Nasdaq Reports Record Quarterly Non-GAAP Diluted Earnings Per Share

- Achieved record non-GAAP: operating and net income, as well as diluted EPS for the first quarter of 2016.

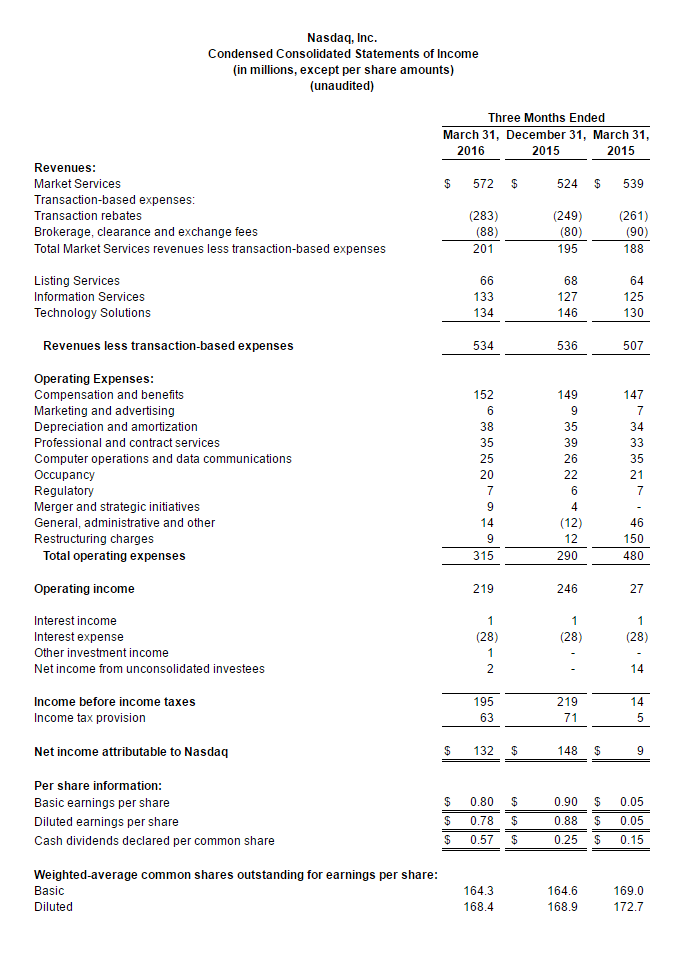

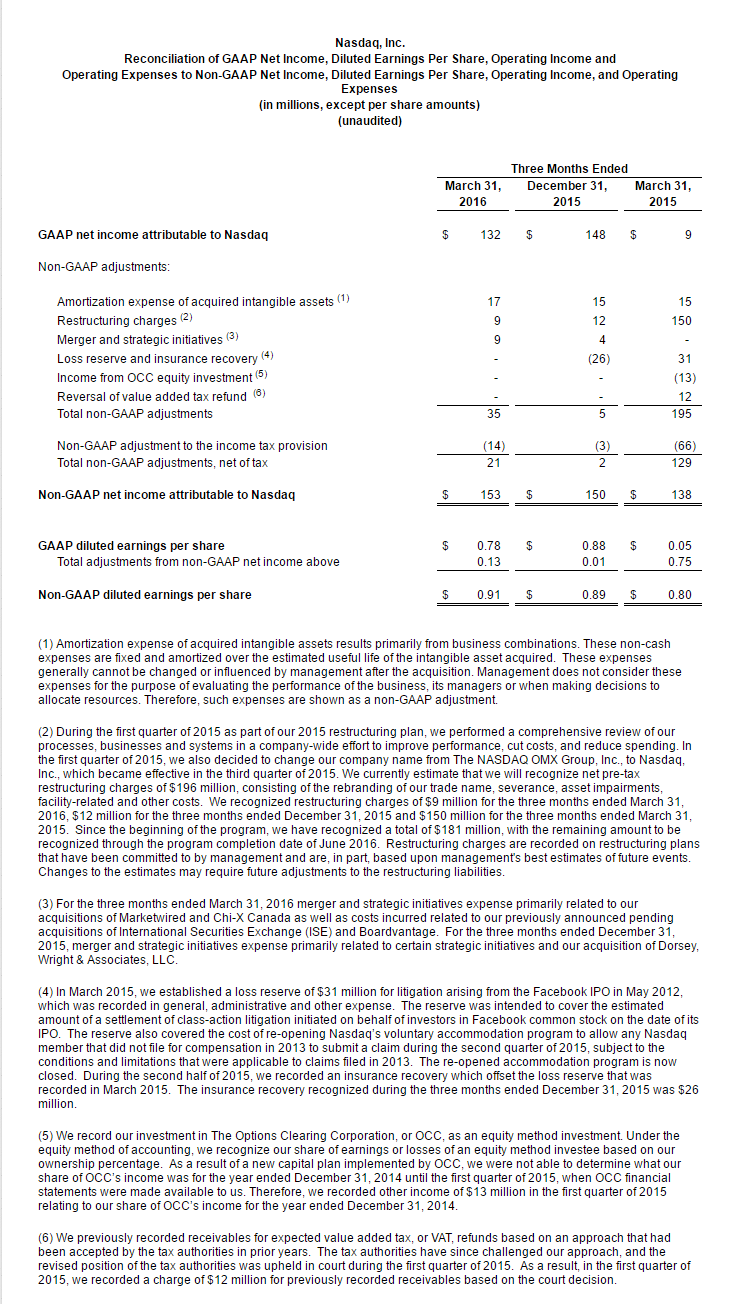

- Non-GAAP diluted EPS of $0.91 for the first quarter of 2016, an increase of 14% compared to the first quarter of 2015. First quarter 2016 GAAP diluted EPS was $0.78.

