MVC Capital Inc. Is Good For Business Development

Every New York stock exchange trading day I'm posting a daily dividend stock review. I'll share the two chief qualities of just one equity or fund that could be selected for a dividend stock portfolio I've named the Safari to Sweet Success.

This week's slot in the Safari portfolio is reserved for the financial services sector.

That sector includes nineteen industries all related to managing money. Industries include: asset management; banks either global or from any of seven regions, capital markets, credit services, financial exchanges, insurance in six specializations, savings banks, and specialty finance.

Today I'm reviewing an asset manager that provides equity and investment capital to small and mid-size companies as a business development company Its name is MVC Capital, Inc. It's trading ticker symbol is MVC.

Beginning as a technology venture capital firm in 1999, the company reorganized itself as a broader business development company in 2002 and solidified its present external management structure in 2006 as MVC Capital, Inc. Headquartered in Purchase, New York.

Two keys evaluate dividend stocks like MVC:

(1) Price

(2) Dividends

(3) Returns

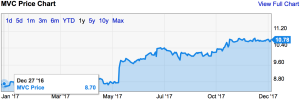

MVC Price

MVC Capital's price at Friday's close was $10.78 per share. The stock has positive momentum. Just a year ago its price was $8.70. That's a gain of $2.08 in the past year. Can MVC do as well in the coming year? If it does MVC price would increase to $12.86, or 19 %.

However, two broker analysts concur on a target price of $12.50 for an increase of just $1.72. Those market makers see only a 16% upside whereas past year momentum shows 19%.

MVC Dividends

The most recent quarterly dividend was $0.15 declared in December, payable in January. The dividend increased a cent and a half from the $0.12 amount set in October 2012.

At last Friday's closing price of $10.78 per share the annual yield from $0.15 to be paid next quarter equaled a $0.60 annual payout per share and showed 5.56% for annual yield.

Are Gains Ahead For MVC?

Adding the dividend of $0.60 to the $2.08 potential upside from a repeat of 2017 performance shows a $2.68 gross gain.

Adding the same dividend to the $1.72 target gain foreseen by two broker analysts shows a $2.32 gross gain.

Calculating potential net gains for MVC depends on how many shares are bought. Using a $1,000.00 budget amount at the $10.78 Friday closing price would allow an even share purchase 93 shares for $1002.54. Figure our 93 shares incur a broker fee of about $5 at purchase and another $5 at sale (if we're to realize any gains) burdens each share with a brokerage cost of about $0.11.

Plotting Returns For MVC

Subtracting the $0.11 brokerage cost shows net gains to 2018 tor equal 2017 momentum of a $2.68 gross gain:

$2.68 - $0.11 = $2.57 X 93 shares = $239.01

or 24% net on our $1,002.54 investment.

Per 2 brokers 2018 shows a $2.32 gross gain:

$2.32 - $0.11 = $2.21 X 93 shares = $205.53

or 20% net on our $1,002.54 investment.

These forward-looking numbers are conjecture based on past year performance and analyst estimates. The actual results remain to be seen. They could turn out to move lower. More study is required for you to determine if MVC Capital, Inc is worth your time and money.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, ...

more