Investors Should Opt Out Of OptiNose Before IPO Lock-Up Expires

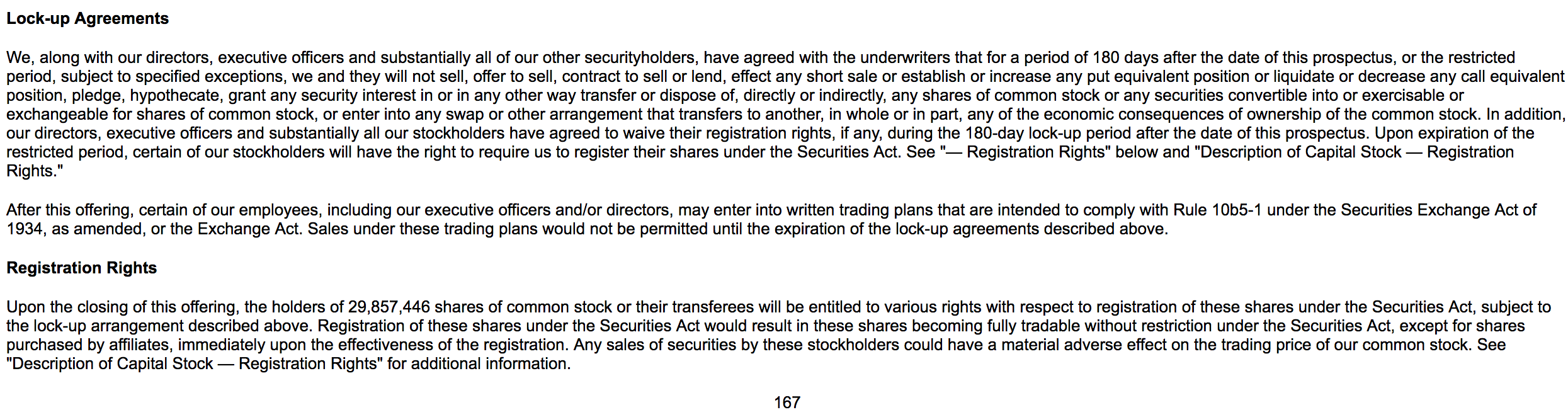

When the 180-day lock-up period for OptiNose, Incorporated (OPTN) ends on April 11, 2018, the company's pre-IPO shareholders and insiders will have the ability to sell large blocks of currently-restricted shares. The potential for an increase in the volume of shares traded on the secondary market could send OPTN's stock price sharply lower in the short-term. More than 29 million shares of OPTN are subject to lock-up restrictions and just 7 million shares of OPTN are currently trading.

(Click on image to enlarge)

(Click on image to enlarge)

Currently, OPTN trades in the $20 to $21 range, slightly higher than its IPO price of $16. OPTN currently has a return from IPO of 25.1% (as of market close 3/29/18).

