Qualcomm's Initiatives Beyond Smartphones Could Drive Its Stock

Qualcomm (QCOM) is a world leader in 3G, 4G and next-generation wireless technologies used mainly in smartphones. However, currently, the company is introducing communications solutions for other categories than smartphones.

On September 27, AUDI AG, BMW Group, Daimler AG, Ericsson, Huawei, Intel (INTC), Nokia and Qualcomm, announced the formation of the “5G Automotive Association”. The association will develop, test and promote communications solutions, support standardization and accelerate commercial availability and global market penetration. According to the announcement, the goal is to address society’s connected mobility and road safety needs with applications such as connected automated driving, ubiquitous access to services and integration into smart cities and intelligent transportation.

As I see it, connected cars could significantly increase the demand for Qualcomm's products. After all, semi-autonomous and fully autonomous vehicles are expected to reach more than 15% of the total the annual world production of about 110 million light vehicles by 2025.

In another development, earlier this year, on January 5, Qualcomm announced that its subsidiary, Qualcomm Life and Novartis are expanding their global connected therapy management collaboration. Novartis will leverage Qualcomm Life’s connectivity solutions to power its next-generation connected Breezhaler, the inhaler for its Chronic Obstructive Pulmonary Disease portfolio. According to the company, this is an exciting time for health care as it sees the proliferation of the Internet of Medical Things. I believe that this collaboration with Novartis could open new markets for Qualcomm's products.

Qualcomm's Sales to Apple (AAPL)

After studying the new iPhone 7 and iPhone 7 Plus components, it has been discovered that the GSM version of the phones features Intel’s modem, and the CDMA version of the device features Qualcomm modem. The use of Intel's modem in the new iPhone harms the dominance of Qualcomm in baseband processors that connect phones to networks and convert radio signals into voice and data. However, while Qualcomm is losing some orders, it is retaining a significant amount of Apple’s business.

While about 65% of the company's revenues in the nine months ended June 26, 2016, came from the chipset segment, the licensing segment Qualcomm Technology Licensing (QTL) accounted for about 85% of the company’s pre-tax income for the same period. A company which sells products that use CDMA and OFDMA in mobile communications products requires a patent license from Qualcomm. As such, although the company will lose some of its baseband processor orders in iPhone 7 to Intel, it will continue to collect royalty fee from Apple for using its technology. What's more, the increase in licensing revenues could compensate for the decline in chipset revenues.

What To Expect From Qualcomm's Earnings Report

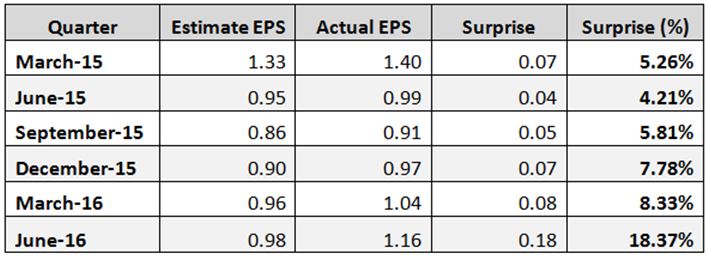

Qualcomm is scheduled to report its fourth quarter fiscal 2016 financial results on Wednesday, November 02, after market close. According to Zacks Investment Research, based on seven analysts' forecasts, QCOM is expected to post a profit of $0.98 a share, a 24.1% rise from its actual earnings for the same quarter a year ago. The highest estimate is for a profit of $1.01 a share while the lowest is for a profit of $0.97 a share, not a big difference. Revenue for the fourth quarter is expected to increase 6.6% year over year to $5.82 billion, according to nine analysts' average estimate. Since QCOM has shown earnings per share surprise in all its last six quarters, as shown in the table below, there is a good chance that the company will beat estimates also in the second quarter.

Qualcomm Stock Performance

Since the beginning of the year, QCOM's stock is already up 33.7% while the S&P 500 Index has increased 5.4%, and the Nasdaq Composite Index has gained 5.7%. However, since the beginning of 2012, QCOM's stock has gained only 22.2%. In this period, the S&P 500 Index has increased 71.3%, and the Nasdaq Composite Index has risen 103.2%.

Qualcomm Valuation

Qualcomm's valuation metrics are very good, the trailing P/E is at 19.56, and the forward P/E is low at 14.13. The price to cash flow is at 15.09, and the current ratio is very high at 3.10. Furthermore, its Enterprise Value/EBITDA ratio is low at 12.20, and its PEG ratio is also low at 1.40.

In addition, Qualcomm's Margins and Return on Capital parameters have been much better than its industry median, its sector median and the S&P 500 median as shown in the tables below.

Source: Portfolio123

Qualcomm Growth

Qualcomm has recorded substantial growth in the last few years. The company's annual average sales growth over the last five years was very high at 18.1%, and the average EPS growth was pretty high at 8.7%. The average annual estimated EPS growth for the next five years is also high at 10.50%.

Dividend and Share Repurchase

Qualcomm generates strong cash flow and returns substantial capital to its shareholders by stock buyback and increasing dividend payments. During the third quarter of fiscal 2016, the company returned $881 million to its stockholders, including $781 million, or $0.53 per share, of cash dividends paid and $100 million through repurchases of 1.8 million shares of common stock.

The current annual dividend yield is pretty high at 3.17%, and the payout ratio is at 57.2%. The annual rate of dividend growth over the past three years was very high at 24.6%, over the past five years was also very high at 20.1%, and over the last ten years was high at 18.9%.

Conclusion

Qualcomm's wireless technologies are used mainly in smartphones. However, currently, the company is introducing communications solutions for other categories than smartphones. Although the company will lose some of its baseband processor orders in iPhone 7 to Intel, it will continue to collect royalty fee from Apple for using its technology. What's more, the increase in licensing revenues could compensate for the decline in chipset revenues. Qualcomm has recorded substantial growth in the last few years, and its valuation is very good. Furthermore, the company generates strong cash flow and returns substantial capital to its shareholders by stock buybacks and increasing dividend payments. All these factors bring me to the conclusion that QCOM's stock is a smart long-term investment.

I am long AAPL, INTC