- Net revenues1 were $534 million in the first quarter of 2016, up 5% year-over-year. On an organic basis, excluding the impact of foreign exchange and acquisitions, net revenues increased 4% year-over-year.

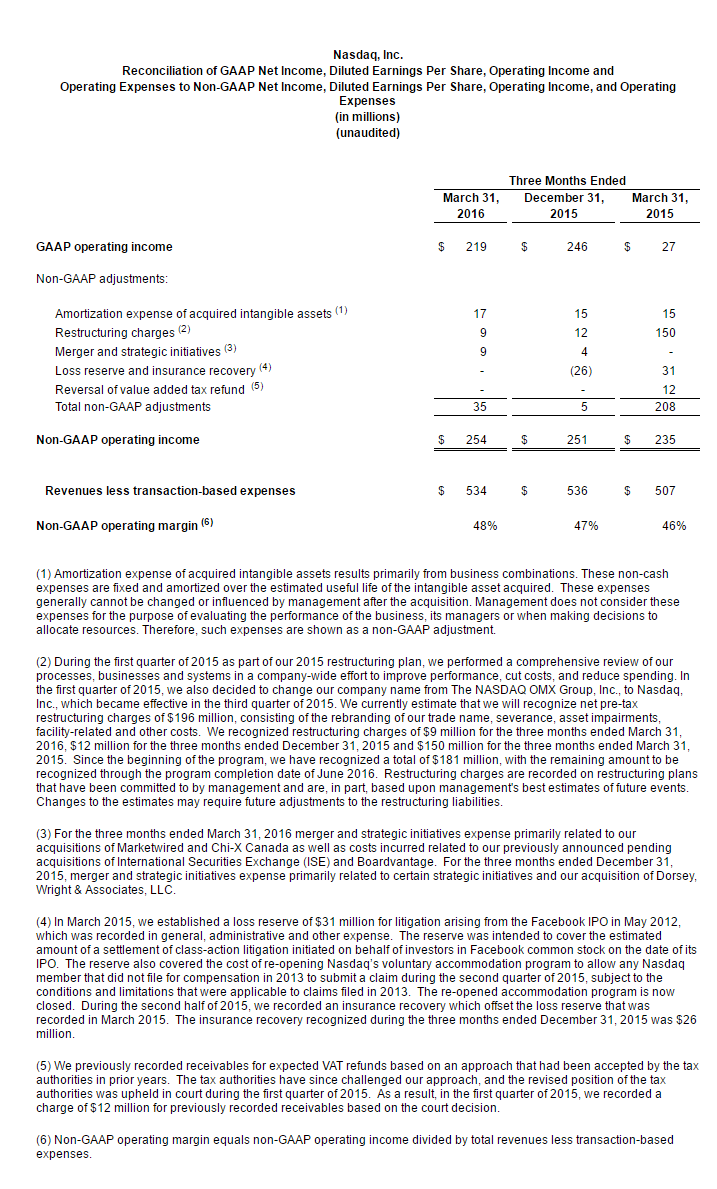

- Non-GAAP operating margin was 48% in the first quarter of 2016, versus 46% in the prior year period.