Business Overview: Specialty Pharmaceutical Targeting Treatments for ENT

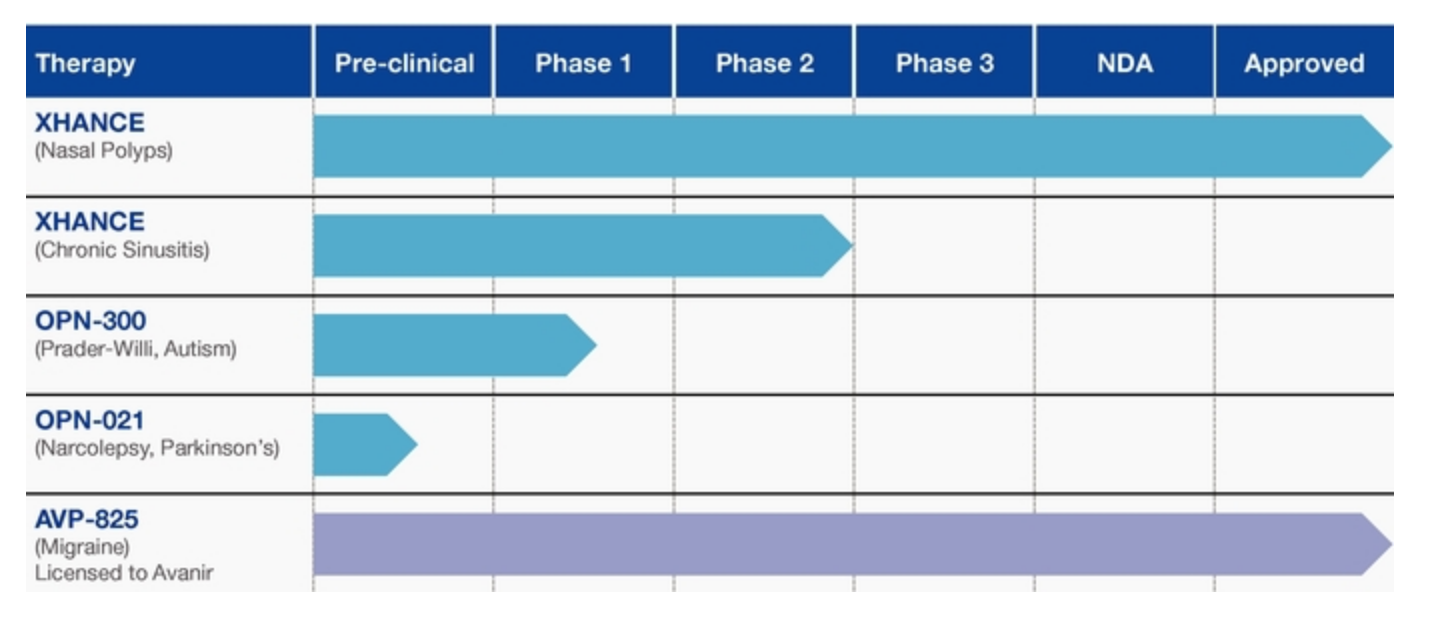

OptiNose is a pharmaceutical company that specializes in developing and marketing treatments and products for ear, nose, and throat issues. Its leading product is XHANCE, which is a therapeutic nasal spray using the company's proprietary delivery system that is powered by breath exhalation. It delivers an anti-inflammatory corticosteroid designed to alleviate chronic rhinosinusitus that may include nasal polyps. OptiNose has also commercialized AVP-825 for treatment of acute migraines in adults. It does this through a licensing agreement with Avanir Pharmaceuticals (Nasdaq:AVNR). OptiNose is exploring the use of XHANCE for chronic sinusitis; OPN-021 for the treatment of Parkinson disease and narcolepsy; and OPN-300 for use in patients with Prader-Willi syndrome, which is a rare genetically-based obesity disorder. OptiNose is also exploring the use of OPN-300 in patients with autism spectrum disorder. In addition, the company is developing other treatments such as leukotriene inhibitors, mucolytics, antihistimines, anticholinergics, and antibiotics.

(Click on image to enlarge)

OptiNose intends to market XHANCE nasal spray within the allergy and ENT industry segments by initially targeting the moderate-to-severe symptomatic patients for whom other intranasal steroids have proven ineffective. The company received FDA approval for XHANCE for the treatment of nasal polyps in adults, and it expects to launch its commercialization of the product in the second quarter of 2018. Its marketing efforts are expected to include a dedicated sales force of 75 professionals focused on close to 15,000 physicians with ENT specialties in the U.S. OptiNose plans to conduct additional clinical trials for its XHANCE product in the second half of 2018.

OptiNose was founded in 2010 and is headquartered in Yardley, Pennsylvania. It has approximately 41 employees.

(Company information for OptiNose is sourced from the firm's S-1/A)

Financial Highlights

OptiNose reported the following results for the fourth quarter and full fiscal year ended December 31, 2017:

Fourth Quarter 2017:

- Research and development costs for the fourth quarter were $1.2 million

- Selling, general, and administrative expenses were $18.5 million

- Net loss was $19.6 million or $0.64 per share

Full Year 2017 Financial Results

- Research and development costs totaled $16.8 million

- General and administrative costs were $13.7 million

- Net loss was $48.9 million or $5.63 per share

- Cash and cash equivalents totaled $234.9 million

(Financial highlights were sourced from OPTN's Q4 earnings press release.)

Management Team

CEO Peter Miller has been with OptiNose since 2010. His previous experience comes from senior positions at Walgreens, Janssen Pharmaceutical, and Johnson & Johnson. Mr. Miller holds a B.S. in Economics from Trinity College and an M.B.A. from Kellogg School of Management, Northwestern University.

President and COO Dr. Ramy Mahmoud has served in his positions since 2010. He has held positions at Johnson & Johnson, and he served as an officer in the U.S. Army as a surgeon. He has over 50 peer-reviewed publications and also served as head of Epidemiology as Walter Reed Army Institute of Research. He earned a Masters in Healthcare Management and Policy from Harvard University and an M.D. from the University of Miami.

(Biographical details sourced from OptiNose's website.)

Competition: Merck (NYSE:MRK) and GlaxoSmithKline (NYSE:GSK)

OptiNose faces competition primarily from the makers of other intranasal treatments such as Nasonex marketed by Merck, and Beconase AQ marketed by GlaxoSmithKline. Other brands include Rhinocort, Qnasl, Nasacort AQ, Zetonna, Omnaris, Veramyst, and Flonase.

