RXi Pharmaceuticals Is Still On Track With Its Sd-rxRNA Technology Despite Recent Sell-Off

Shares of RXi Pharmaceuticals (RXII) have been hammered over the last few weeks with a steep decline, but despite this drop in share price the long term thesis of the company remains the same. The company presented a week ago on Jan 12, 2015 at the Biotech Showcase conference. We believe that the drop in share price has nothing to do with the fundamentals of the company and that's why we are still bullish for the long term prospects of the company.

For starters the company displayed an additional 3-month photo in the presentation shown here on slide #14 in the presentation. If you look on the left, the placebo side scar at month-3 has started to grow back by a huge margin, while on the right-hand side scar using RXI-109 is thin and more flat. Now that we have deduced that, keep in mind that scars take 9 month to 12 months to fully heal back to their original form. Theoretically on the placebo side at month 6 and 9 we should see that the scar continues to grow back to its original size, while on the RXI-109 side it will remain just about the same as it is now. Therefore too many people believe that RXI-109 now at 3 months shows the true efficacy of the drug but that is not the case. The true efficacy won't be seen until months 6 and 9, but in the meantime looking at slide #14 you can see that RXI-109 is in fact suppressing the CTGF from growing back at an alarming rate.

Keep in mind that the 3-month photo from slide #14 is for study RXI- 1301. We mention this because the company has already initiated a second hypertrophic scar study known as RXI-1402. What this means is that the efficacy seen in the 3-month results for study 1301 should be markedly improved in study 1402. This is because everything learned in study 1301 will be improved upon in study 1402 which will in turn increase the efficacy even more. The reason is that the company learned that starting treatment with an injection of RXI-109 2 weeks post surgery removal of the scar is better than at the same time of the scar removal (p<0.001). This efficacy effect can be seen on the same presentation on slide #12. Notice that cohort 2 at month 3 already has RXI-109 at 60% better compared to placebo only at 40%. Now going out from month 3, to months 6/9 respectively we expect the efficacy to increase because the scar on the placebo side will have grown back to its former self (remember we stated above that scars take 9 to 12 months to grow back and placebo tends to not do much for scars). Which means the efficacy seen now on slide #12 will be way better at month 6 and month 9 for study 1301. Now add to the fact that the other hypertrophic scar study 1402 will add more doses, you can already see that RXI-109 is showing great efficacy in the early stages.

RXi Pharmaceutcials will also further prove that its sd-rxRNA technology and RXI-109 works in the upcoming keloid data expected in Q1 2015. Why is it that the keloid data will showcase the RXI-109 technology in a better light? Because keloids grow back at a much quicker rate than hypertrophic scars. Therefore the results at month 3 will be more noticeable for keloids since the difference between RXI-109 and placebo will be more clearly visible at the 3-month time point. Also because what RXi learned in hypertrophic scar study 1301 was also applied to the keloid study 1401.

There was a lot of speculation that RXi had decided to obtain Samcyprone (licensed from Hapten), a new dermatology target, because the RXI-109 drug wasn't showing efficacy. We are here to say this is completely false for two reasons. One reason is the efficacy seen in RXI-109 in pictures to date. The second reason is that Samcyprone is a gel which may have a lot of synergy with the company's technology. As quoted by Rxi Pharmaceuticals on the company website discussing Samcyprone:

"Our work with Samcyprone should allow us to discover specific targets for the potential treatment of immunological disorders that are relevant to the skin as well as various systemic diseases. This approach may result in the development of sd-rxRNA or other drugs that are more potent and selective for various indications, including the treatment of alopecia areata, warts or cutaneous metastases of malignant melanoma."

What the quote above is implying is that the sd-rxRNA technology is built on delivering topical gels or other drugs directly to the skin without a delivery vehicle. This means the fact that Samcyprone is a topical gel gives it good synergy with the sd-rxRNA platform for delivery. Why is that good? Well, the sd-rxRNA platform allows drugs to enter the cells at a quicker, more efficacious rate. This means that the sd-rxRNA technology will take the current form of Samcyprone and improve the efficacy of the current compound. That's not the only thing that the acqusition of Samcyprone will do. Samcyprone works as immunological agent which means it will allow RXi to create new target proteins of immunotherapy for other disease areas. RXi expects the closing of Samcyrpone to take place in Q1 2015 which provides the company with another catalyst that investors can look forward to.

