Sell Cameron Before Schlumberger Invokes Its MAC-Out Clause

In a shot in the arm to the oilfield services sector, in August Schlumberger SLB announced it was acquiring Cameron International CAM for $66 per share -- a 56% premium to its previous share price. The entire oilfield services sector traded up on the announcement. It hurt me personally as I was holding puts on CAM and had already started counting my profits.

Most merger agreements include a material adverse change "MAC" clause which allows the buyer to terminate the transaction in case of a material adverse change to the business of the seller. A material adverse change can be interpreted broadly, including but not limited to, a loss of a large client, the expiry of a patent or trademark deemed important to the business, or a sharp reduction in prices.

The world has changed since the deal was announced. I believe there is a real possibility that Schlumberger could or "should" invoke its MAC out. Here's why:

Oil Prices Have Fallen

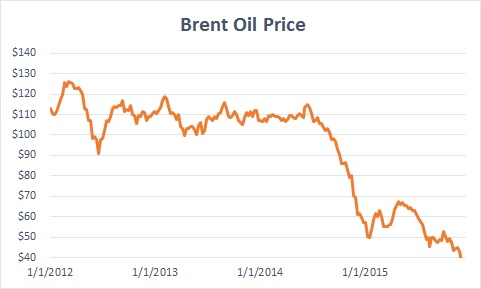

Oil prices diverged to the downside in Q2 2014; coincidentally, that's also when the Fed began to taper its bond buying program, or at least speak earnestly about it.

When the Cameron deal was announced brent oil prices hovered around $50. They have since fallen below $37 -- a decline of over 25%. Looked at another way, average oil prices have fallen by 13% from $52 in Q3 2015 to $45 in Q4 2015. That means Schlumberger and Cameron's clients are realizing less revenue for each barrel of oil since the deal was struck. They could share that pain with Cameron by cutting E&P further or asking for price concessions.

Fed Rate Hike, China Currency Devaluation

Last week the Fed hike rates for the first time in nearly a decade. Though the hike was on 25bps, it signals the end of Fed stimulus for now. U.S. GDP has grown steadily since the financial crisis of 2008/2009, but that was under a zero interest rate environment. Sans Fed stimulus and no semblance of fiscal policy to spur the economy, I expect GDP growth to slow from here. Secondly, since the hike, the S&P 500 SPY has fallen nearly 4%. At a minimum, the assets that the Fed put on individuals' balance sheets by spurring the stock market or commercial real estate will also likely decline.

In early August China devalued its currency about 2% against the dollar. The move came amid disappointing net exports. It also made exports to China -- oil, iron ore commodities, etc. -- more expensive. Since August, China's currency has fallen another 4% against the dollar. This does not bode well for oil prices or for countries looking to export to China.

Expected Default Rates For Oil Companies Have Spiked

Oil companies feasted on cheap debt to fund themselves after the crisis. Many have sub-optimal capital structures and are now being exposed. Though oil prices have fallen, principal and interest payments have remained constant. According to Moody's, the market value of high yield energy and basic material sector debt now trades at 72%, down from a high of 107% last year. The North American oil & gas space has seen 15 defaults so far this year and Moody's expects more if oil prices remain at current levels. It begs the question, "With so much cash flow being sucked up by debt obligations, who has money to fund E&P projects?"

Big drivers of offshore E&P like Petrobras PBR , British Petroleum BP and PEMEX have canceled drilling contracts and equipment orders. According to Forbes, "the ultra-deepwater rig market is currently in a phase of oversupply, after years of heavy capital spending by drillers." This could negatively impact purchases of subsea equipment going forward.

In Q2 2015 Cameron's subsea segment (over 25% of revenue) was up only 4% sequentially, while total revenue fell 2%. I believe the company will be hard-pressed to grow its top line from here, jeopardizing the $300 - $600 million cost synergies expected from the merger. If Cameron gives a dismal outlook for 2017, it may be time for Schlumberger to re-price the deal or pull the plug altogether.

Disclosure: I am short CAM.

Good Luck with this one. Cameron is already changing their building signs to Schlumberger's in Houston.