MillerCoors Buys Craft Brewer - If You Can't Beat Them, Buy Them

Molson Coors Brewing Company (TAP) is the world's fifth-largest global brewer. Molson Coors Brewing Company has 15,000 employees worldwide, 18 breweries, and a broad portfolio of over 40 brands, including Molson Canadian, Coors Light and Carling.

SABMILLER PLC (SBMRY) is one of the world's largest brewers with brewing interests or distribution agreements in over sixty countries across six continents. The principal activities of the Company and its subsidiaries are the manufacture, distribution and sale of beverages. The group's brands include premium international beers such as Grolsch, Miller Genuine Draft, Peroni Nastro Azzurro and Pilsner Urquell, as well as an exceptional range of market leading local brands. Outside the USA, SABMiller plc is also one of the largest bottlers of Coca-Cola products in the world.

Together these two giants form MillerCoors LLC and they are the latest macro brewer to enter the craft beer market, NOT by making better beer on their own, but via an acquisition. The firms announced today that they had acquired Saint Archer Brewing, San Diego, California. Saint Archer produces @35000 bbl/year. The deal will close next month.

This purchase comes on the heels of another high-profile acquisition as Heineken also announced this week that it was purchasing a 50% portion of famed craft brewer Lagunitas.

Macro brewers remain stymied by the better craft beers, and keep losing market share to the far more numerous competitors. Miller Coors hopes that they can have an easier time of penetrating the market by pushing the popular Saint Archer IPA across the US.

These sorts of arrangements pose a conundrum for craft beer aficionados as drinkers want to try quality beers from across the nation, but are reticent to do so once the craft brand is "tainted" by its association with a big macro brewer. MillerCoors promises that Saint Archer will remain independent, and just "benefit" from large-sale distribution and sales resources. But, often that doesn't pass muster with the notoriously picky craft drinkers.

Meanwhile the big boys continue to claim craft cannot continue to expand, that "real men" drink weak American lagers such as Budweiser and Coors, and that many of the upstarts will soon go under. So far, that has not been the case, and mocking craft beer drinkers via Super Bowl ads and other means has been a colossal waste of resources which would be better spent on ingredients and some better brews.

Below, we present the latest top-ten list of major beer brewing/beverage stocks from our models. They are ranked according to their one-month forecast return figures.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

|

KIRIN HLDGS CO |

13.81 |

N/A |

4.46% |

0.13% |

1.51% |

N/A |

Consumer Staples |

|

|

CERV UNIDAS-ADR |

20.99 |

-11.31% |

-5.71% |

0.12% |

1.49% |

18.23 |

Consumer Staples |

|

|

ANHEUSER-BU ADR |

108.06 |

-6.11% |

-3.07% |

0.07% |

0.82% |

19.76 |

Consumer Staples |

|

|

HEINEKEN NV |

39.015 |

N/A |

0.87% |

0.06% |

0.74% |

N/A |

Consumer Staples |

|

|

BOSTON BEER INC |

213.34 |

-17.36% |

-1.09% |

0.01% |

0.15% |

29.41 |

Consumer Staples |

|

|

DIAGEO PLC-ADR |

105.95 |

N/A |

-11.57% |

-0.06% |

-0.72% |

18.29 |

Consumer Staples |

|

|

MOLSON COORS-B |

68.44 |

25.92% |

-2.49% |

-0.06% |

-0.75% |

18.04 |

Consumer Staples |

|

|

AMBEV-PR ADR |

5.03 |

-15.86% |

-26.35% |

-0.11% |

-1.27% |

17.34 |

Consumer Staples |

|

|

SABMILLER PLC |

46.25 |

N/A |

-17.73% |

-0.17% |

-2.06% |

19.21 |

Consumer Staples |

|

|

CARLSBERG A/S |

14.96 |

N/A |

-19.72% |

-0.27% |

-3.19% |

N/A |

Consumer Staples |

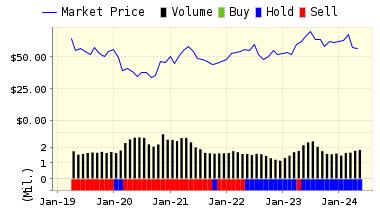

Below is today's data on TAP and SBMRY:

TAP: ValuEngine continues its HOLD recommendation on MOLSON COORS-B for 2015-09-09. Based on the information we have gathered and our resulting research, we feel that MOLSON COORS-B has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

68.40 | -0.06% |

|

3-Month |

70.13 | 2.47% |

|

6-Month |

72.59 | 6.06% |

|

1-Year |

67.93 | -0.75% |

|

2-Year |

84.67 | 23.72% |

|

3-Year |

77.09 | 12.64% |

|

Valuation & Rankings |

|||

|

Valuation |

25.92% overvalued |

Valuation Rank |

|

|

1-M Forecast Return |

-0.06% |

1-M Forecast Return Rank |

|

|

12-M Return |

-2.49% |

Momentum Rank |

|

|

Sharpe Ratio |

0.49 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

8.93% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

18.10% |

Volatility Rank |

|

|

Expected EPS Growth |

3.08% |

EPS Growth Rank |

|

|

Market Cap (billions) |

11.29 |

Size Rank |

|

|

Trailing P/E Ratio |

18.04 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

17.50 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

5.87 |

PEG Ratio Rank |

|

|

Price/Sales |

2.94 |

Price/Sales Rank |

|

|

Market/Book |

79.08 |

Market/Book Rank |

|

|

Beta |

1.00 |

Beta Rank |

|

|

Alpha |

-0.07 |

Alpha Rank |

|

SBMRY: ValuEngine continues its HOLD recommendation on SABMILLER PLC for 2015-09-09. Based on the information we have gathered and our resulting research, we feel that SABMILLER PLC has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

46.17 | -0.17% |

|

3-Month |

46.47 | 0.47% |

|

6-Month |

46.82 | 1.23% |

|

1-Year |

45.30 | -2.06% |

|

2-Year |

47.91 | 3.58% |

|

3-Year |

50.66 | 9.54% |

|

Valuation & Rankings |

|||

|

Valuation |

n/a |

Valuation Rank |

|

|

1-M Forecast Return |

-0.17% |

1-M Forecast Return Rank |

|

|

12-M Return |

-17.73% |

Momentum Rank |

|

|

Sharpe Ratio |

0.49 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

10.06% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

20.46% |

Volatility Rank |

|

|

Expected EPS Growth |

9.97% |

EPS Growth Rank |

|

|

Market Cap (billions) |

74.60 |

Size Rank |

|

|

Trailing P/E Ratio |

19.21 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

17.47 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.93 |

PEG Ratio Rank |

|

|

Price/Sales |

n/a |

Price/Sales Rank |

|

|

Market/Book |

45.71 |

Market/Book Rank |

|

|

Beta |

1.25 |

Beta Rank |

|

|

Alpha |

-0.14 |

Alpha Rank |

|

Disclosure: None.

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading ...

more