- In the first quarter of 2016, Nasdaq announced a 28% dividend increase and repurchased $29 million of common stock. Through dividends and buybacks, Nasdaq returned $70 million to shareholders in the period.

- Nasdaq’s Board of Directors authorized an additional $370 million in share repurchases, bringing the total remaining value authorized to $500 million.

NEW YORK, April 27, 2016 (GLOBE NEWSWIRE) -- Nasdaq, Inc. (Nasdaq:NDAQ) today reported record results for the first quarter of 2016. First quarter net revenues were $534 million, up 5% from $507 million in the prior year period, driven by a $29 million positive impact from operations, partially offset by a $2 million negative impact from changes in foreign exchange rates. On an organic basis, excluding the impact of changes in foreign exchange rates and acquisitions, total first quarter net revenues were up 4% from the prior year period.

“Our relentless focus on applied technology, innovation, and resiliency continues to strengthen our competitive position, deliver value to our clients, and produce record results for shareholders,” said Bob Greifeld, CEO, Nasdaq. “In addition, we expect our recently announced acquisitions, which are strategically aligned with our vision and business direction, to significantly enhance the effectiveness of our value proposition to serve our corporate and capital markets clients, while creating significant value for our shareholders.”

Mr. Greifeld continued, “We remained encouraged by the progress within key new growth initiatives, including our IR Insight platform, where we have migrated 1,200 users in the first three months since launch, in serving the private market through The NASDAQ Private Market, LLC, which served 122 companies in the first quarter of 2016, more than twice the number of the prior year period, and our U.S. commodities platform which saw open interest grow to over 800 thousand contracts last week. These initiatives are a key demonstration of Nasdaq investing in our future.”

