Retailer J Jill IPO’d At A Bad Time, But You Can Buy At A Good Time

J Jill, a retailer of its own brands of women’s apparel, is not sizzling right now. And that, in my experience, is the best time to consider buying a such a stock. But this isn’t a naive buy-any-shunned-stock contrarian play. Instead, think of it as thoughtful contrarianism.

Why this Stock is Being Considered

It’s important, before you start to read about or evaluate a stock, to know why the it came under consideration and be comfortable soundness of those reasons. J Jill (JILL), came to my attention through the micro-nano-cap screen I created on Portfolio123 that looks for very small companies (whose shares have at least a tolerable level of trading liquidity) with fundamentals that, although not necessarily excellent, are sufficient to allow investors to benefit from the positive aspects of micro- nano-cap investing. Details of the approach are described in a 6/18/18 blog post. See also a 6/21/18 follow-up discussing analytic approaches to stocks that are discovered through screens like that.

The screen produced 20 stocks and as I scanned for ideas, JILL did jump up for me as a high-priority choice given its presence in brick-and-mortar retailing and the well-known disasters that have befallen that business (apart from widespread economic challenges that might result from Trump’s trade wars). But I did notice one user advocating for this stock in the comments area, likening J Jill, in one comment, to Chico’s (CHS) back when it was a single-digit micro and before it rose to large-cap status. That got my attention since I found Chico’s in a screen back around 2000 and started recommending it way back then. So I decided to take a look. Besides the Chico’s aura, this kind of stock is generally in my wheelhouse, not that I am a customer of this women’s apparel firm, but in that I spent a lot of time analyzing retail stocks.

My First Impression Remains Valid . . .

I’m still very very concerned about the future of brick-and-mortar retailing. We all know about price competition from on-line merchants including Amazon.com (AMZN), the biggest gorilla here. But I think it’s more than that and will remain so even with state sales tax collections by Amazon. It’s about convenience. It’s about product selection and availability. I’ve given up visiting stores of the store form which I usually by clothing (I suppose a J Jill male alter ego) because I’ve been taught well, by that outfit’s merchandisers, to expect that there will be no inventory in any specific item I want to consider. I’ve learned to just go on-line and if need be, make use of today’s easy return-exchange functionality. I see the empty malls, the empty stores. It’s not a fluke. I’m not the only one.

. . . But The Second Impression Casts J Jill in a More Favorable Light

While I’d hesitate to say any apparel retailer is just like another one, I do recognize similarities to what Chico’s looked like when I first found it. J Jill has a similar target market; college educated women earning about $150,000 who work outside the home and who want to look good but rather than seeking to lead trends, prefer to have a merchant (i.e. J Jill) interpret trends. It’s sexy to think in terms of social media, influencers, what’s trending and so forth. But for investability, fashion forward is not really where I like to be.

It seems as if J Jill recognizes that many in its target market think like I do and are not keen nowadays to visit stores. The company describes itself as “omni-channel” (stores, internet, catalogs) and takes the e-commerce portion very seriously.In the latest fiscal year, stores contributed 57% of company sales, catalogs, 5% and e-commerce, 38%.

The company is still growing its store base but slowly and, obviously, selectively. It only had 276 stores at the end of the last fiscal year, including just 9 that were new; three were closed in the current year. I’m comfortable assuming e-commerce will be the main growth engine going forward. For one thing, this is the kind of merchant that is well positioned to go that route. It doesn’t sell any old brand and hope somebody will buy on its site as opposed to the same or substantially similar thing elsewhere. The company is the apparel brand it sells. So in a sense, I was too narrow when I first thought of J Jill as a brick and mortar retailer. It’s more appropriate to think of it as an apparel brand selling in whatever ways customers want to buy. It’s not the only such business model out there, but I have generally fared well with companies that are more brand than store, and fully control distribution. In olden days, it was mainly via the mall. In newer times, it’s emerging as e-commerce and combinations (such as order on line and pickup in store, as others do). Same business model; different details.

And, by the way, e-commerce isn’t just a matter of sitting back, waiting for internet orders to arrive and sending out the merchandise. J Jill does the electronic (and more respectable) version of going out into the street (or mall walkways), grabbing customers, and pulling them into the store. I does this through data; specifically, data capture that matches approximately 98% of transactions to an identifiable customer, analysis of customer information (e.g., name, address, age, household income and occupation), contact history (e.g., catalog and email), and transaction behavior (e.g., orders, returns, order value) across all channels. Being able to understand who among its customers does what enhances its ability to show the right goods to the right customers at the right prices.

