How Will Apple's Services Influence Its Growth Prospects

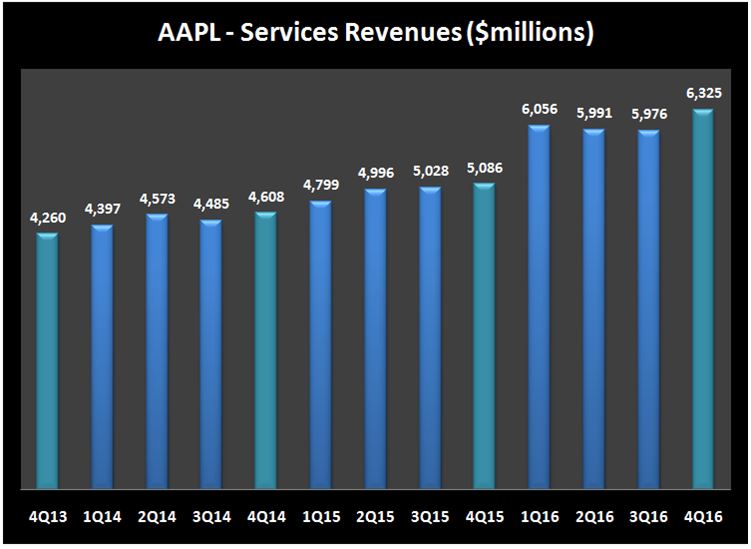

Apple's Inc. (AAPL) services which include Internet Services, AppleCare, Apple Pay, licensing and other services, have shown an impressive growth in the last few quarters. Apple services revenues have grown by 48.5% in the last three years from $4,260 million in the fourth quarter of 2013 to $6,325 million in the final quarter of fiscal 2016, as shown in the chart below.

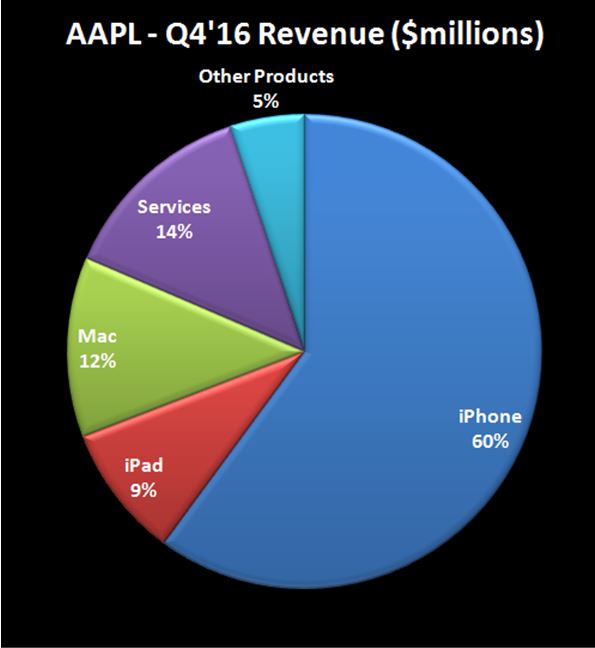

Although Apple services revenues accounted for only 14% of the company's total revenues in the recent quarter, Apple’s CEO Tim Cook emphasized the segment contribution to the company growth.

In Apple's fourth quarter earnings report CEO Tim Cook said:

“Our strong September quarter results cap a very successful fiscal 2016 for Apple. We’re thrilled with the customer response to iPhone 7, iPhone 7 Plus and Apple Watch Series 2, as well as the incredible momentum of our Services business, where revenue grew 24 percent to set another all-time record.”

At the conference call on October 25, CEO Tim Cook dedicated much room to the company's services performance. According to Mr. Cook, App store revenue continued to skyrocket while music revenue grew by 22% thanks to the growing popularity of Apple music. What's more, the company sees very strong growth in transaction volume through Apple Pay, which is very popular in Japan, and also recently was launched in Russia and New Zealand and is coming to Spain in the next few months. According to the company, Apple Pay transactions in the recent quarter were up nearly 500% year-over-year.

As I see it, besides the very positive response to iPhone 7, iPhone 7 Plus and Apple Watch Series 2, Apple is well positioned to show better growth in the next few quarters due to the contribution of its fast-growing services business.

Apple Stock Performance

Year to date, the AAPL stock is up 5.9%, while the S&P 500 index has increased 3.3%, and the Nasdaq Composite Index has gained 2.9%. Since the beginning of 2012, the AAPL stock has gained 92.7%. In this period, the S&P 500 Index has increased 67.9%, and the Nasdaq Composite Index has risen 97.8%. According to TipRanks, the average target price of the top analysts is at $132.38, indicating an upside of 18.7% from its November 01 close price. However, in my opinion, shares could go higher than that.

AAPL'sDaily Chart

AAPL'sWeekly Chart

Charts: TradeStation Group, Inc.

Valuation

Considering its compelling valuation metrics and solid growth prospects, AAPL's stock, in my opinion, is undervalued. AAPL's trailing P/E is low at 13.42, and its forward P/E is even lower at 11.07. The Enterprise Value/EBITDA ratio is very low at 8.70, the price to cash flow ratio is low at 10.70 , and the PEG ratio is at 1.24..

Dividend and Share Repurchase

Apple generates high free cash flow and returns substantial capital to its shareholders by stock buybacks and increasing dividend payments. In April 2016, the company announced a $50 billion increase in its capital return program. According to Apple, it is committed to returning $250 billion to shareholders by the end of March 2018. At the same time, the company raised its quarterly dividend by 10%, to $0.57 per share. Apple started to pay a dividend in April 2012. The present annual dividend yield is at 2.05%, and the payout ratio is only 26.2%. The annual rate of dividend growth over the past five years was very high at 55%.

Ranking

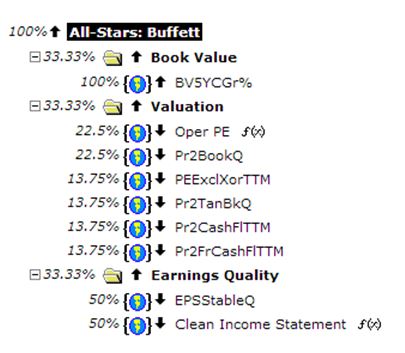

According to Portfolio123’s "All-Stars: Buffett" ranking system AAPL's stock is ranked first among all 66 S&P 500 tech stocks. The "All-Stars: Buffett " ranking system is based on investing principles of the well-known investor Warren Buffett. The 20 top-ranked S&P 500 tech companies according to the ranking system are shown in the table below:

The ranking system is quite complex, and it takes into account many factors like book value growth, operational P/E, price-to-book value, trailing P/E, price-to-tangible book value, price-to-cash flow and EPS stability, as shown in Portfolio123's chart below.

Back-testing over seventeen years has proved that this ranking system is very useful.

Summary

Apple's services have shown an impressive growth in the last few quarters, increasing revenue by 48.5% in the last three years. As I see it, besides the very positive response to iPhone 7, iPhone 7 Plus and Apple Watch Series 2, Apple is well positioned to show better growth in the next few quarters due to the contribution of its fast-growing services business. The average target price of the top analysts is at $132.38, indicating an upside of 18.7% from its November 01 price close. However, in my opinion, shares could go higher than that.

I am long AAPL

Thanks for sharing