Sell Ahead Of Lock-Up Expiration: Cotiviti Holdings, Inc.

Cotiviti Holdings, Inc. (NYSE: COTV) - Sell or Short Recommendation

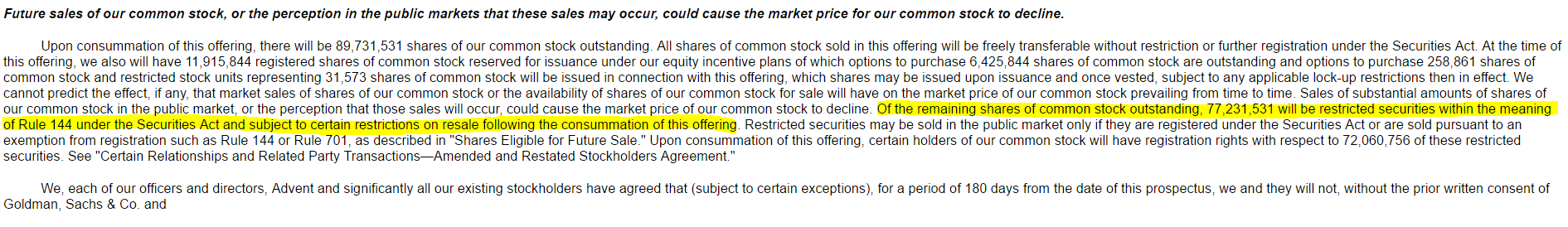

The 180-day lockup period for Cotiviti Holdings, Inc. is scheduled to expire on Nov. 28, 2016. At that time, the pre-IPO shareholders will be able to sell their 77.2M shares, potentially flooding the market and driving the price down as a result. The 77.2M restricted shares represent approximately 86% of the 89.7M outstanding shares.

If the thirteen insiders (as well as funds held by Advent International) sell even a portion of their holdings, they could push COTV stock price down considerably due to an oversupply of shares on the market. We recommend either selling or shorting COTV shares in advance of the IPO lockup expiration. We predict a stock decline of approximately 4%, which is inline with what we have found in past research. We first previewed the IPO lock up expiration to our premium readers here.

(COTV S-1/A Filing, Edgar Pro-Online)

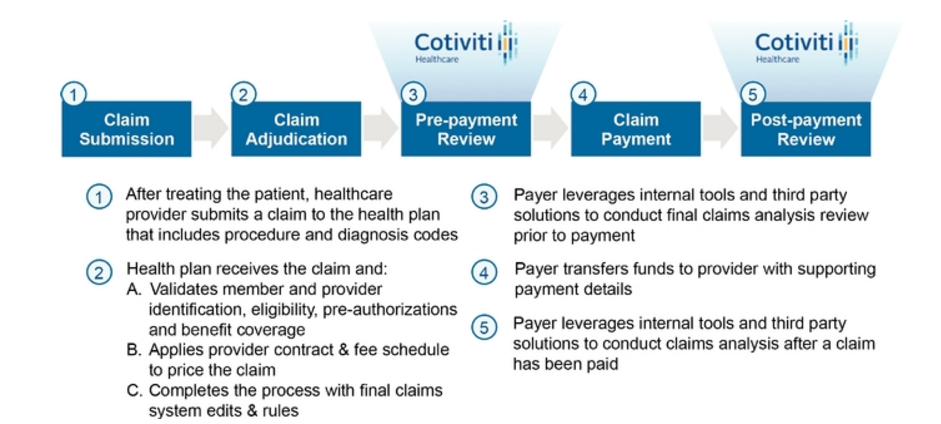

Business summary: Payments solutions provider for the healthcare and retail industries

Based in Atlanta, Georgia, Cotiviti Holdings, Inc. provides analytics-driven payment solutions for the healthcare industry. It counts among its customers Medicare, Medicaid and the 40 largest healthcare providers in the country. It also provides payment solutions for eight out of the 10 largest retailers in the U.S. and more than 40 retailers in total.

