Intellia Therapeutics IPO: Regulatory Scrutiny Keeps Us Cautious

Intellia Therapeutics Incorporated (Nasdaq: NTLA) expects to raise $88.3 million in its upcoming IPO. Based in Cambridge, Massachusetts, Intellia Therapeutics is a gene editing company developing proprietary therapeutics using a biological tool called the CRISPR/Cas9 system.

Intellia Therapeutics will offer 5 million shares at an expected price range of $16 to $18.

NTLA filed for the IPO on April 11, 2016.

Lead Underwriters: Credit Suisse Securities, Jeffries LLC, and Leerink Partners

Underwriters: Wedbush Securities

Business Summary: Gene Editing Company Developing Proprietary Therapeutics

(Source)

According to company filings, Intellia Therapeutics is a gene editing company working to develop treatments with a biological tool called the CRISPR/Cas9 system. The company believes its CRISPR/Cas9 system has the potential to permanently edit genes; in particular, those genes associated with diseases that currently have a single course of therapy.

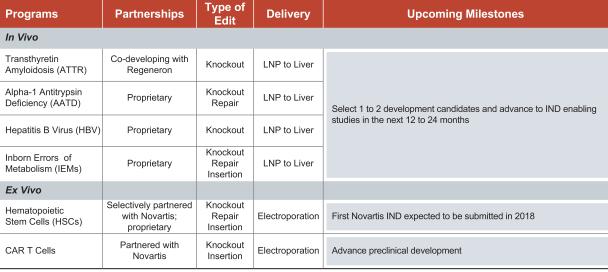

Gene editing is a precise method of modifying genetic material in human cells; the CRISPR/Cas9 system provides a new technique with considerable potential for precision. The system makes gene edits three different ways: repairs, knockouts and insertions.

The new method has the potential to offer curative treatment options for patients with chronic diseases by targeting the underlying drivers. The CRISPR.Cas9 system is an improvement on earlier technologies. It utilizes a single protein, Cas9, which cleaves the targeted DNA sequence with guide RNAs.

Use of IPO Proceeds

Intellia Therapeutics describes how it intends to use the net proceeds from this IPO:

- $25 million to further the research and development of its product candidates

- $15 million to advance additional in vivo and ex vivo product candidates in its pipeline

- $10 million to further development of the CRISPR/Cas9 gene editing platform and other delivery technologies

- The remainder for general corporate purposes and working capital

Executive Management

According to the firm's description, CEO, President and Founder Nessan Bermingham has over 15 years of experience in life sciences investments. He has been a partner at Omega Funds and Atlas Venture and is a founding partner of Bio Equity Capital. Dr. Bermingham serves on Intellia's Board of Directors. He received his Ph.D. in Molecular Biology from Imperial College London and was a Howard Hughes Associate Fellow at Baylor College of Medicine.

Chief Finance and Strategy Officer Sapna Srivastava has held positions as a senior analysts at Goldman Sachs, Morgan Stanley and ThinkEquity Partners LLC. Ms. Srivastava holds a Ph.D. in Neuroscience from New York University.

Potential Competition: Editas Medicine, Precision BioSciences, Juno Therapeutics and Others

Intellia Therapeutics faces competition from other gene editing companies using the CRISPR/Cas9 technology including CRISPR Therapeutics Inc., Editas Medicine and Tracr Hematology Limited. Competition also comes from other types of gene editing companies such as bluebird bio, Cellectis, Poseida, Precision BioSciences, Sangamo BioSciences, and Juno Therapeutics.

Financial Overview: Early Stage Losses Noted

Intellia Therapeutics Inc. provided the following figures from its financial documents for the years ended December 31:

|

2015 |

2014 |

|

|

Collaboration Revenue |

$6,044,000 |

n/a |

|

Net Income (Loss) |

($12,397,000) |

($9,539,000) |

As of Dec. 31, 2015:

|

Assets |

$82,139,000 |

|

Total Liabilities |

$14,783,000 |

|

Stockholders' Equity |

($21,201,000) |

Conclusion: Consider Holding Off

NTLA notes that investment risks include its novel technology, as well as some negative public opinion/regulatory scrutiny over the topic of gene editing.

Overall, we are hesitant about the deal, given the relatively small underwriting team and uncertain IPO market. We suggest holding off for now.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 ...

more