NexGen Energy Ltd, Best House In A Bad Neighborhood

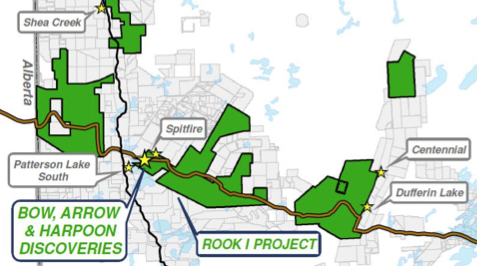

NexGen Energy Ltd (TSX: NXE) (OTC: NXGEF) is a well known emerging uranium company with assets within and near the border of the world-class Athabasca Basin in northern Saskatchewan, Canada. I believe NexGen is one of the best ways to articulate a contrarian view in the demand for, and spot price of, uranium. Instead of rattling off facts about the global nuclear fleet of reactors, those interested in an excellent overview are encouraged to visit the World Nuclear Association website. This article is not about convincing readers of the need for clean, reliable, base-load electricity generation. Instead, for readers who believe in nuclear power, I review various ways one can get invested in the theme through uranium companies.

It’s all about supply & demand

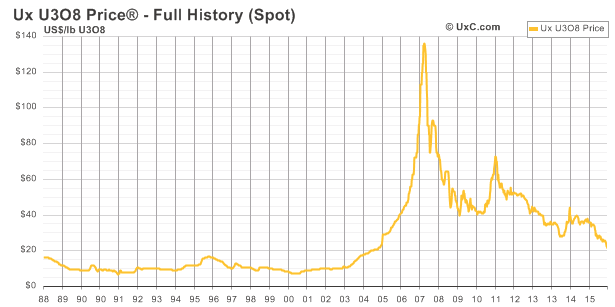

Currently, there’s too much uranium supply on the market (and on the sidelines as “shadow inventory”). Attendees at the World Nuclear Association’s Symposium in London were treated to a grim reckoning. Traders reported that they expected to see the spot price trade below $20/lb. Well, we’re now at $20/lb., the price is down ~40% year-to-date, and ~20% since the September symposium. Yet, the lower the spot price, the more likely greenfield projects and capital-intensive expansions will be delayed or abandoned. For a company like NexGen, funded for the several years, the spot price might as well be at $10/lb., it makes little difference. Sometimes NOT being in production is a good thing.

On the demand side, things are much more laid back. Like many, I believe uranium consumption will experience a 3-4% CAGR for the next few decades. That may not sound like much, but 3.5% growth equates to a doubling in demand by 2036. Interestingly, it’s been widely reported for years that countries in the Middle East are very interested in nuclear power. Several are making great strides in the industry. Just this month the UAE raised $24.4 billion specifically for a nuclear plant, and Saudi Arabia had orders for $67 billion and accepted $17.5 billion in a ground-breaking sovereign bond deal. Nuclear power could be a beneficiary of cheap debt (low-interest rates) across the globe.

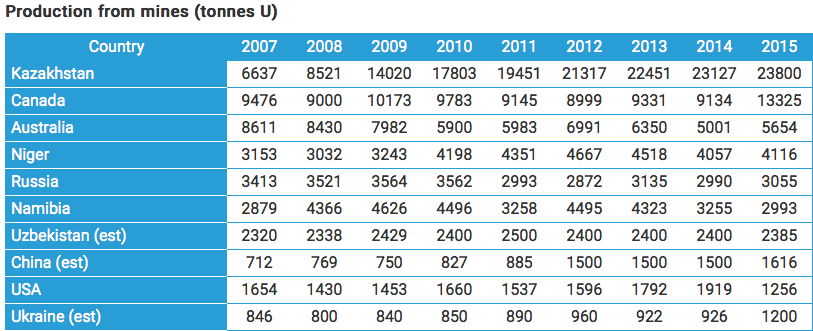

Where will new supply come from? The top 10 uranium-producing countries delivered approximately 60,000 metric tons in 2015. Of that amount, a combined ~47% came from top producing country Kazakhstan, along with Russia & Ukraine. By comparison, just ~34% came from Canada, Australia & the U.S.

Kazakhstan, Russia & Ukraine accounted for ~47% of uranium supply in 2015

Tensions between Russia and the West have increased dramatically. Putin’s sphere of influence over a major portion of the world’s supply (Russia + Kazakhstan + Ukraine) should be of grave concern. Consider this article in which the author points out,

“Russia dominated Kazakhstan for almost 200 years until Kazakhstan regained independence in 1991. Still, capital Astana retains close ties with Moscow through membership in the Russian-backed Eurasian Economic Union & the Collective Security Treaty Organization. 20% of Kazakhstan’s population is ethnic Russian, most living along the country’s 4,250-mile border with Russia. After Russia annexed Crimea in early 2014, many ethnic Russians from Kazakhstan were said to sympathetic with their counterparts in eastern Ukraine.”

Putin is well known to project power through his country’s energy and natural resource assets. As a top-3 global hydrocarbons producer, the oil price collapse has hit Russia hard. Putin has an incentive to seize, control or disrupt Kazakhstan exports (40% of global production in 2015). Luckily, if market supply gets dicey, we can always rely on Niger, Namibia & Uzbekistan to fill in the gaps….

I don’t believe a Russia-related event is an outlier, therefore, I don’t think it’s priced into the spot market.

So far, I’ve touched on supply and demand and thrown in a dose of geopolitical intrigue, free of charge. For contrarian and value investors alike, what better place to look for a more despised investment theme? Think about it, interest in coal stocks is above that of uranium juniors. Who saw that coming?