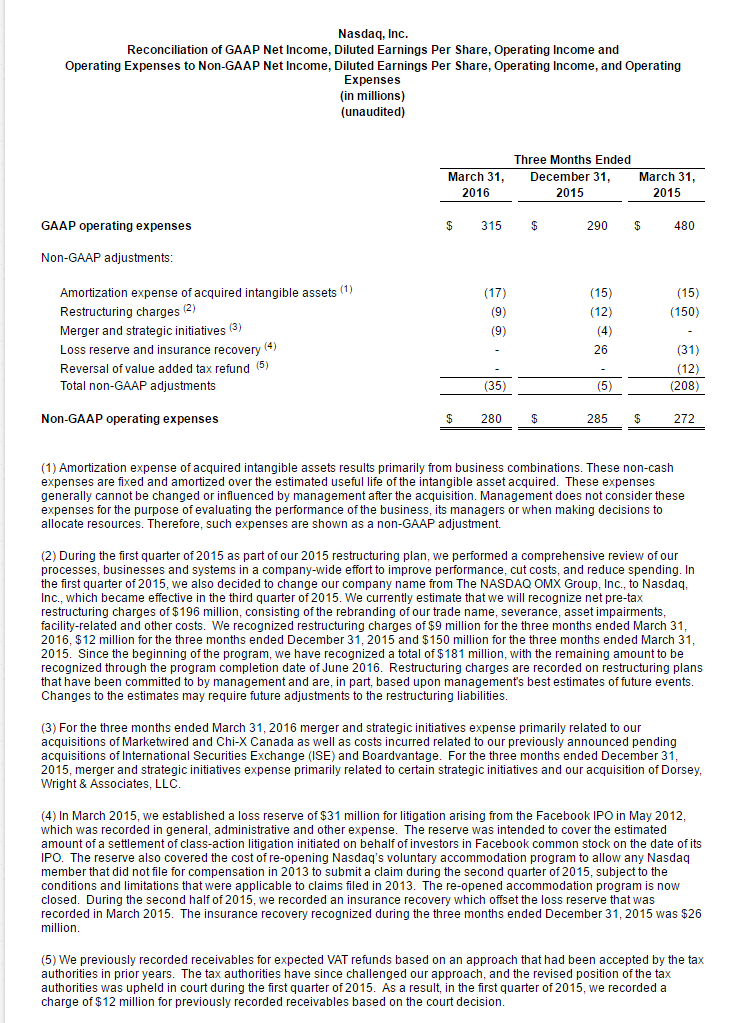

On a non-GAAP basis, first quarter 2016 operating expenses were $280 million, up 3% as compared to the prior year quarter, due to higher organic spend and the acquisitions of Dorsey, Wright & Associates, LLC, or DWA (January 2015), Chi-X Canada ATS Limited (February 2016), and Marketwired (February 2016), partially offset by the favorable impact of changes in foreign exchange rates. On a GAAP basis, operating expenses were $315 million in the first quarter of 2016, compared to $480 million in the prior year quarter, which included restructuring charges of $150 million.2

1 Represents revenues less transaction-based expenses.

2 Please refer to our reconciliation of GAAP to non-GAAP net income, diluted earnings per share, operating income and operating expenses included in the attached schedules.

“The first quarter of 2016 was very strong in terms of cash flow generation, and we continued to apply our return on invested capital based discipline to direct capital deployment, while also furthering our strong capital return track record with our recent announcement of a 28% increase in the quarterly dividend,” saidRon Hassen, Interim CFO, Nasdaq.

Mr. Hassen continued, “The 14% increase in our non-GAAP earnings per share year-over-year, combined with our common stock’s dividend yield, serves as evidence of our total shareholder return potential.”

On a non-GAAP basis, net income attributable to Nasdaq for the first quarter of 2016 was $153 million, or $0.91 per diluted share, compared with $138 million or $0.80 in the first quarter of 2015, an increase of $15 million, or $0.11 per diluted share. On a GAAP basis, net income attributable to Nasdaq for the first quarter of 2016 was $132 million, or $0.78 per diluted share, compared with $9 million, or $0.05 per diluted share, in the prior year quarter.

Please refer to our reconciliation of GAAP to non-GAAP net income, diluted earnings per share, operating income and operating expenses included in the attached schedules.

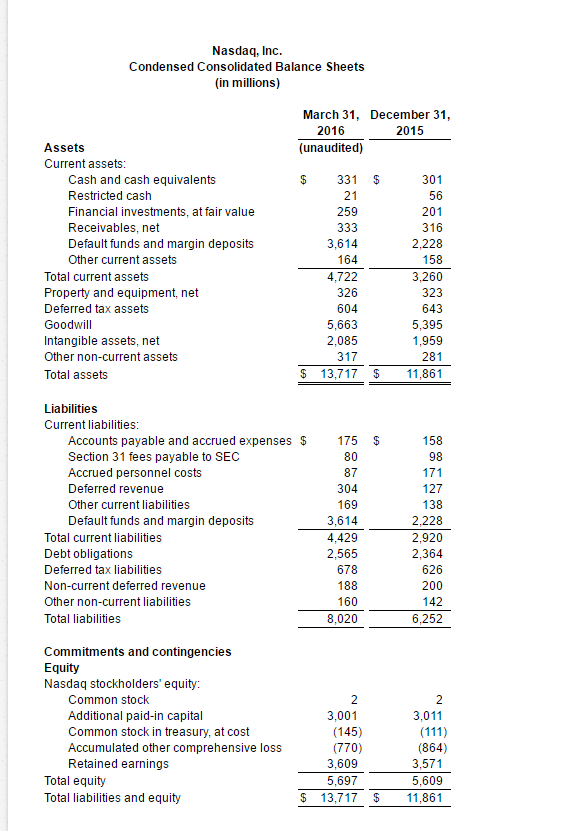

The company repurchased 490,032 shares for $29 million in the first quarter of 2016 at an average price of $59.37. At March 31, 2016, there is $500 million remaining under the board authorized share repurchase program, which includes a $370 million increase in authorized value.

