Nvidia Stock: The Numbers Look Good

Nvidia (NVDA) has benefited tremendously from the growing demand for GPUs in the gaming industry over the past several years. In addition to this, computing is becoming increasingly more visual in all kinds of areas, which is providing a strong tailwind for GPUs.

Management has played its cards well, positioning the company for growth in areas with massive potential for expansion in the years ahead. Artificial intelligence and deep learning applications that use the company’s graphics chips are particularly promising, and Nvidia is betting on autonomous vehicles with its Drive PX self-driving platform.

Source: Nvidia.

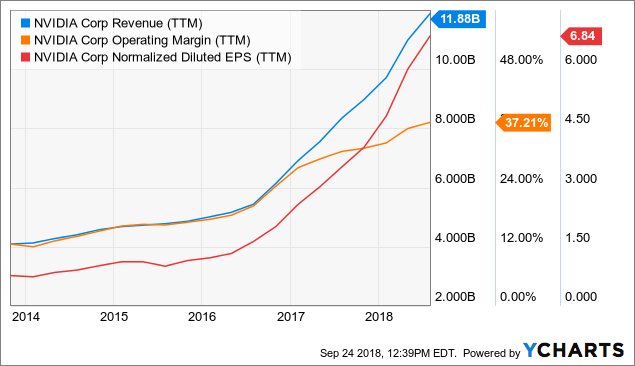

Financial performance is quite remarkable. The company has delivered booming revenue growth over the past five years, while profit margins have enlarged. Rapidly growing sales in combination with expanding profit margins have provided a double boost to earnings per share over time.

NVDA Revenue (TTM) data by YCharts

The following chart compares key financial performance metrics for Nvidia versus the average company in the industry, and Nvidia is substantially above-average across the board. Revenue growth, net income growth, operating profit margin, net profit margin, return on assets (ROA), and return on equity (ROE) are all pointing in the same direction.

The most recent earnings report from Nvidia confirms that the business keeps growing at full-speed as of the quarter ended on July 29, 2018. Total revenue amounted to $3.12 billion during the quarter, growing by 40% versus the same quarter in the prior year. Non-GAAP earnings per diluted share were $1.94, up by 92% percent from $1.01 a year earlier.

Looking at the company's main growth engines, performance looks quite solid across the board, and this is a major positive in terms of evaluating Nvidia's ability to sustain performance going forward.

Source: Nvidia

The gaming industry looks as strong as ever thanks to vigorous trends such as booming demand for eSports and the unprecedented success of Fortnite and PUBG, which has popularized the Battle Royale genre and expanded the gaming market. This segment accounts for 58% of the company's revenue, and the year-over-year growth rate in the gaming business reached 52% last quarter.

Revenue in the datacenter segment reached $760 million during the period, with year-over-year revenue growth accelerating to 83%. This performance was driven by expanding demand as internet services are increasingly leveraging AI.

Scale advantages and unique intellectual properties provide key sources of competitive strength for Nvidia. Besides, the company is building strategic alliances with players such as Amazon (AMZN), Baidu (BIDU), and Facebook (FB) in AI. Nvidia is also partnering with industry leaders such as IBM (IBM), Microsoft (MSFT) and SAP (SAP) in order to bring AI to the enterprise market.

In the automotive industry, Nvidia is working with more than 320 automakers, tier-one suppliers, research institutions, mapping companies, and startups to develop and deploy AI systems for self-driving vehicles.

Technological strengths, in combination with partnerships and alliances with powerful players in different areas, make of Nvidia a top player when it comes to benefiting from the AI revolution in the years ahead.

The Price Of Growth

When analyzing valuation levels for a high-growth company such as Nvidia, it’s of utmost importance to move beyond the typical, more static, valuation metrics and consider growth into the valuation framework. The PEG ratio, which is calculated by dividing the PE ratio by the long-term expected growth rate in earnings, can be a particularly useful tool in these cases.

Most valuation indicators have a key weakness, which is that they don’t include growth into the equation. Ratios such as price to earnings (P/E), enterprise value to EBITDA (EV/EBITDA), and price to cash flow (P/FCF) can be very intuitive. However, if two companies have different expected growth rates, then the analysis is far more nuanced than simply looking at the stock price versus current earnings or cash flows.

All else the same, the higher the expected growth in earnings, the more valuable each dollar in earnings from such company. In other words, the P/E ratio is obviously higher for high growth companies. This means that focusing solely on the P/E ratio would make high-growth companies erroneously look overvalued when comparing stocks. By dividing the P/E ratio by the expected earnings growth rate,, the resulting ratio is far more valuable and comprehensive.

In a nutshell, the PEG ratio is a particularly strong valuation ratio because it incorporates the impact of different growth rates into valuation, and this makes it superior to most other valuation metrics.

The chart below shows PEG ratios for Nvidia versus Intel (INTC), Texas Instruments (TXN), Advanced Micro Devices (AMD), and Altair Engineering (ALTR). In comparison to other successful players in the specialized semiconductor industry, Nvidia doesn't look excessively priced.

The market is expecting vigorous growth from Nvidia in the years ahead. If the company fails to deliver in accordance with expectations, then the stock price could be very vulnerable to the downside from current valuation levels, and this is an important risk factor to consider. Nevertheless, the main point is that Nvidia is not necessarily overvalued when considering the company's growth potential.