Even though the spot price is at a level last seen in October 2004, betting on a rebound has been a widow maker trade for years {see price chart above}. But, with the spot price at $20/lb., even a 75% bounce to $35/lb. would leave it 50% below where it was in March 2011 (the month of Japan’s Fukushima disaster).

Commodity prices can move quite rapidly

How aggressive an assumption is a potential move from $20/lb. to $35/lb.? At inflection points, natural resource prices can move rapidly, both up and down. Consider coking coal. According to an October 25th article from mining.com

Metallurgical coal’s rise this year has been even more dramatic than that of iron ore and trading at $245.50 a tonne on Tuesday, the steelmaking raw material is up 25% so far in October. According to data provided by the Steel Index premium Australia hard coking coal prices are up more than three-fold since hitting multi-year lows around $70 a tonne in November last year.

What does coking coal have to do with uranium? Not much really, except to point out that commodity price spikes are not uncommon. Instead of coking coal, how about commodities more aligned with energy markets? BOTH natural gas and WTI crude prices have roughly doubled from February 2016 lows.

Back to uranium prices, from 2003 to 2005 a doubling in the price. From 2005 to 2007, another doubling. In the 9-month period ending in March 2011, spot was up 75% from $40/lb. to $70/lb. More recently, from July to November 2014, it was up 60%. While one might want to own more than one uranium investment, NexGen truly stands out. It ticks a lot of boxes. In the single-best uranium jurisdiction (Canada’s Athabasca basin) on the planet? Check. Undisputed world-class assets? Check. Strong takeout potential? Check. Extraordinary management team, Board and technical advisors? Check. Funded for several years of exploration (~$85 million in cash)? Check. A green and renewable energy investment? Check. Liquid shares that C$100mm+ sized mutual & hedge funds can buy? Check.

NexGen Energy, a widely held uranium stock that’s not Cameco Corp

NexGen is a stock that can be held by a variety of investment strategies, including; natural resource, generalist, long-short, clean energy, value & contrarian funds. With ~C$85 million in cash, it should exhibit relatively low correlation to the more mainstream stock indices. This is key, once investment capital comes roaring back into the sector, few companies have capital structures that can accommodate larger high net worth and family office accounts and institutional investors.

NexGen has approximately 2x-4x the C$ equivalent dollar trading volume of peers such as Fission Uranium (TSX: FCU) (FCUUF), Denison Mines (TSX: DML) (DNN), Paladin Energy (TSX: PDN) (PALAF), Energy Fuels (TSX: EFR) (UUUU) and Uranium Energy Corp (NYSE: UEC). And, there are dozens of other uranium juniors, but most have a nasty habit of harboring 100% downside. If nothing else, most remain addicted to repeated injections of equity capital. NexGen need not issue another share this decade, unless for success-based corporate initiatives, or to drill out new discoveries.

What about the Global X Uranium ETF (NYSE: URA)? Indicative of weak sector sentiment, trading liquidity in this investment vehicle is currently less than that of NexGen’s. Also, it should be noted that the ETF’s (somewhat) diversified portfolio [20% in Cameco Corp (TSX: CCJ) (NYSE: CCO )] reduces risk, but also reward. The same can be said of Uranium Participation Corp (“UPC”) (TSX: U). UPC owns physical uranium oxides, nothing else. It’s seen as a direct way to play a rebound in the spot price. However, it’s far from a coiled spring-like higher beta names.

A 25-30% uptick in the share price of UPC could kick-start a major advance in juniors like NexGen. Note: {NexGen’s share price is nearly 45% below where it was in early June}. Interestingly, UPC announced a $19.5 million equity financing in order to buy spot material. Might this signal a market bottom? I guess at least UPC thinks so.

Why not simply own Cameco? It too is in the Athabasca basin, has more than 30 times the dollar trading volume of NexGen, is a top global producer and bellwether uranium investment. Still, some analysts and pundits believe Cameco’s best days are behind it. Brand new Cigar Lake is a great asset, but Cameco’s 50% ownership puts it at just 9 million pounds of production next year. Further, Cigar Lake’s mine life is only about 10-12 years [that could grow, but growth won’t come cheap]. By the end of next decade, a tired McArthur River/Key Lake might need replacement or an expensive (billion(s) of dollars) facelift. Cameco also has a $2.1 billion tax problem that could hinder stock price appreciation in a bull market.

NexGen’s 100% owned Arrow project is the best discovery in a generation, a lower technical risk proposition than McArthur River & Cigar Lake, and therefore likely to be lower cost if it reaches production. It has a maiden resource of 202 million pounds (inferred), but many analysts and investors believe that after an additional eleven months of drilling, it’s now 300 million or more. If Arrow becomes a mine next decade, it could be the single largest source of mined uranium in the world. For these reasons, I believe that NexGen is a prime takeout candidate, arguably the biggest prize in the entire sector.

As mentioned, NexGen shares are nearly 45% lower than they were 20 weeks ago. Little has changed except that the Company continues to accrue pounds in the face of a collapsing spot price. However, I see three clear catalysts. First, a dead, or live cat bounce in pricing. That would improve investor and industry market sentiment. Second, the release of an updated mineral resource estimate in 1q 2017. Third, building on catalysts 1 & 2, the achievement of a healthy takeover premium in the share price. Catalyst #2 will certainly happen, and all three could come into play within 6-12 months. Another very important milestone and de-risking event will be a Pre-Feasibility Study, expected by year-end 2017.

Conclusion

Due to the fundamental and technical attributes described above, I think NexGen Energy Ltd (TSX: NXE) (OTC: NXGEF ) has a superior risk-adjusted return profile. NexGen should be a core holding in the speculative portion of an investor’s portfolio.

Disclosures: The content of this interview is for informational purposes only. Readers fully understand and agree that nothing contained in ...

more