At March 31, 2016, the company had cash and cash equivalents of $331 million and total debt of $2,565 million, resulting in net debt of $2,234 million. This compares to net debt of $2,063 million at December 31, 2015.

BUSINESS HIGHLIGHTS

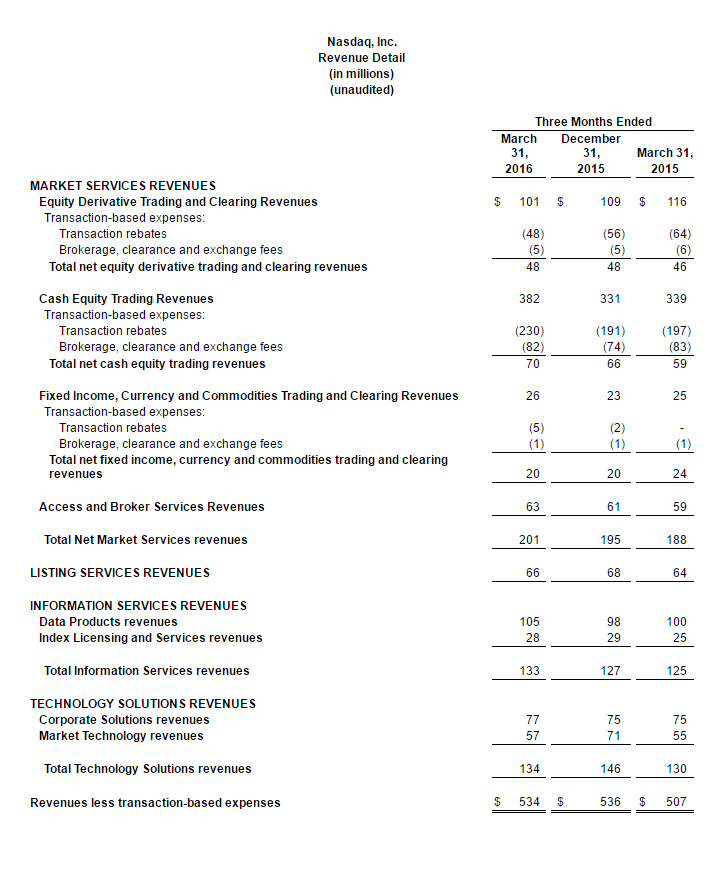

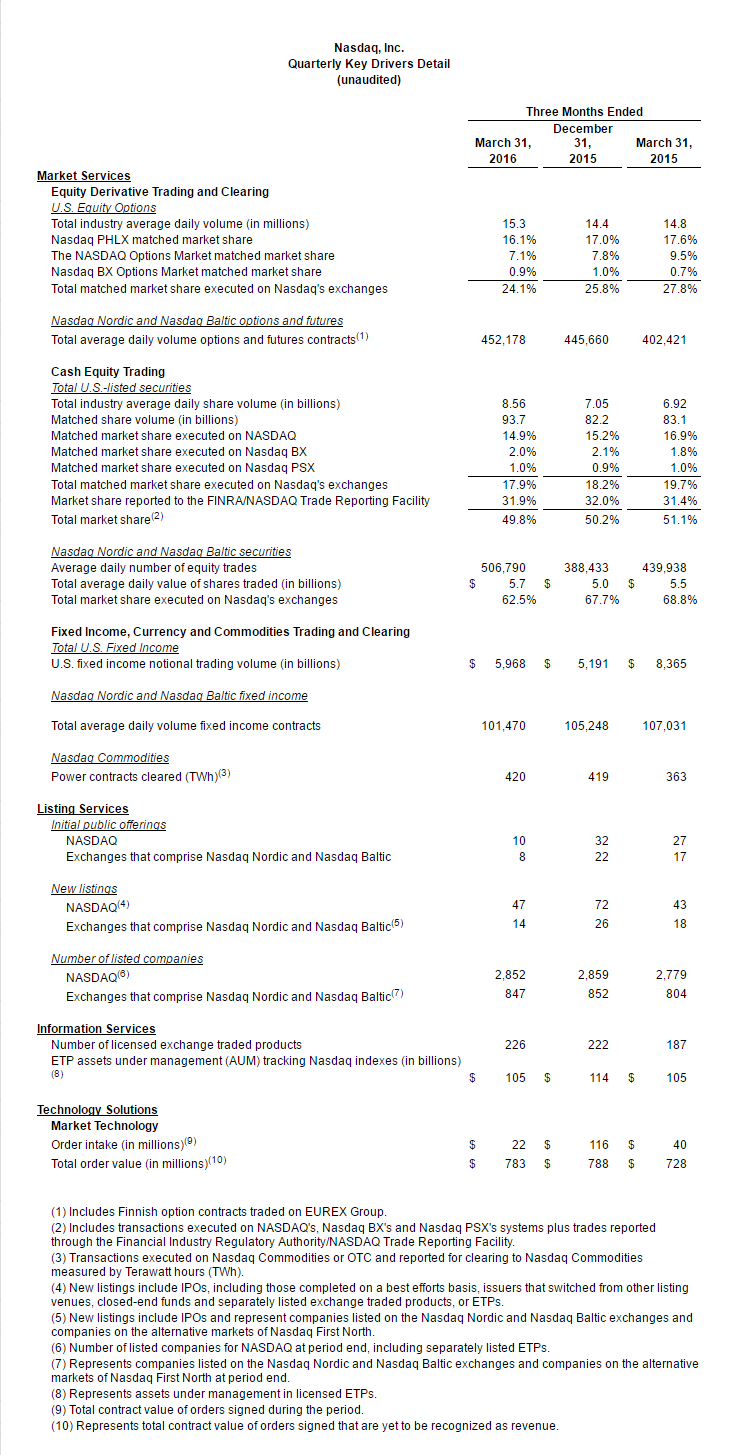

Market Services (38% of total net revenues) - Net revenues were $201 million in the first quarter of 2016, up $13 million when compared to $188 million in the first quarter of 2015. The $13 million year-over-year increase reflects a $12 million organic increase and $2 million increase from the Chi-X Canada acquisition, partially offset by a $1 million decrease due to the negative impact of changes in foreign exchange rates.

Equity Derivatives (9% of total net revenues) – Net equity derivative trading and clearing revenues were $48 million in the first quarter of 2016, up $2 million compared to the first quarter of 2015. The increase in equity derivatives revenues was primarily driven by higher U.S. industry trading volumes and higher U.S. average net capture, partially offset by lower U.S. market share.

Cash Equities (13% of total net revenues) – Net cash equity trading revenues were $70 million in the first quarter of 2016, up $11 million compared to the first quarter of 2015. The increase in cash equity revenues resulted primarily from higher industry trading volumes as well as higher average net capture, partially offset by lower market share and the negative impact of changes in foreign exchange rates. In addition, the increase reflects the inclusion of revenues associated with our acquisition of Chi-X Canada.