Per its filings, Cotiviti Holdings was formed in 2014 through the merger of Connolly Superholdings, Inc., and iHealth Technologies, Inc. As we described in our IPO preview, Connolly was a leader in providing post-payment solutions for accuracy; iHealth was a leader in providing pre-payment solutions for accuracy. The merger allowed Cotiviti Holdings to greatly expand its ability to provide solutions for its customers.

(COTV S-1/A Filing, Edgar Pro-Online)

Executive Management

CEO Doug Williams served as the CEO of iHealth Technologies from its founding in 2001. Before this position, Mr. Williams held executive positions at Cigna Healthcare, Magellan Specialty Health and Vivra.

Dr. Richard Pozen, Chief medical officer and executive vice president, co-founded iHealth Technologies. Dr. Pozen has more than 40 years of experience in the medical field. He founded Cardiology Network, Inc. and held leadership positions at Magellan Specialty Health and Vivra.

Third quarter financial highlights

Cotiviti Holdings, Inc. released its third quarter financial report on Nov. 9, 2016. The company reported that it had profits of $4.6 million during the quarter, beating the expectations of analysts. The company reported adjusted earnings per share of 36 cents while analysts had estimated earnings per share of 31 cents. It had revenues of $156.2 million during the quarter and expects its total yearly revenues to range between $615 to $620 million. The company also increased its full year 2016 guidance.

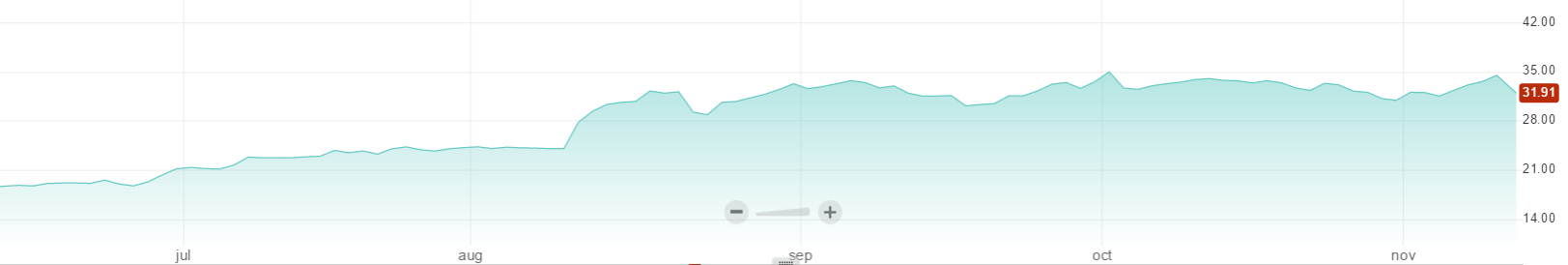

Early market performance: strong and steady growth

Cotiviti Holdings made its market debut on May 25, 2016 and raised $238 million through its offer of 12.5 million shares at $19, the high end of its initial price range of $17 to $19. COTV share price dipped 9.9% during the first day. Since then, the company's stock has soared. As of the market close on Nov. 10, the share price was $32.39. Analysts estimate that the company will experience earnings growth between 27 cents and 62 cents over the next few years and have a mean target price of $34.67, just slightly above where it is currently trading.

(Click on image to enlarge)

(Source)

Conclusion: Sell or Short COTV before its lockup period Expiration

Given Cotivi's early market success, its pre-IPO shareholders are likely ready to take initial profits.

On 11.28, one corporation and 13 individuals will be able to sell their pre-IPO shares.

Our research has shown that lockup expirations are often more pronounced when the firms have a tech focus and include multiple and diverse insiders.

For these reasons, we recommend investors sell or short shares of Cotiviti Holdings in advance of the IPO lockup period expiration catalyst.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in COTV over the next 72 hours.