RedHill Expects An Eventful Next Few Months

On November 14, 2016, RedHill Biopharma Ltd. (Nasdaq: RDHL) reported financial results and provided an update on operations for investors following the end of the third quarter 2016. Management has outlined a number of major events expected over the next several months. I believe these could act as catalysts to drive the shares higher in 2017. In the meantime, the company is actively engaged in business development activities and well-capitalized, with $40.5 million in cash on hand and no debt as of September 30, 2016. Below is a quick review of some of the upcoming events for the company.

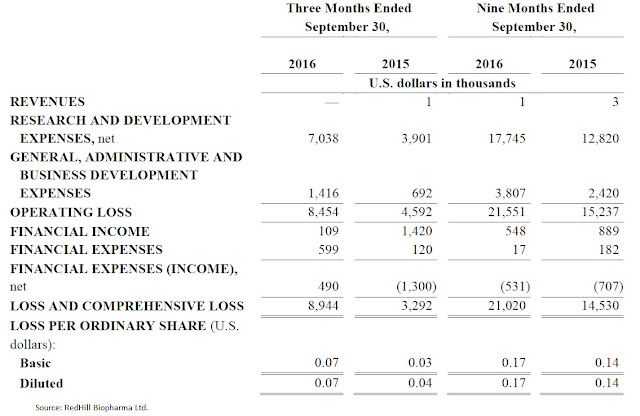

Financial Update

RedHill did not report revenues for the third quarter ending September 30, 2016. This was expected, as the company reported negligible revenues over the past two years. Operating loss for the quarter totaled $8.5 million, comprised of $7.0 million in R&D and $1.4 million in G&A. R&D has been on the rise over the past year, primarily driven by the increase in late-stage clinical activity. Active Phase 3 programs include the RHB-104 MAP US study and the Bekinda GUARD study. G&A expenses were up year-over-year due to increased business development and investor relations activities. Net loss totaled $8.9 million, or $0.07 per share. For the first nine months of 2016, the company reported a lost $21.0 million, or $0.17 per share.

RedHill exited September 30, 2016, with $40.5 million in cash and investments. Net cash used in operating activities during the third quarter total $7.4 million. For the first nine months of the year, the company burned $18.1 million from operations. That equates to roughly $2 million per month, although the number is slowly climbing. Management expects burn to increase in 2017 to roughly $3 million per quarter, putting the current cash balance of $40.5 million enough to fund operations for at least the next 12 months.

On November 1, 2016, RedHill announced a proposed public offering of common stock (American Depository Shares). Although no pricing or transaction size was announced, the company decided to withdraw the offering on November 2, 2016. Management cited market conditions stating, "It is not in the best interest of its stockholders to raise the equity capital in the current market environment." RedHill shares went into a precipitous decline during the last week in October 2016 and have yet to fully recover.

- Potential Business Development Transaction

Despite the large cash balance, I think the company will try again to raise cash again in near future; however, I think it will be in conjunction with some sort of business development transaction where investors can clearly see why and where the new money will be spent. To that point, on November 1, 2016, the company entered into a non-binding term sheet with a pharmaceutical company as part of a potential strategic vertical integration plan to build a U.S. specialty pharmaceutical company by establishing a commercial presence and capabilities.

Under the term sheet, RedHill would be granted the right to exclusively promote a specialty gastrointestinal product in certain territories in the U.S. The parties would share revenues generated in such territories based on an agreeable split between the parties. RedHill is not required to make any upfront or milestone payments under the term sheet. Management's goal is to close the deal before the year of the year. I think if the deal closes and the market see the positive merits of the transaction, RedHill will raise cash on the back of the deal.

Pipeline Update

RedHill's pipeline rivals that of larger biotech and specialty pharmaceutical companies. The company boasts twelve programs and eight drugs at various stages of clinical development, several of which are in Phase 3. The core focus is on gastrointestinal and inflammatory diseases, but management is making a strong push into cancer with some novel drugs in mid-stage trials.