Fixed Income, Currency and Commodities (4% of total net revenues) – Net FICC trading and clearing revenues were $20 million in the first quarter of 2016, down $4 million from the first quarter of 2015, due to the negative impact of NFX trading incentives and a decline in U.S. fixed income revenues, partially offset by higher European fixed income and commodities revenues.

Access and Broker Services (12% of total net revenues) – Access and broker services revenues were $63 million in the first quarter of 2016, up $4 million compared to the first quarter of 2015, driven by an increase in customer demand for network connectivity.

Information Services (25% of total net revenues) – Revenues were $133 million in the first quarter of 2016, up $8 million from the first quarter of 2015. The $8 million year-over-year increase reflects a $5 million organic increase primarily from index data, proprietary data, and growth in DWA subsequent to the January 2015 close, and a $4 million increase from the acquisitions of DWA, which included one additional month in first quarter of 2016, and Chi-X Canada. In addition, the increase was partially offset by a $1 million decrease due to the negative impact of changes in foreign exchange rates.

Data Products (20% of total net revenues) – Data products revenues were $105 million in the first quarter of 2016, up $5 million compared to the first quarter of 2015, as increased revenues from index and proprietary data products as well as the inclusion of revenues associated with the DWA and Chi-X Canada acquisitions were partially offset by the negative impact of changes in foreign exchange rates.

