Schlumberger Q2 Earnings Beat; Down Y/Y On Weak Activity

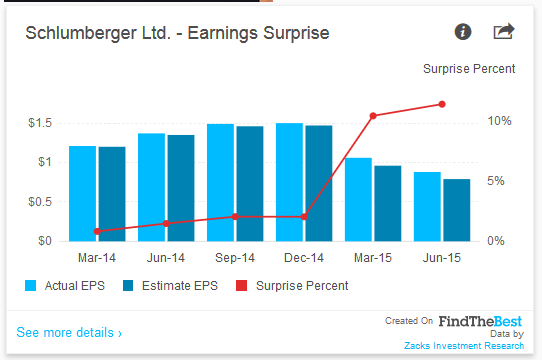

The world’s largest oilfield services provider Schlumberger Ltd. (SLB - Analyst Report) reported adjusted second-quarter 2015 earnings of 88 cents per share (excluding special items), which came above the Zacks Consensus Estimate of 79 cents.

However, the quarter’s results decreased from $1.37 per share earned in the year-earlier quarter. The decline stemmed from a severe fall in North American land activity and related pricing pressures. International operations were affected by reduced customer spending along with customer budget cuts and pricing concessions.

Schlumberger Ltd. - Earnings Surprise | FindTheCompany

Total revenue of $9.0 billion was down 25% from the year-earlier level of $12.1 billion. This also came below the Zacks Consensus Estimate of $9.1 billion.

Second-Quarter Highlights

All groups – Reservoir Characterization, Drilling Group and Production Group – registered year-over-year fall in revenues. Production Group revenues declined due to lower pressure pumping services in North America, while Reservoir Characterization and Drilling Group revenues fell as a result of a sharp fall in exploration-related services and development drilling activity. Product, software and multi-client sales also declined as customers spent lesser on exploration and discretionary items.

Reservoir Characterization: This group posted revenues of $2.4 billion, down 25% from the prior-year quarter. Pre-tax operating income was $642 million, which decreased 31% year over year.

Drilling Group: This group recorded revenues of $3.5 billion, which fell 25% from the year-ago quarter. Pre-tax operating income was $685 million, down 30% year over year.

Production Group: Revenues recorded by this group were $3.1 billion, which declined 26% from the year-earlier quarter. Pre-tax operating income was $397 million, down 44% year over year.

Financials

As of Jun 30, 2015, the company had approximately $7.3 billion in cash and short-term investments and $9.1 billion in long-term debt. In the reported quarter, Schlumberger repurchased 5.8 million shares of its common stock at an average price of $90.01 for a total purchase price of $520 million.

Zacks Rank

Schlumberger currently carries a Zacks Rank #3 (Hold). Better-ranked stocks from the same space include Enbridge Energy Partners L.P. (EEP - Analyst Report), EQT Midstream Partners L.P. (EQM - Snapshot Report) and Cheniere Energy, Inc. (LNG - Snapshot Report), sporting a Zacks Rank #1 (Strong Buy).

Disclosure: more