Is Now The Right Time To Buy Alibaba?

Chinese stocks have been under heavy selling pressure lately, mostly because of investor concerns about the trade war and its impact on China's economy and currency value. In this context, Alibaba (BABA) stock is down by nearly 32% from its highs of the last year.

On the other hand, Alibaba is growing at full speed, the company's long-term growth prospects look as strong as ever, and valuation levels are fairly attractive for such a powerful growth business. For investors who can tolerate the short-term uncertainty in Alibaba stock, the recent adjustment in the stock price looks like a buying opportunity.

Alibaba Remains Solid

Judging by recent financial performance numbers, it's hard to argue against the fact that Alibaba keeps growing at full speed as of the quarter ended in September of 2018.

Total revenue amounted to RMB85,148 million ($12,398 million) during the period, an increase of 54% versus the same quarter in the prior year. Growth tends to slow down as a company gains size over the years, and it's hard to find companies that can sustain this kind of growth from such a gargantuan revenue base.

Alibaba's different segments look quite healthy, and this is a major positive when it comes to evaluating the company's ability to sustain performance going forward.

- Revenue from core commerce increased 56% year-over-year to RMB72,475 million ($10,553 million).

- Revenue from cloud computing increased 90% year-over-year to RMB5,667 million ($825 million).

- Revenue from digital media and entertainment increased 24% year-over-year to RMB5,940 million ($865 million).

- Revenue from innovation initiatives and others increased 20% year-over-year to RMB1,066 million ($155 million).

Annual active consumers on the company's retail marketplaces reached 601 million during the quarter, an increase of 25 million new users. Mobile monthly active users reached 666 million in September 2018, an increase of 32 million over June 2018.

Alibaba is aggressively investing in all kinds of growth initiatives, and this is having a negative impact on profit margins. But the business is financially solid, and Alibaba produced $2.3 billion in free cash flow during the quarter ended in September of 2018.

The Long-Term Picture

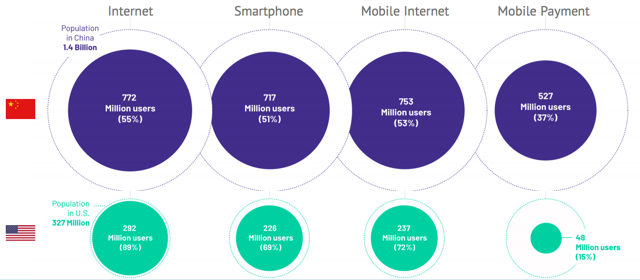

From a long-term perspective, Alibaba is benefiting from powerful tailwinds, as the company operates in industries offering abundant room for growth. Internet penetration in China is still quite small at only 55%. However, the country is so big that there are three times more smartphone users and eleven times more mobile payments users in China than in the U.S.

Source: Abacus News China Internet Report

Economic growth, rising income levels, expanding discretionary spending, and increased internet penetration in China should benefit industries such as online commerce, digital payments, and online entertainment in the years. Alibaba is remarkably well positioned to capitalize on those growth opportunities in the long term.

Alibaba is a textbook example of a company benefitting from the network effect. Buyers and sellers attract each other to the leading e-commerce platforms in search for opportunities, and this creates a self-sustaining virtuous cycle of growth and increased customer value for a market leader such as Alibaba.

The same dynamic is at play in the digital payments industry, customers want a payment method that is accepted everywhere, and merchants need to accept the payment methods that can bring more customers to the store.

Scale also provides a key cost advantage in areas such as cloud computing infrastructure and digital entertainment since the size of the business allows Alibaba to make bigger investments and distribute its fixed costs on a larger revenue base, which reduces the cost per unit.

Risk, Value, and Opportunity

The economic deceleration in China is a very real concern, and it's having an impact on Alibaba's business. From the company's most recent conference call:

Just in the past month, global macroeconomic conditions have become more uncertain. People wonder about potential reverberations from the global economic slowdown, the threat of rising interest rates and political and debt turmoil in Europe. In the case of China, we see reports of decelerating GDP growth, weak Purchasing Managers' Index, and stressed equity markets.

According to some reports, China may have as much as $6 trillion in hidden debt, which could be a major risk for the global economy and financial markets as a whole if the country goes into a recession.

In the words of Warren Buffett: "You only learn who has been swimming naked when the tide goes out". Debt is generally not a big problem when the economy is growing strongly, but during challenging economic conditions, excessive debt levels can become a huge burden and a major source of financial instability.

Global stock markets have been under considerable selling pressure lately, and the current market environment is quite hard for a high growth stock such as Alibaba. A position in Alibaba clearly means accepting considerable volatility and downside risk in the short term.

But the main point is that those risks are already incorporated into valuation levels. Wall Street analysts are on average expecting Alibaba to make $5.14 in earnings per share in the current year and $6.66 in earnings per share next year. Under these assumptions, the stock is trading at a forward price to earnings ratio of 28 times earnings for the current year and 22 times earnings for the next fiscal year. This is quite an attractive valuation for such a dynamic growth stock.

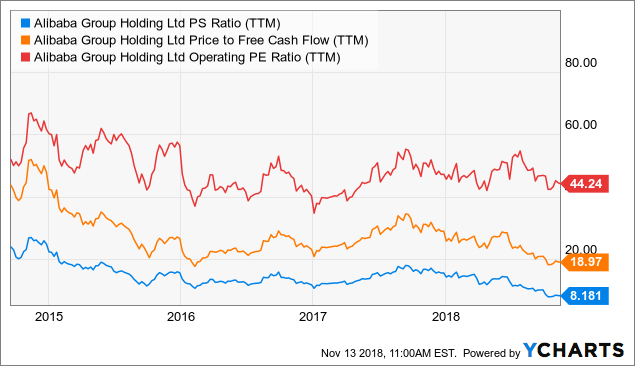

Looking at valuation metrics such price-to-sales, price-to-free cash flow, and operating price-to-earnings, Alibaba stock looks quite conveniently priced by historical standards.

(TTM) data by YCharts

Alibaba stock could remain volatile in the short term, for those looking to build a position in the company, a smart approach would be starting with a partial position and increasing the size of such a position if the price keeps moving down in the coming months.

One thing is quite clear, Alibaba is a high-quality growth business. As long as the fundamentals remain solid, any short-term dips in the stock should be buying opportunities for investors over the long-term.

Disclosure: I am/we are long BABA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more