Index Licensing and Services (5% of total net revenues) – Index licensing and services revenues were $28 million in the first quarter of 2016, up $3 million from the first quarter of 2015. The revenue growth was primarily driven by organic growth in DWA.

Technology Solutions (25% of total net revenues) – Revenues were $134 million in the first quarter of 2016, up $4 million from the first quarter of 2015. The $4 million year-over-year increase primarily reflects the inclusion of revenue from the acquisition of Marketwired and organic growth in surveillance products.

Corporate Solutions (14% of total net revenues) – Corporate solutions revenues were $77 million in the first quarter of 2016, up $2 million from the first quarter of 2015. The corporate solutions revenue increase reflects a contribution from the Marketwired acquisition and growth in Directors Desk, partially offset by the negative impact of changes in foreign exchange rates and lower multimedia related revenues. Directors Desk delivered record revenue.

Market Technology (11% of total net revenues) – Market technology revenues were $57 million in the first quarter of 2016, up $2 million from the first quarter of 2015. The increase was driven primarily by organic growth in surveillance products. New order intake was $22 million for the first quarter of 2016, and the total order value at March 31, 2016 was $783 million, up 8% from the prior year period and near the all-time record of $788 million at December 31, 2015.

Listing Services (12% of total net revenues) – Revenues were $66 million in the first quarter of 2016, up $2 million compared to the first quarter of 2015. The $2 million year-over-year increase reflects an increase in the number of U.S. and European listed companies.

UPDATING 2016 NON-GAAP EXPENSE GUIDANCE – The company has revised 2016 non-GAAP operating expense guidance to $1,180-$1,230 million from $1,110-$1,160M to reflect the impact of the acquisitions of Chi-X Canada and Marketwired, which closed during the first quarter of 2016, as well as the pending acquisition of Boardvantage, which is expected to close in the second quarter of 2016.

CORPORATE HIGHLIGHTS

- Nasdaq Futures Market shows consistent growth. Nasdaq Futures, or NFX, a U.S.-based futures and options market for key energy benchmarks, has seen consistent growth and marketplace traction since launch in late July 2015. NFX has gained support from multiple sectors of the energy trading community, including 17 prominent global Futures Commission Merchants, with open interest rising to over 800,000 contracts last week. Over ten million contracts have traded since launch and NFX has registered greater than 20% daily market share in natural gas options on several occasions.

- Nasdaq launches a new innovative Investor Relations platform known as Nasdaq IR Insight. Nasdaq officially launched its next generation Investor Relations platform known as Nasdaq IR Insight, a platform specifically designed for financial executives, especially Investor Relations officers. Nasdaq IR Insight was designed with extensive client collaboration to capture the Investor Relations work stream, improve data intelligence, and enhance decision making through a single product.

- The Nasdaq Stock Market (Nasdaq) Led U.S. Exchanges for IPOs and ETPs listings in 1Q16. Nasdaq welcomed 47 new listings in the first quarter of 2016, including 10 IPOs. 100% of all U.S. IPOs listed with Nasdaq in the first quarter of 2016. Among U.S. ETPs, Nasdaq led U.S. listing exchanges with 42% of new ETP listings and switches in the first quarter of 2016.

- First Trust AlphaDEX smart beta ETFs switch index provider and listing venue to Nasdaq. First Trust announced the switch of the index provider and listing venue for 12 smart beta AlphaDEX ETFs effective Friday, April 8, 2016, which contain approximately $6 billion in assets under management. Last year, Nasdaq partnered with First Trust to switch 17 First Trust global, regional and country AlphaDEX ETF benchmarks to track Nasdaq branded AlphaDEX indexes.

- Nasdaq and Digital Reasoning establish exclusive alliance to deliver holistic next generation surveillance and compliance technology. Nasdaq and Digital Reasoning, a leader in cognitive computing, announced a strategic alliance to offer surveillance technology to global capital markets participants, including the buy-side, brokers, regulators, and exchanges. The combination of Digital Reasoning’s eComms compliance and Nasdaq’s SMARTS surveillance solutions will offer a unified interface to take a holistic approach to surveillance and compliance across structured and unstructured data.

