Q3 Earnings Preview: Strong Start From Banks And High Expectations For Netflix Tonight

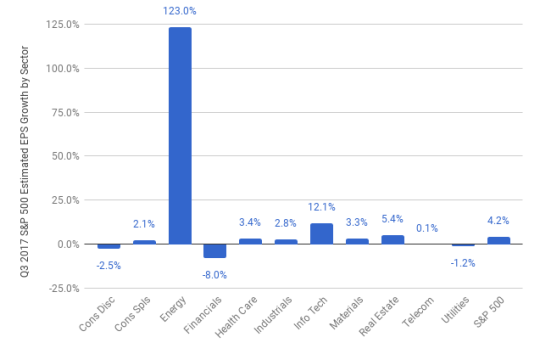

The big banks kicked off earnings season on a fairly high note when they reported last week, with JPMorgan and Bank of America beating on both the top and the bottom line, Citi only beating on the top line, while Wells Fargo missed on both. Overall the Estimize community is expecting another strong earnings season, but a pull back from the first half of the year. S&P 500 EPS is anticipated to grow 4.2% from the year ago quarter, a deceleration from last quarter’s 10.2%. Revenues are expected to grow 6%, up slightly from 5.2% in Q2.

(Click on image to enlarge)

In a near repeat of last quarter, winning sectors once again include Energy and Technology, while Consumer Discretionary remains as one of the biggest laggards, only to be topped by Financials.

Energy is leading the pack right now with expected growth of almost 123% due to easier year-over-year comparisons. If you remove energy, index growth is almost cut in half to 2.5%, just shy of the 20 year historical average. The question then becomes, is 2.5% growth enough to justify a market that is trading at nearly 19x? Investors may be wishing for stronger fundamentals at these prices.

Following energy, technology is expected to see the second highest growth rate of all the sectors with profit growth of 12.1% and revenue growth of 8%. All 10 industries within the sector are estimated to record positive numbers this quarter, but none more than semiconductors which are currently anticipated to increase earnings by 50% YoY. Micron Technology is driving the semiconductors and is the largest contributor to sector growth. The company posted EPS of $2.02 on September 26, a record high, vs. the year ago result of -$0.05, an increase of 4140%. Optimism around Micron’s stock is due to favorable pricing of DRAM and NAND chips, MU’s main businesses. Next week we’ll hear from more big names in this space, including Advanced Micro Devices, Texas Instruments, and Intel, among others.

Despite great results thus far from the big banks, the overall Financials sector is expecting a fairly significant earnings downturn of -8% this quarter, lead by poor expectations for the insurers. Insurance companies have yet to report for the season, but kick off this week with Progressive and Travelers, estimated to post YoY profit growth of 21% and -68% respectively. Excluding insurers, Financials would be up 5.6% for the quarter. Excluding Financials from the S&P 500 index would escalate growth to 8.2%.

Consumer discretionary is the biggest laggard this quarter and the only sector expected to post negative numbers. Earnings per share are anticipated to fall 2.5% from Q3 2016, while revenues should be up slightly at 1.3%. Automobiles, auto components, textiles, apparel and luxury good and multiline retailers (department stores) are all contributing to that profit decline. On top of increased labor costs that have been noted in press releases for several quarters now, these companies, and many from other sectors, are having to contend with the loss of business due to hurricanes.

Thus far hurricanes have been the most highly mentioned factor negatively impacting earnings, and not just by retailers, but airlines, homebuilders, and transports & logistics names as well. Despite this, retail sales for September recorded their highest level in 2.5 years on Friday due to demand for building materials and motor vehicles to aid with disaster relief efforts. As such home improvement retailers such as Home Depot and Lowe’s are anticipated to see a profit jump this quarter of 13% and 16% respectively.

On Friday the Nasdaq closed at a record high as investors anticipate a strong earnings season. Nasdaq-listed Netflix reports today after the bell, and the stock was up nearly 2% on Friday, crossing the $200 mark for the first time.

This week 56 companies are scheduled to report from the S&P 500, mostly from the financials and technology sectors.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.