Strong Fundamental Momentum

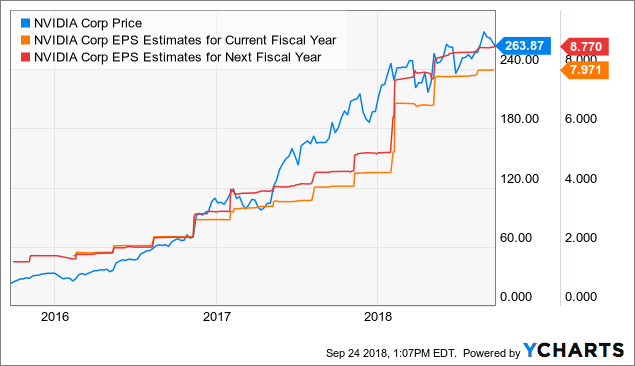

Looking at the fundamentals in isolation doesn't tell the whole story behind a stock, since the fundamentals in comparison to expectations can have a huge impact on stock prices. In other words, when the company is delivering better-than-expected earnings and expectations about future earnings are increasing, this can be a powerful upside fuel for the stock.

The chart shows the evolution of Nvidia's stock price and earnings expectations for both the current year and next fiscal. Unsurprisingly, the stock price and earnings estimates are moving in the same direction over time.

NVDA data by YCharts

As long as this trend remains in place, raising earnings estimates should be a powerful upside fuel for Nvidia's stock.

Outstanding Relative Strength

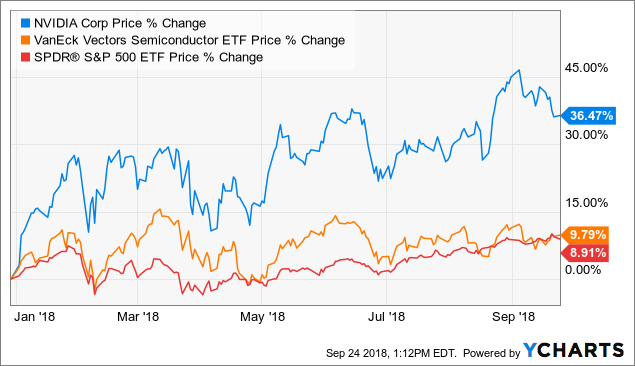

Money has an opportunity cost; when you buy a stock with mediocre returns, that capital is not available for investing in companies with superior potential. Besides, winners tend to keep on winning in the stock market, so you want to invest in stocks that are not only doing well but also doing better than other alternatives.

Nvidia's stock is outperforming both the SPDR S&P 500 (SPY) and the VanEck Vectors Semiconductor ETF (SMH) on a year-to-date basis. The stock is displaying outstanding relative strength in comparison to both the market in general and the industry in particular, and this bodes well for investors in Nvidia stock going forward.

NVDA data by YCharts

Putting It All Together

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to the factors analyzed in this article for Nvidia: financial quality, valuation, fundamental momentum, and relative strength.

The system has produced solid performance over the long term. The chart below shows the annualized returns for companies in 10 different PowerFactors ranking buckets since January of 1999 in comparison to the SPDR S&P 500.

There is a direct relationship between the PowerFactors ranking and annualized returns, meaning that companies with higher rankings tend to produce superior returns and vice versa. In addition, stocks with relatively high quantitative rankings tend to materially outperform the market over the years.

Data from S&P Global via Portfolio123

Nvidia is among the best 10% of stocks in the market based on the quantitative algorithm. This means that the stock looks clearly attractive when considering quantitative return drivers such as financial quality, valuation, fundamental momentum, and relative strength in combination.

Historical performance does not guarantee future returns, and performance numbers for quantitative systems should always be interpreted with caution, since the future is always a matter of possibilities and probabilities as opposed to certainties.

Because of its own nature, a quantitative system is always backward-looking. This means that a system can tell you that a specific group of companies with certain quantitative attributes has a good chance of delivering market-beating returns over long periods of time, but it does not tell you much about a particular stock.

In the case of Nvidia, there are some important risk factors to consider.

- The company operates in a high-growth industry prone to technological disruption. Investors may want to keep a close eye on the competitive landscape to make sure that Nvidia is still delivering the most innovative products in the industry in order to sustain financial performance going forward.

- The stock is priced for aggressive growth expectations. If growth slows down more abruptly than expected, compressing valuation ratios could deliver a considerable blow to Nvidia's stock.

- The PC industry is maturing, which could have a negative impact on GPUs demand in the years ahead.

- Nvidia's GPUs have benefited from growing demand from the cryptocurrency industry, but demand from such market stagnated last quarter, and management is expecting no significant contribution from cryptocurrency in the ongoing quarter.

- Nvidia generates almost 80% of revenue from international markets. This means that the company is exposed to substantial macroeconomic uncertainty and currency risks, especially in times of international trade wars and economic jitters in emerging markets.

The quantitative system alone does not tell you the whole story - it's important to understand the business behind the numbers in order to truly understand the main risks and return drivers in Nvidia's stock.

That being acknowledged, making investment decisions based on quantified data is certainly a sounder approach than relying entirely on emotions and subjectivities when picking stocks. If the statistical evidence is any valid guide, Nvidia is well-positioned for attractive performance over the middle term.

Disclosure: I am/we are long AMZN, FB.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more