The company expects another catalyst in early 2015 as well. RXi had a good pre-IND meeting with the FDA to initiate RXI-109 in the ophthalmology franchise. RXi will begin focus on the opthalmology space with an IND filing for PVR expected to be filed by Q2 2015. PVR stands for Proliferative Vitreoretinopothy, which is intraocular scarring that occurs in the back of the eye when the retina is detached. For starters this counts as orphan drug since it targets a population of under 200,000 patients, giving it such benefits as market exclusivity for seven years after drug is marketed and other tax benefits.

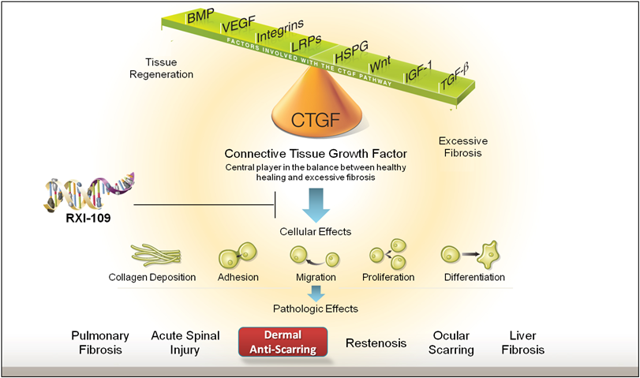

Early clinical efficacy in RXI-109 is positive for RXi Pharmaceuticals as a company. This is because RXI-109 has already been validated to work against CTGF at a 3 month time point in hypertrophic scars. But this sd-rxRNA techology validation bodes well for RXi as a biotechnology company because it gives plenty of potential for partnerships in other areas. For instance observe the graphic below from the company's website:

As you can see from the graphic above RXI-109 targets CTGF -- skin -- which can be applied to other high level targets. Such high level targets would include reducing the scars of the liver -- liver fibrosis -- and scarring of the lung -- pulmonary fibrosis, two very sought-out targets by big pharmaceutical companies because of the enormous market potential for each.

For instance Roche (RHHBY) acquired Intermune for $8.3 billion just for its pulmonary fibrosis drug back in August of 2014. This highlights how much big pharmaceutical companies are looking to find potential acquisitions or partnerships for drugs that could potentially target the liver or, in the case of Roche, a drug targeting Pulmonary Fibrosis which targets about 100,000 people in the United States alone. What does Pulmonary Fibrosis have to do with RXi and RXI-109? Pulmonary Fibrosis is a disease whereby patients experience a build up of scar tissue in the lungs making it hard for the lungs to supply oxygen to vital organs like the brain and other parts of the body. This is just one example of where RXI-109 can be injected into to reduce scar formation in, and possibly to obtain a partnership with a big pharamceutical company. As the picture above shows, the company could have a lot of possibilities in terms of partnerships as the sd-rxRNA technology platform is further validated in months 6 and month 9 of the scar data.

Additionally RXi has developed a more potent anti-VEGF compound that is higher in efficacy than the acquired Bevasirinib from OPKO Health (OPK). RXi used the chemical modification of Bevasirinib but improved upon it and has developed a more potent compound. Now this means that RXi will also be targeting another huge target known as macular degeneration. As many know, Regeneron Pharmaceuticals (REGN) has seen great success with their macular degeneration drug Eylea. What makes RXI-109 so special for macular degeneration and how could it potentially compete with Eylea, which is a huge blockbuster drug? Well, the potent anti-VEGF compound from RXi will do what Regeneron's drug already does, and that is to reduce the protein of the macular degeneration disease. The key difference is that RXi is considering combining RXI-109 together with the new potent anti-VEGF compound. This could possibly allow RXi to not only improve the vision of patients with macular degeneration but also to heal the underlying scars that occurs with the disease as well -- knocking out two birds with one stone, so to speak.

In addition to the risks inherent with all biotechnology companies, RXi Pharmaceuticals carries risks being that it is a micro-cap company. One of the risk currently daunting the company is that it only has $8.5 million of operating cash left according to the latest presentation -- slide #31, mentioned above. The good news, though, is that the company reforged a deal with Lincoln Park Capital [LPC] that would give RXi the ability to operate up until Q3 2016. This in turn is a short term risk that would have a dilutive effect if the company is unable to obtain a partnership in time. We feel that as the company continues to move closer to proving its technology in the coming months it will make it a lot easier to establish partnerships with other pharmaceutical companies.

The recent selloff could be due to the fact that the preferred shareholders are continuously selling their shares, putting pressure on the share price. Long term investors, though, should be happy with the company despite the share price because the company has put out nothing but good news but continues to be hammered furiously. We are still long RXi Pharmaceuticals despite the recent downtrend and we believe that the company continues to create value for its shareholders with long term value in mind.

Disclosure: I am Long RXII