Sea Could Sink When IPO Lockup Expires

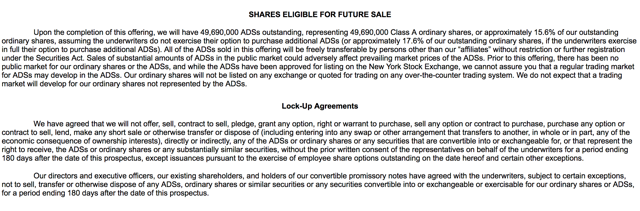

The 180-day lockup period for Sea Limited (SE) expires on April 18, 2018. When this six month period concludes, the company’s pre-IPO shareholders will have the ability to sell their large blocks of currently-restricted shares. The potential for an increase in the volume of shares traded on the secondary market could negatively impact the stock price of SEA.

(Click on image to enlarge)

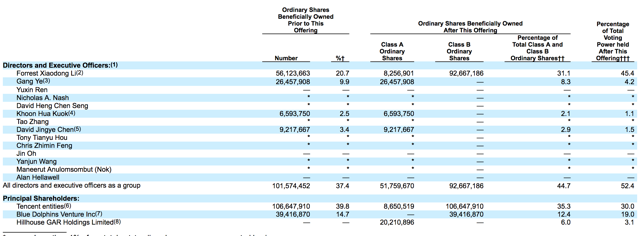

This group currently-restricted shareholders includes fourteen individuals and three corporate entities.

(Click on image to enlarge)

Currently SEA trades in the $10-$11 range, significantly lower than its IPO price of $15. Shares of Sea Limited started off well by closing on its first day of trading in the secondary market at $16.26. However, the shares have since been in decline.

Business Overview: Internet Platform Provider in Greater Southeast Asia

Sea Limited is a provider of internet platform services in Greater Southeast Asia. It focuses on ecommerce, digital entertainment, and digital financial services across three primary platforms. The company offers financial services to businesses and individuals through its AirPay mobile app, which includes payment and e-wallet services. The AirPay app also offers services through computers as well as mobile devices, and the app has features for payment processing services through Shopee, another platform the company offers.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more