive growth.

Source: Southern Power Fixed Income presentation, page 11

Southern Power is in good financial shape. It has a diverse group of customers at the core power business, that spreads across multiple industries. And, its customers generally have high credit ratings.

Source: Southern Power Fixed Income presentation, page 8

Growth from new, more efficient sources could not come at a better time for Southern, given its ordeal with the Kemper facility.

Competitive Advantages & Recession Performance

Southern is a major U.S. utility, which provides it with scale benefits. The company is highly profitable, and there are clear barriers to entry in the utility industry.

Utilities are extremely capital-intensive businesses, meaning it is almost assured that Southern is not under threat from competition.

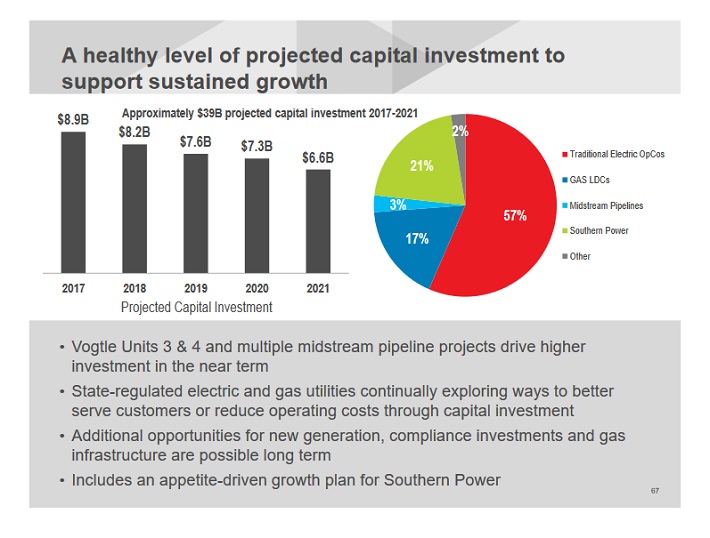

Any competitive threat that might exist is further mitigated by Southern’s consistent capital investment program. The company invests significant amounts into improving and modernizing its assets. This helps Southern receive rate increases each year.

Source: 2016 Analyst Day presentation, page 67

A major operating advantage for Southern is that it sells electricity, which consumers cannot do without. Even when the economy enters recession, Southern enjoys stable profitability.

This is why utilities are among the most recession-resistant businesses in the entire economy. Southern’s earnings-per-share during the Great Recession are as follows:

- 2007 earnings-per-share of $2.28

- 2008 earnings-per-share of $2.25

- 2009 earnings-per-share of $2.32

Southern managed to grow earnings-per-share from 2007-2009. This kept its dividend payments intact, and allowed Southern to continue raising dividends, even in the Great Recession.

Valuation & Expected Total Return

Southern stock trades for a price-to-earnings ratio of 17. This is below the average price-to-earnings ratio of 25 for the S&P 500 Index.

Since 2000, Southern has traded for an average price-to-earnings ratio of 15. While Southern stock is cheaper than the S&P 500, it is trading above its own average.

Therefore, the stock appears to be fairly valued. Going forward, investor returns will be comprised mostly of earnings-per-share growth and dividends.

A reasonable breakdown of future shareholder returns could be as follows:

- 4%-6% earnings-per-share growth

- 4.8% dividend yield

Under this scenario, shareholders would generate approximately 9%-11% annualized returns.

Final Thoughts

Southern Company has mostly recovered from its Kemper project cost-overruns. Going forward, it should continue to see modest earnings-per-share growth from customer additions, and rate increases.

In addition, Southern can achieve growth through acquisitions and in renewable energy projects.

For investors looking for stability and high dividend yields, the utility sector is a haven of potential investment opportunities. Southern is a strong stock pick for rock-solid dividends.

Disclosure:

Sure Dividend is published as an information service.It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of ...

more