- Nasdaq completes acquisitions of Chi-X Canada and Marketwired. On February 1st, 2016, Nasdaq completed the acquisition of Chi-X Canada, a leading alternative market in Canada. The deal expands Nasdaq’s equities trading business beyond the Nordics and the U.S., and enhances the trading experience for customers by promoting greater uniformity in technology and functionality across these trading venues. On February 25th, 2016, Nasdaq announced the completion of its acquisition of Marketwired, a leading global provider of news distribution services and analytics for communications professionals. Nasdaq customers will benefit from an enhanced offering including Marketwired’s leading social media targeting tools and analytics.

- Nasdaq announces agreements to acquire International Securities Exchange and Boardvantage. In March 2016, Nasdaq announced it will acquire International Securities Exchange, or ISE, an operator of three electronic U.S. options exchanges, from Deutsche Börse Group. Nasdaq will build on its robust offerings by providing greater breadth and depth of products and services to participants, and the acquisition is expected to allow Nasdaq to offer efficiencies for clients. In March 2016, Nasdaq announced that it will acquire Boardvantage, Inc., a leading board portal solution provider which also specializes in leadership collaboration and meeting productivity.

ABOUT NASDAQ

Nasdaq (Nasdaq:NDAQ) is a leading provider of trading, clearing, exchange technology, listing, information and public company services across six continents. Through its diverse portfolio of solutions, Nasdaq enables customers to plan, optimize and execute their business vision with confidence, using proven technologies that provide transparency and insight for navigating today's global capital markets. As the creator of the world's first electronic stock market, its technology powers more than 70 marketplaces in 50 countries, and 1 in 10 of the world's securities transactions. Nasdaq is home to nearly 3,700 listed companies with a market value of $9.3 trillion and over 17,000 corporate clients. To learn more, visit: nasdaq.com/ambition or business.nasdaq.com.

NON-GAAP INFORMATION

In addition to disclosing results determined in accordance with GAAP, Nasdaq also discloses certain non-GAAP results of operations, including, but not limited to, net income attributable to Nasdaq, diluted earnings per share, operating income, and operating expenses, that include certain adjustments or exclude certain charges and gains that are described in the reconciliation table of GAAP to non-GAAP information provided at the end of this release. Management believes that this non-GAAP information provides investors with additional information to assess Nasdaq's operating performance and assists investors in comparing our operating performance to prior periods. Management uses this non-GAAP information, along with GAAP information, in evaluating its historical operating performance.

The non-GAAP information is not prepared in accordance with GAAP and may not be comparable to non-GAAP information used by other companies. The non-GAAP information should not be viewed as a substitute for, or superior to, other data prepared in accordance with GAAP.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information set forth in this communication contains forward-looking statements that involve a number of risks and uncertainties. Nasdaq cautions readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. Such forward-looking statements include, but are not limited to (i) projections relating to our future financial results, growth, trading volumes, products and services, order backlog, taxes and achievement of synergy targets, (ii) statements about the closing or implementation dates and benefits of certain acquisitions and other strategic, restructuring, technology, de-leveraging and capital return initiatives, (iii) statements about our integrations of our recent acquisitions, (iv) statements relating to any litigation or regulatory or government investigation or action to which we are or could become a party, and (v) other statements that are not historical facts. Forward-looking statements involve a number of risks, uncertainties or other factors beyond Nasdaq’s control. These factors include, but are not limited to, Nasdaq’s ability to implement its strategic initiatives, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors detailed in Nasdaq’s filings with the U.S. Securities and Exchange Commission, including its annual reports on Form 10-K and quarterly reports on Form 10-Q which are available on Nasdaq’s investor relations website at http://ir.nasdaq.com and the SEC’s website at www.sec.gov. Nasdaq undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

NDAQF

MEDIA RELATIONS CONTACT: Joseph Christinat +1.646.441.5121 joseph.christinat@nasdaq.com INVESTOR RELATIONS CONTACT: Ed Ditmire, CFA +1.212.401.8737 ed.ditmire@nasdaq.com

Disclosure: None