Market Briefing For Monday, May 15

Staggering and stammering, moved the S&P, generally mirroring the political rhetoric coming from Washington, while generally ignoring, or in a sense relegating to minor import, some of the significant developments of the day Friday.

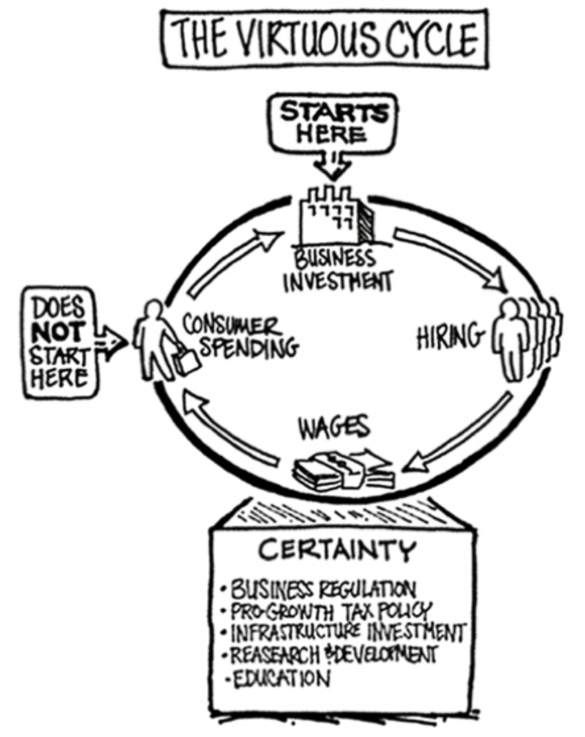

Commerce Secretary Ross announced the significant trade agreements worked on for weeks with China; and that really was the most important, as it reflects significantly improved ties with China. It involves 'beef' (off-limits over the recent years); and more about coal, natural gas and other areas.

This really reflects a trend (minimized or ignored by most media) to move in a businesslike manner to cement important economic agreements that are significantly more favorable to both partners; and in this case improving the future US trade balance with China, which is quite an important issue.

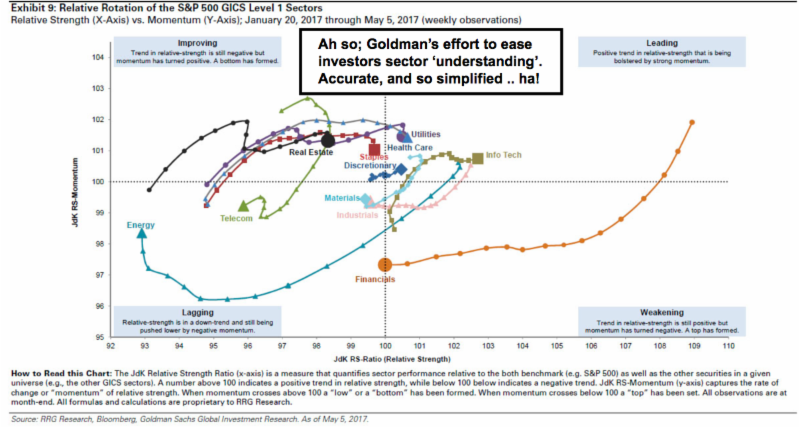

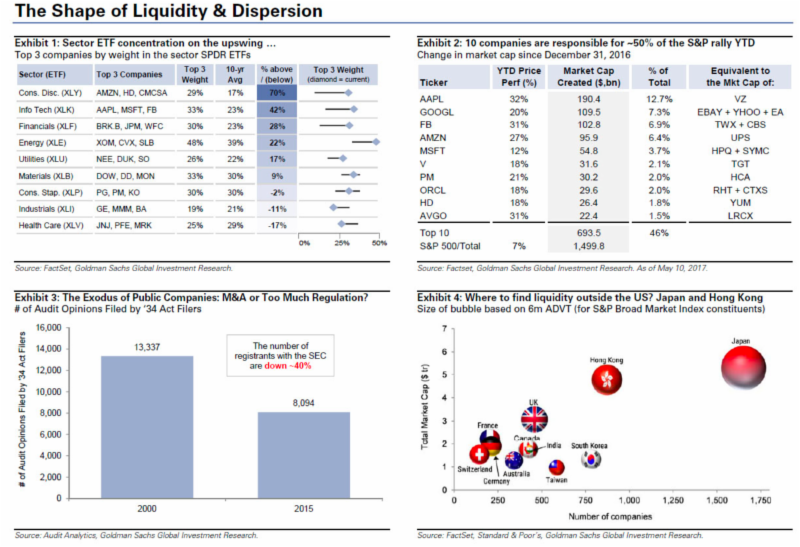

Persistent resilience roared in full glory for awhile on Thursday; giving an impression that 'nothing' can take this stock market down. In reality it's been an ongoing rotational correction for over two months now; with momentum a non-factor, which is why 'rotation' into dormant or under-performing sectors, has actually been 'how' managers have kept the Indexes levitated, while the (sort of) stealth-like rolling adjustments have persisted sector-by-sector.

This matters now; because some see this an a no longer overbought stock market, that is thus prepared for another leg up. We see it as simply a mask that was cleverly orchestrated, and has not really taken overall portfolios of most funds, or diversified investors, particularly higher in a couple months. It also suggests that those sectors that have been on the defensive may find an earlier low but ideally would show some classic signs, like 'failing to be hit hard', when (not if) the broader market gets hit.

Friday morning was a hint of how that works, as the already-corrected stocks either did or did not participate in the morning decline (notice how the retail stocks, which were already down, did decline, proving they weren't yet at an important low; whereas the energy sector generally didn't get hit much and then rebounded, suggested it's view as a more stable holding and if further decline is seen with a broad-market sell-off, those may be more attractive in terms of further buys). Just examples; Apple (for instance), Exxon (the energy example); or in speculative stocks even little LightPath (which should move independently of the larger cap markets as under their radar).

Essentially the market faces more landmines that are out there but they won't get tripped over all at once, which is actually a good bit healthier than a broad brush decline that takes everything. In a normal setting this might imply a correction risk likes ahead, rather than a big overall market decline. However this isn't a normal market environment.

| Geopolitics are forecast to contribute to impact (depth-and-breadth) of any evolving rallies or retreats. Many will 'blame' geopolitics alone; but as you know key economic factors, including delay of tax-reform and exhaustion of seasonal reinvestment funds coming-into markets, contributed to my view of risks in this time-frame and ideally after the achievement (now realized) of a new S&P high, even if brief and not particularly sustainable. Politics can be an additional impediment. Avoiding corrections of a greater magnitude in the weeks ahead is pretty unlikely; short-term higher highs notwithstanding. |

I'll touch on a few issues via the videos; generally we still see risks in these markets; and even if there is progress on 'peace' in Asia (fingers crossed on that; nothing at all known to be in the works yet; but just hinted at so far), it's a market that can play catch-down by the Senior Averages with corrections already ongoing for weeks in a number of market sectors.

Monday may start a little defensively or mixed. Then barring more news of a concerning nature (like North Korea or for instance another variant of that computer malware), the market should try an intraweek rally, then sort of hold it's 'breadth' ahead of the President's trip to Saudi Arabia; another topic which should get wider coverage by the press given the importance of some sort of precedent-setting effort at rapprochement between most key Arab nations and perhaps Israel.

| |

Disclosure: None.