IPO Preview: Liberty Oilfield Services

Liberty Oilfield Services Inc. (Pending:BDFC) filed an S-1/A with the Securities and Exchange Commission for its initial public offering, which we previewed here.

The company plans to offer 22,857,143 shares at a marketed price range of $16 to $19. It has an additional 3,428,571 shares as an overallotment option for its underwriters.

The underwriters for the IPO include: Morgan Stanley, Goldman, Sachs & Co., Wells Fargo Securities, Citigroup, J.P. Morgan, Evercore ISI, Simmons & Company International, Tudor, Pickering, Holt & Co., Houlihan Lokey, Intrepid Partners, Petrie Partners Securities, SunTrust and Robinson Humphrey.

If BDFC prices at the midpoint of its proposed range, and underwriters exercise their option to purchase additional shares, BDFC could have a market cap of $2.24B.

Business overview

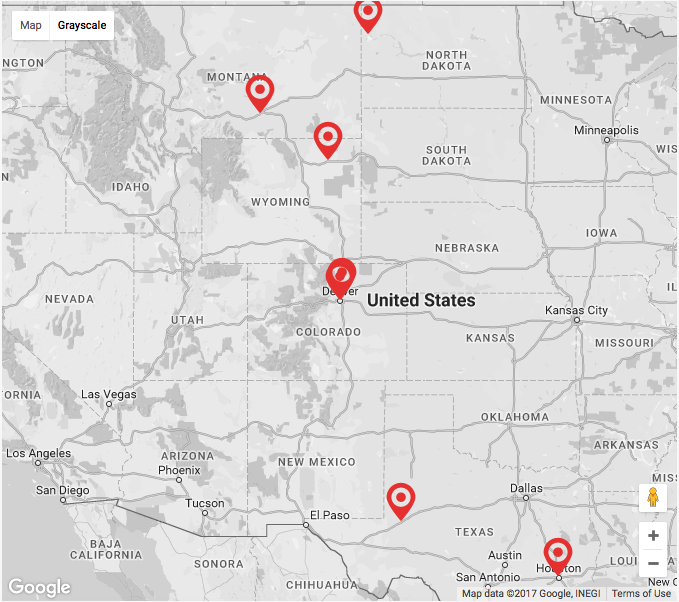

Liberty Oilfiend Services Inc. is based in Denver, Colorado. It provides hydraulic fracturing services to companies that are involved in the exploration and development of natural gas and oil resources. The company reports that it has grown rapidly since Dec. 2011, when it had one hydraulic fracturing fleet. As of April 2017, it has 13 hydraulic fracturing fleets. It reports that the demand for its services currently outpaces its capacity. It primarily operates in the Denver-Julesberg Basin, the Permian Basin, the Powder River Basin and the Williston Basin.

Executive management overview

Christopher A. Wright is the chief executive officer and a director nominee of Liberty Oilfield Services. He has served as the CEO since Dec. 2016 and as the CEO of Liberty Holdings since it was formed in March 2011. Wright also serves as the executive chairman of Liberty Resources and was the CEO of that company from Sept. 2010 until March 2017. Wright founded Pinnacle Technologies and served as its CEO from 1992 to 2006. He has held executive roles in multiple companies. He holds a Bachelor of Science in mechanical engineering from the Massachusetts Institute of Technology.

Michael Stock is the chief financial officer of the company and has served in that position since Dec. 2016. He has also served as the CFO of Liberty Holdings since April 2012. Prior to that, he served as the CFO of TAS Energy Inc. from 2009 to 2012 and as the CFO of Pinnacle Technologies from 1997 to 2009.

Financial risks and highlights

For the year that ended on Dec. 31, 2016, Liberty Oilfield Services reported total revenues of $374,772,000 and a net loss of $60,560,000. For the year that ended on Dec. 31, 2015, the company reported that it had total revenues of $455,404,000 and a net loss of $9,061,000.

The company reports that it depends on domestic spending on its services within the oil and gas industry. When the industry decreases its capital expenditures, it can have a negative impact on Liberty Oilfield Services. It also reports that the volatility of oil and gas prices may lead to a decreased demand for its services. The company intends to use its proceeds to purchase units of Liberty LLC from certain legacy owners. It intends to use its remaining proceeds to repay its debts under its credit facility.

Competitors: A Fragmented Field

Liberty Oilfield Services reports that its industry is very fragmented and competitive and that it competes with numerous oilfield services providers, including large, national companies and smaller regional providers.

Major rivals in Liberty's hydraulic fracturing services include Halliburton Company and Schlumberger Limited; Basic Energy Services, Inc., BJ Services Company, C&J Energy Services, Inc., Calfrac Well Services Ltd., FTS International, Inc., Keane Group, Inc., Patterson-UTI Energy, Inc., ProPetro Services, Inc., RPC, Inc., Superior Energy Services, Inc. and U.S. Well Services, LLC.

Using $2.24B market cap, as well as the last twelve mos. sales, BDFC will have a P/S of 5.97X. This is well above the industry average of 2.4.

Conclusion: We Remain Cautious

Liberty Oilfield Services showed a sharp decline in its revenues and an increase in losses from 2015 to 2016.

The oil industry is highly volatile and we don't expect it to significantly improve during this year.

We recommend that investors hold off on this IPO also given Liberty's less than attractive relative valuation at the moment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more