An Overlooked Stock

In my 6/21/18 post, I discussed the role of “Noise” in stock prices and quantified it as what’s left over after accounting for what I referred to as “standstill” value (net operating profit after tax, which we pretend will never grow) divided by cost of capital. It’s possible for the Noise portion of a price to be negative, if a company trades below standstill value. Often that occurs if the market expects operating profit to from the current level either due to bad prospects or, as discussed in my 6/25/18 post on Entravision, current operating profit is temporarily inflated by an unusual development.

For J Jill, I estimated that Noise accounts for minus 28% of the stock price. Unusual tax-related items inflated net income and EPS in the year endedJan. 2018, but that doesn’t impact the estimate of Noise, which is driven by normal Net Operating Profit After Tax. There may be some pessimism about retailing at play here(sales this year are expected to be flattish), but on review, I think this is a legitimate case of lack of visibility for a very small company. It only went public in March 2017, which was a terrible time for anybody associated with brick-and-mortar retailing.

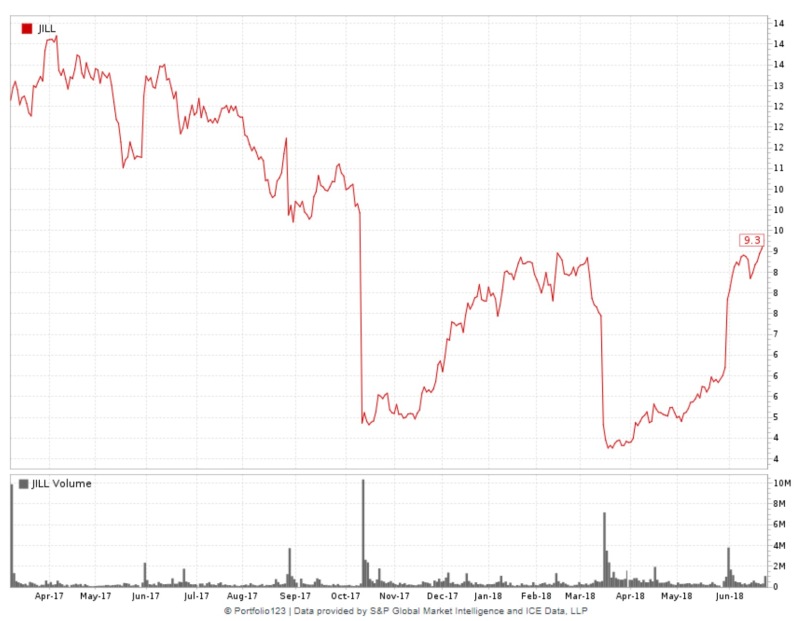

And with Wall Street having not completely forgotten the definition of volatility (although in the not too distant past, there seemed cause to wonder), what isn’t widely known and analyzed can wallop the daylights out of a stock. The price history to date includes two especially wicked declines, so there are some members of the investment community whose association with J Jill has been traumatic.

Figure 1

The first shock came from an instance of lackluster guidance in late 2017 and the second related to snags with the e-commerce site. Did those justify such extreme selloffs? I’ve long thought reactions like those were silly and counterproductive for those who sold. Business is part of real life, not a neat spreadsheet plot. Demands for perfection belong in Michelin-starred restaurants, not the business word or the stock market. And as we saw with the rapid snap-backs experienced after both plunges, the sellers were the ones who wound up eating crow.

Actually, that sort of thing is very commonplace in retail and specialty retail. The greatest piece of investment wisdom I heard regarding this came from Monroe Milstein, who once ran Burlington Coat Factory. On a conference call in which analysts were skewering the daylights out of the CFO after a disappointing report, Milstein eventually interrupted and said: “I’ve been in this business for many years. There are good months and bad months. This was a bad month.” That completely silenced the analysts.

My experience has consistently been that when the wannabe masters of the universe are heading for the hills, I want to be buying. I think this area of the market tends to be more contrarian friendly than most. I’m fine with buying JILL now, but realistically, it would make sense to keep some dry powder on hand for the next, probably inevitable, bear raid. But we’re getting ahead of ourselves; there are fundamentals to consider (and I’d never be a contrarian just for the heck of it; any Buy decision needs to have a credible basis).

The Fundamentals

A difference for me between J Jill and Chico’s is that the latter had a longer financial track record when I found it. J Jill went public in early 2017. Data before that is limited.