- RHB-104

RHB-104 is a proprietary and potentially groundbreaking oral antibiotic combination therapy with potent intracellular, anti-mycobacterial, and anti-inflammatory properties, currently undergoing a first Phase 3 study for Crohn’s disease (CD) and a Phase 2a study for multiple sclerosis (MS). The development of RHB-104 is based on increasing evidence supporting the hypothesis that Crohn’s disease is caused by Mycobacterium avium paratuberculosis (MAP) infection in susceptible patients.

The Phase 3 MAP U.S. Study continues to enroll, with a target enrollment of 410 patients. In October 2016, management provided an update and changes to the Phase 3 program. The changes are designed to enhance the overall robustness of the study and provide a more comprehensive assessment of RHB-104’s treatment effect. These changes will allow RedHill to increase the pace of enrollment, as well as better evaluate all patients enrolled in the study and bolster the likelihood of success (see my analysis → Here).

Management expects the first safety-focused independent DSMB review of the trial to take place in the fourth quarter 2016. This is essentially a review of the trial once 25% of the patients have completed the primary analysis. A second independent DSMB meeting is expected in the second quarter of 2017 and will include safety and interim efficacy analysis, with evaluation of an early stop for success for overwhelming efficacy, under pre-specified efficacy criteria. Assuming enrollment of all 410 planned subjects, completion of patient recruitment in the MAP US Phase 3 study is expected by the end of 2017.

Also expected during the fourth quarter 2016 is the final analysis from the RHB-104 Phase 2a CEASE-MS study. Back in August 2016, RedHill announced that the last patient completed the final scheduled follow-up visit in this proof-of-concept clinical study evaluating RHB-104 in patients treated for relapsing-remitting MS. The previously announced interim results after 24 weeks RHB-104 treatment demonstrated positive safety and efficacy signals and support further clinical development. Full analysis of the study is ongoing, with topline final results expected before the end of the year. During the third quarter 2016, the company secured a patent for RHB-104 in MS in Europe and a notice of allowance in Japan.

I think RHB-104 is a potential blockbuster drug. Pricing remains an unknown at this point, but if we assume RHB-104 costs $1,500 per month (a 40-60% discount to biologics) and captures 20% market share of the active CD / MAP infected patients, sales in CD alone peak at $700 million. MS is more of a wildcard given the early-stage nature of the program, but this indication could easily add another $300 million in sales, putting total peak sales of RHB-104 over $1 billion. As stated in some of my previous reports, I think RHB-104 alone is worth more than the entire market value of the company ($150 million as of today).

- RHB-105

RHB-105 is a proprietary oral triple-antibiotic for the treatment of H. pylori infection. In June 2015, RedHill successfully completed a Phase 3 clinical trial with RHB-105 called ERADICATE-Hp. ERADICATE-Hp was a randomized, double-blind, placebo-controlled study in 118 patients that took place at 13 centers in the U.S. Top-line results demonstrated RHB-105 was 89.4% effective in eradicating H. pylori infection. This was highly statistically superior over the placebo and the 70% benchmark use for statistical modeling (p <0.001). More importantly, following the 14 day treatment period, patients on placebo were allowed to receive a current standard of care. Follow-up analysis from this portion of the study showed these patients achieved only 63% eradication.

Last week, the company announced it has completed a positive Type B meeting with the U.S. FDA, validating the manufacturing and CMC aspects of the planned RHB-105 confirmatory Phase 3 trial. As a reminder, following the success first Phase 3 trial, RedHill met with the U.S. FDA in April 2016 to discuss the protocol and endpoints for a confirmatory Phase 3 trial to start during the first half of 2017. The trial will be a two-arm, randomized, double-blind, active comparator confirmatory Phase 3 study with a target enrollment of 440 patients in up to 50 clinical sites in the U.S. Positive data from this study will support the filing of a New Drug Application, and I believe once approved RHB-105 will become the new standard-of-care.

My analysis shows that there are 5 million individuals in the U.S. with H. pylori infection and at risk of gastric ulcers. This is an enormous market and management has already shown the drug to be superior to current standard-of-care. Conservatively, if RedHill Biopharma were to price RHB-105 at $500 for a course of treatment, the market opportunity for the drug in the U.S. would equate to approximately $1.5 billion. RHB-105 has QIDP designation from the U.S. FDA and the company secured another patent protecting the drug in July 2016.

