Market Briefing For Friday, June 8

High-tech stimulus - is not key to levitating this market for now; rather it's 'rotation' and even a return to strength in Oil stocks, with a rather welcome decision by the EU not to purchase oil from Iran; in-line with sanctions. Of course it's all eyes on Canada first; given the tweets tonight.

The underlying tone of this market is skittish. It's got support being brought to bear (pun intended) by trotting-out the most prominent Quantitative and other analysts to sort of (pre-gaming ahead of risk?) handhold investors. I even view Dimon and Buffett arguing not to give quarterly guidance as a part of the effort to mitigate market volatility.

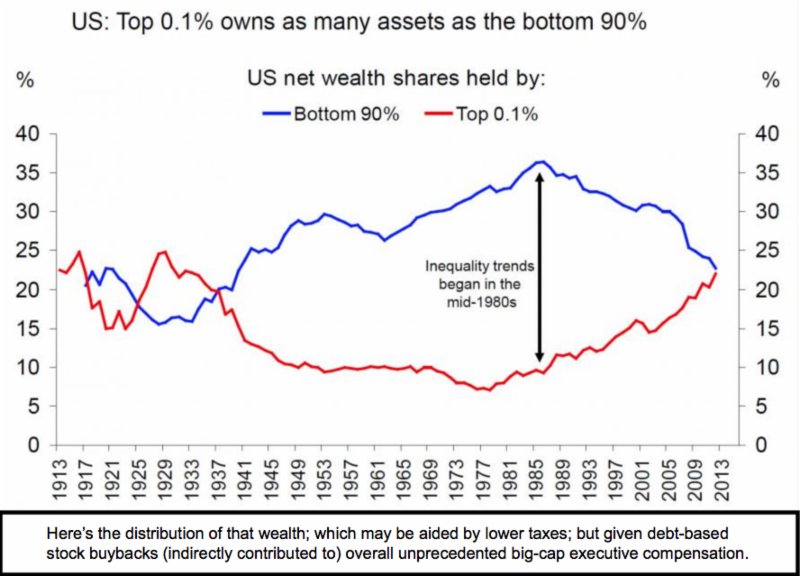

Hence whether it's an analyst arguing for nominally higher S&P levels, or a minimization of 'earnings matters'; while there's some validity to arguing about pressures on CEO's to deliver, there's also an element of trying not to let investors 'in' on what's going on in companies.

While I embrace the idea of approaching a company as a business you'll run for 50 years as well (Warren Buffett suggested that); the reality is very different for most investors. And there's also an element there addressed (in a stealth way) 'as if it was intended for shareholders', because 'churn' or turnover happens to be a characteristic of many mutual and hedge fund managers; even as they counsel their clients and investors almost always to 'stay the course'. They often don't; just check-up on turnover statistics.

On this theme; I view the FANG or FANM and similar as pricey vehicles of course capable of moving up; but not worth the risk of pursuing. In fact the approach here has been (as we have been in some of those at lower level entries) to suggest scaling-out on rallies all year; and that's regardless of a prevailing argument you'll hear about new highs in the S&P coming. But in the case of an Apple or IBM or Texas Instruments; no I would not bail from all holdings; there's no reason. But I would have cutback; and particularly in a stock like Facebook, which has become a bit too controversial.

Bottom-line: given my view of letting the other guy get the last 10% of a move, providing there is even another 10% (and in most cases NOT in my opinion for this particular phase of market advance); it's hard to advise the purchase of any of the big-cap issues up here; and as I suspect most main institutional guys and gals suggesting that are 'talking their book', I'm going to be suspicious. And there are those lingering 'trade/tariff' issues too.