Table 1

| JILL | Medians | ||

| Industry | S&P 500 | ||

| % Gross Margin — TTM | 70.69 | 36.53 | 41.68 |

| % Gross Margin — 5Y Avg | 66.18 | 37.76 | 40.08 |

| % Oper. Margin — TTM | 10.42 | 5.49 | 17.32 |

| % Oper. Margin — 5Y Avg | 9.63 * | 6.59 | 0.52 |

| Asset Turnover — TTM | 1.21 | 1.88 | 0.52 |

| Asset Turnover — 5Y Avg | 0.97 | 1.76 | 0.97 |

| Inventory Turn — TTM | 2.73 | 3.54 | 5.38 |

| Inventory Turn — 5Y Avg | 2.55 | 3.28 | 5.30 |

| Quick Ratio – PYQ | 1.49 | 1.64 | 1.40 |

| Current Ratio – MRQ | 0.65 | 0.57 | 1.06 |

| TotDebt to Eq MRQ | 1.26 | 0.40 | 0.81 |

| LTDebt to Eq MRQ | 1.25 | 0.29 | 0.72 |

| Interest Coverage – TTM | 3.89 | 5.02 | 7.48 |

| % Return on Assets – TTM | 9.98 | 5.00 | 5.23 |

| % Return on Assets – 5Y Avg. | 3.96 | 5.49 | 5.37 |

* 4-year average

Data from S&P Compustat via Portfolio123.com and reflects Compustat standardization protocols, TTM = Trailing 12 Months, MRQ = Most Recent Quarter

Return on Assets (ROA) has built to a nice level (I’m not showing Return on Equity at present because I think its artificially high due to lingering impact of the balance sheet the company was given for the IPO). We see that the ROA rests more on margin than turnover, which is consistent with what we’d want to see given the company’s target customer base, one that is less likely to engage in high-frequency purchases of discounted items.

Table 2

| The key Inflows: | Important Outflows | Surplus | |||

| Cash Fr. Oper. | Dividend | CapEx | Acquisitions | ||

| 2015 | 41 | 0 | 24 | 0 | 17 |

| 2016 | 56 | 0 | 34 | 0* | 22* |

| 2017 | 67 | 0 | 37 | 0 | 30 |

| 2018 | 76 | 0 | 38 | 0 | 38 |

| TTM | 75 | 0 | 36 | 0 | 39 |

- Excludes $386 million listed on books as an acquisition — this was pre-IPO and related to formation of the corporate-retailing entity that would eventually be sent into the public markets as JIL

Data prior to 3/17 is pro forma

Data from S&P Compustat via Portfolio123.com and reflects Compustat standardization protocols

I wish the debt ratios for J Jill were lower, but this is hardly the first time a private-equity firm sent one of its portfolio companies out into the public markets with a less-than-ideal balance sheet, and it won’t be the last. I can live with what we see now, since I’m looking at the stock well after it was tossed into the markets at the selling owners/investment banker-determined IPO price (by the way, I really hate buying in IPOs). At least the company is significantly covering its interest and is very much cash flow positive, which should enable it to strengthen the balance sheet going forward, either by reducing debt or simply allowing the equity portion of the capital ratios to build.

Meanwhile, the stock looks bargain priced in all respects other than EV-to-Sales (a ratio that makes for better comparisons among companies with different debt ratios), but even this is not exorbitant.

Table 3

| JILL | Medians | ||

| Industry | S&P 500 | ||

| PE using TTM EPS | 6.87 | 21.64 | 22.54 |

| PE using Est CurYr EPS | 12.02 | 16.11 | 17.08 |

| PE using Est Next Y EPS | 11.10 | 14.83 | 16.12 |

| Price/Sales | 0.56 | 0.55 | 2.65 |

| Ent. Val./Sales | 0.85 | 0.59 | 3.17 |

| Price/Free Cash Flow | 4.17 | 10.95 | 15.28 |

| Price/Book | 2.11 | 2.13 | 3.26 |

| Noise as % Mkt. Cap. * | -28.0 | 49.7 | 53.0 |

- Click here further information about the concept of P=V+N (Price = Value + Noise)

Conclusion

Things are not by any means perfect at the moment. Web site improvements are ongoing as are efforts to refine the inventory. However, I’ve analyzed enough retailers to know that there are always issues like this arising, being solved, arising again, being solved again, etc., and that operators with sensible business models are most buyable when snags are visible (and when valuation ratios reflect imperfections). The last thing I’d want to do is buy a stock like this when its winning popularity contests.

Disclosure: None.

Nice find with $JILL. You mentioned your screening produced a list of 20 stocks. What were some of the others worth taking a closer look at?