- BEKINDA®

Earlier in the month, RedHill provided an update on Bekinda. Management expects to report data from an ongoing Phase 3 clinical trial for the treatment of acute gastroenteritis and gastritis - known as the GUARD Study - around the middle of 2017. GUARD is randomized, placebo-controlled, registration study designed to compare Bekinda to placebo in 320 patients age 12 to 85 years old with acute gastroenteritis or gastritis that have presented to an emergency center and have vomited at least twice in the four hours preceding consent into the study. The primary endpoint is the proportion of patients without vomiting and rescue medication from 30 minutes post dose over the subsequent 24 hours. With strong, statistically significant data demonstrating overwhelming efficacy, management may be in a position to file the NDA after only one Phase 3 study.

Beyond the Phase 3 study in gastroenteritis and gastritis, RedHill is also studying Bekinda in a Phase 2 trial for the treatment of diarrhea-predominant irritable bowel syndrome (IBS-D). The first patient in this trial was dosed in June 2016. The Phase 2 study is seeking to enroll 120 patients with IBS-D at 12 clinical sites in the U.S. Top-line results are expected around the middle of 2017.

Bekinda looks to have an interesting market potential for the treatment of some common GI disorders, including gastroenteritis and gastritis and irritable bowel syndrome with diarrhea. The scientific merits of both indications are rooted deep with support from the literature and the once-daily administration should help improve patient compliance and convenience to dose.

- YELIVA™

One of the most interesting candidates in RedHill's pipeline is Yeliva, a first-in-class SK2 selective inhibitor for the treatment of various cancers. The ongoing clinical work supported by research grants for Yeliva is impressive. For example, a Phase 1/2 study for the treatment of refractory or relapsed multiple myeloma at Duke University is supported in part by a $2 million grant from the National Cancer Institute (NCI). This study began in September 2016 and will seek to enroll 77 patients, with data likely in 2017.

A separate grant from the NCI also supports another Phase 1/2 clinical study evaluating the drug in patients with refractory/relapsed diffuse large B-cell lymphoma (DLBCL) at the Louisiana State University. That study is currently on administrative hold, pending a protocol amendment aimed at improving overall recruitment prospects.

In October 2016, a Phase 2 study with Yeliva for the treatment of advanced hepatocellular carcinoma (HCC) initiated at the Medical University of South Carolina (MUSC) Hollings Cancer Center. It is supported in part by a $1.8 million grant from the NCI awarded to MUSC, along with additional support from RedHill to fund a broad range of studies on the feasibility of targeting sphingolipid metabolism for the treatment of a variety of solid tumor cancers.

September 2016, RedHill announced yet another research collaboration with Stanford University School of Medicine for the evaluation of Yeliva as a radioprotectant for prevention of mucositis in head and neck cancer patients undergoing therapeutic radiotherapy. As part of the collaboration, Stanford will evaluate the effect of Yeliva on mucositis reduction and tumor control in a murine model of head and neck cancer administered in combination with a chemotherapy agent and radiotherapy, similar to the design of RedHill’s planned radioprotectant Phase 1b clinical study expected to run in parallel with the Stanford research collaboration. Results from the research collaboration are expected in mid-2017.

In June 2016, RedHill reported positive Phase 1 data with Yeliva in cancer patients with advanced solid tumors. I believe Yeliva's mechanism of action is solid and that RedHill should have ample opportunity to partner the drug as development continues (see my analysis → Here). That being said, most oncology assets do not hit valuation inflection until after Phase 2 or even Phase 3 data has been reported. RedHill will have an opportunity to deliver such data throughout 2017.

- Mesupron®

Mesupron is another mid-stage drug with the potential to expand the company's focus into oncology. RedHill’s current development program for Mesupron includes non-clinical studies as well as re-analysis of certain prior clinical data. Mesupron is a first-in-class, orally-administered uPA inhibitor targeting gastrointestinal and other solid tumors. To date, a total of eight Phase 1 and two Phase 2 clinical studies have been completed with the drug. The ongoing nonclinical work is intended to define better the molecular markers and patient population for future clinical studies. RedHill plans to initiate a Phase 2 development program with Mesupron in 2017, subject to a successful outcome in the ongoing non-clinical studies (see my analysis → Here).