Early Market Performance

The underwriters for OptiNose priced its IPO at $16 per share, at the mid-point of its expected price range of $15 to $17. The stock has fluctuated considerably, reaching $20.76 on November 6, dropping to $15.20 on November 14, rising again to $20.82 on January 29. It dropped back to $15.91 on February 20, and it currently trades in the $20 to $21 range.

Conclusion: Short Shares Before April 11 Lock-up Expiration

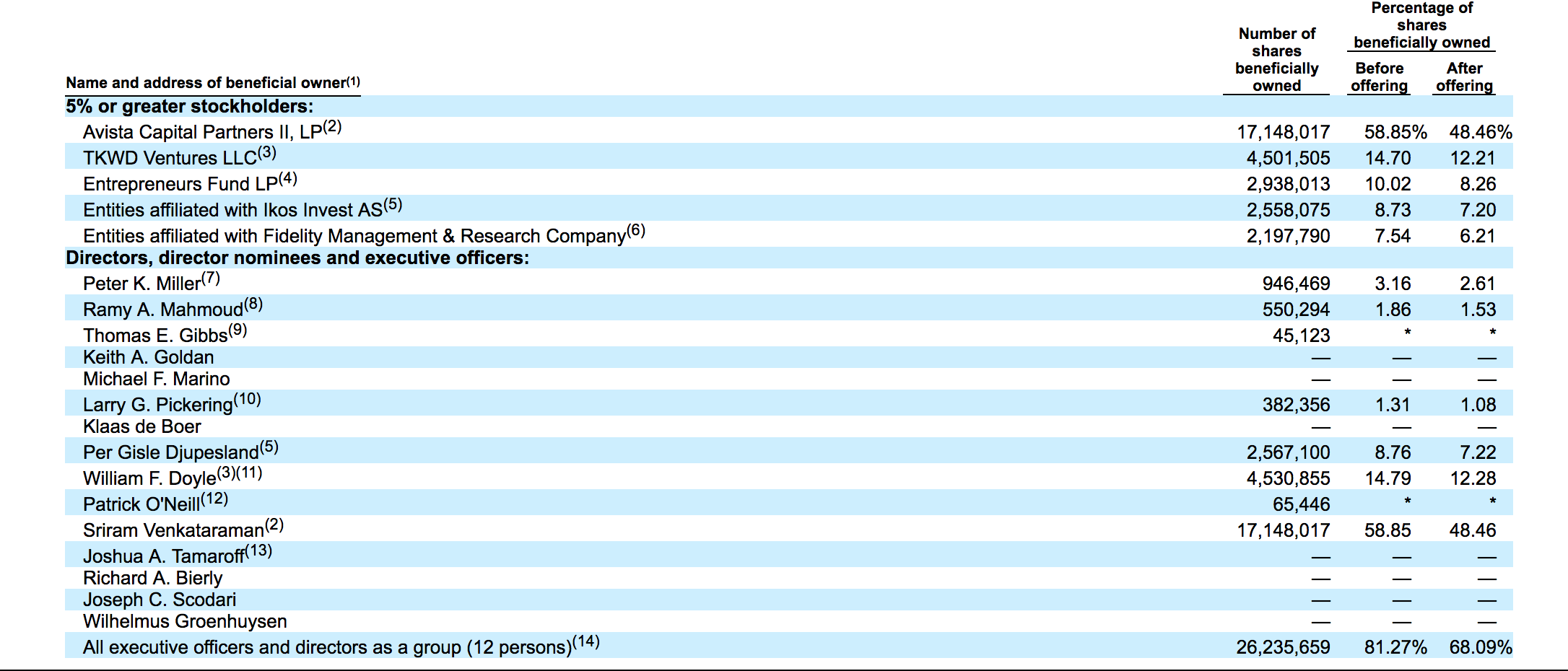

When OPTN's IPO lock-up expires on April 11, 2018, a substantial number of pre-IPO shareholders and company insiders will be allowed to sell a large number of currently restricted shares for the first time. This group is comprised of five corporate entities and twelve individuals.

(Click on image to enlarge)

Currently, more than 29 million shares of OPTN are subject to lock-up restrictions and just 7 million shares of OPTN are currently trading. If just some of these currently-restricted shareholders and entities sell just a portion of their shares, the secondary market could be flooded. A sudden, large increase of shares traded in the secondary market could send OPTN's share price sharply lower in the short term. We recommend that risk-tolerant investors short shares of OPTN ahead of the company's April 11th IPO lock-up expiration. Interested investors should cover these short positions during the April 12th and April 13th trading sessions.

Disclosure: I am/we are short OPTN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more