- Other Key Programs

RedHill seems particularly excited about the signing of a recent research collaboration with the U.S. National Institute of Allergy and Infectious Disease (NIAID) in July 2016. The collaboration is intended to evaluate RedHill’s proprietary experimental therapy for the treatment of Ebola virus disease. Initiation of research programs is expected to commence in the fourth quarter of 2016. The company has shared encouraging results from preliminary non-clinical studies conducted in conjunction with NIAID. Top-line results from the first studies are expected in 2017.

Management is also planning a resubmission of the Rizaport® NDA to the U.S. FDA in the first half of 2017. Rizaport was approved for marketing in Germany under the European Decentralized Procedure (DCP) in October 2015, and a first commercialization agreement was recently signed with Grupo JUSTE S.A.Q.F for Spain and additional potential territories in July 2016. In September 2016, a term sheet was signed for South Korea. The company is in discussion with additional potential commercialization partners in the U.S., Europe, and other territories. The drug is a proprietary oral fast dissolving thin film formulation of rizatriptan for the treatment of a migraine.

Other programs in development include RP101, first-in-class Hsp27 inhibitor in Phase 2 development for pancreatic cancer. RP101 has completed several Phase 1 and Phase 2 trials with a total of 429 subjects. The drug has been granted Orphan designation in the U.S. and EU.

RHB-106 is a bowel preparation for gastrointestinal tract procedures such as a colonoscopy. Advantages of RHB-106 are that the product is an oral capsule and requires no liquid solution. I've had a colonoscopy, the worst part of the entire procedure is drinking the bowel preparation liquid the day before! A Phase 2a study with RHB-106 was conducted in Australia demonstrating safety and tolerability. RedHill licensed RHB-106 to Salix Pharmaceuticals in February 2014. Salix was acquired by Valeant in early 2015, but just recently announced plans to sell the division to Takeda in November 2016. I think RHB-106 has sat on the back-burner at Valeant for the past year given the company's financial troubles. I view new ownership of the asset as a plus for RedHill.

Sum-Of-Parts Valuation

Valuing biopharma stocks that do not have revenues or earnings is a bit of a challenge, but I've done my best to use objective measures, including valuation multiples established by a reasonable peer group and historic success rates for similar assets at the same stage of development compiled by reputable organizations. Things like peak sales are highly subjective based on my own beliefs with respect to market share and penetration rates. Discount rates and time frames are generally known for these types of stocks, but certainly, delays do occur and could have a material impact on net present value calculations.

That being said, I believe RedHill BioPharma is worth approximately $500 million in value today. I see the most valuable asset as RHB-104 for Crohn's disease, followed by RHB-105 for H. pylori infection. Other important assets include Bekinda for gastroenteritis and IBS-D, RHB-104 for MS, and Yeliva and Mesupron in mid-stage development for various oncology indications. The company held $40.5 million in cash as of September 30, 2016, of which I'm including only $25 million into my sum-of-parts analysis. The company has no debt.

Conclusion

RedHill's stock has taken a bit of a hit over the past few months. The shares peaked at over $16 in August 2016 and have pulled back to $11 today. The market got spooked with the prospects of the company raising cash a week before the U.S. election and the shares have yet to fully recover. Management has also pushed back the timeline for a number of catalysts, including the Phase 3 results of the MAP US and GUARD study. While it seems clear that the burn rate will increase in 2017, management is also making plans to bring in a commercial asset that will potentially generate revenues and catapult RedHill into a fully integrated U.S. specialty pharmaceutical.

RedHill has numerous catalyst on the horizon that should make the next six to nine months a good time to be a shareholder. Below is a slide from the company's most recent investor presentations that highlights some of these important events.

Disclosure: BioNap is party to a services agreement with the company that is the subject of this report pursuant to which BioNap is paid twenty-five hundred dollars per month by the company in ...

more