How Will Apple's Next Report Influence Its Share Price?

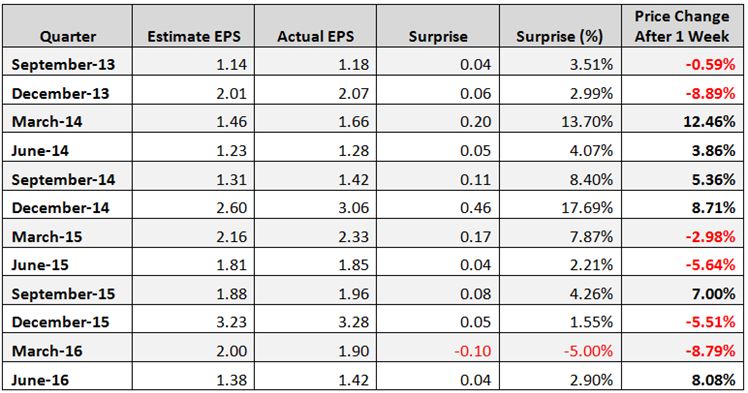

Apple's Inc. (AAPL) stock is one of the most popular and heavy traded stock in the market. In fact, on average 36 million of its shares valued about $4.2 billion are traded every single day. This is much higher than the second ranked stock by this criterion Facebook, Inc. (FB) where shares valued about $2.4 billion are traded each day and the third-ranked stock Amazon.com, Inc. (AMZN) where shares valued about $2.3 billion are traded each day. As such, many investors are eager to know how the next report will influence AAPL's stock price. Apple is scheduled to report its fiscal fourth quarter financial results on Tuesday, October 25, after market close. As shown in the table below, there were significant price changes in AAPL's stock after the earnings reports in both directions. The average price change one week after reporting in the last 12 quarters was pretty high at 6.5%.

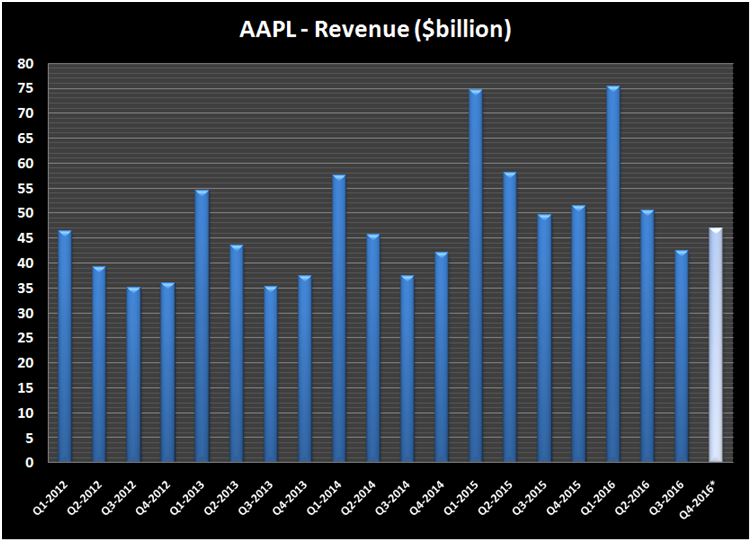

According to 37 analysts' average estimate, AAPL is expected to post a profit of $1.65 a share, a 15.8% decline from its actual earnings for the same quarter a year ago. The highest estimate is for a profit of $1.73 a share while the lowest is for a profit of $1.57 a share. Revenue for the fourth quarter is expected to decrease 9% year over year to $46.88 billion, according to 35 analysts' average estimate. There were four up earnings per share revisions and one EPS down revision during the last 30 days. Since AAPL has shown earnings per share surprise in nine of its last ten quarters, there is a good chance that the company will beat estimates also in the fourth quarter.

In my view, since the new iPhone 7 and iPhone 7 Plus seem to gain significant success, Apple is poised to offer a better outlook for the next quarters, and its shares could surge.

* Q4-2016, average estimate value

Apple Stock Performance

Year to date, the AAPL stock is up 11.3%, while the S&P 500 index has increased 4.7%, and the NASDAQ Composite Index has gained 4.6%. Since the beginning of 2012, the AAPL stock has gained 102.4%. In this period, the S&P 500 Index has increased 70.2%, and the NASDAQ Composite Index has risen 101%. According to TipRanks, the average target price of the top analysts is at $131.07, indicating an upside of 11.9% from its October 19 price. However, in my opinion, shares could go higher than that.

AAPL's Daily Chart

AAPL's Weekly Chart

Charts: TradeStation Group, Inc. valuation

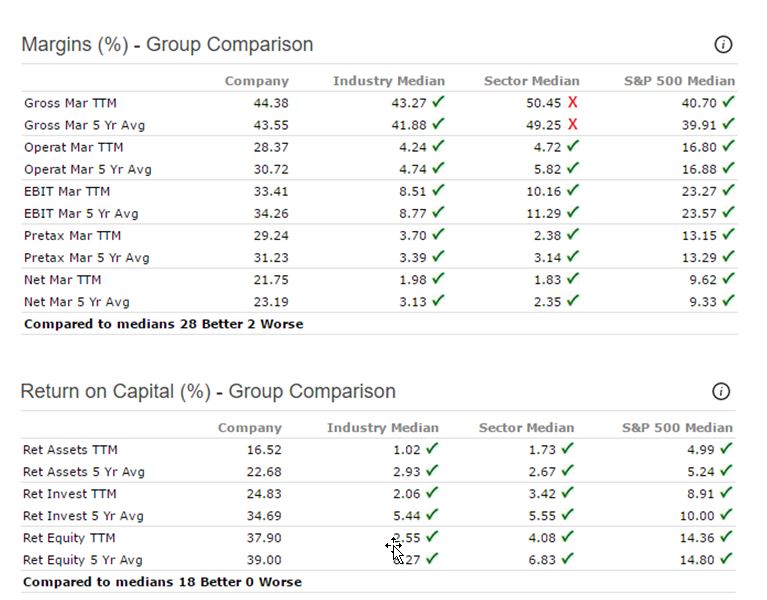

Considering its compelling valuation metrics and solid growth prospects, AAPL's stock, in my opinion, is undervalued. AAPL's trailing P/E is low at 13.66, and its forward P/E is even lower at 13.07. The Enterprise Value/EBITDA ratio is very low at 8.86, the price-to-free-cash-flow ratio is low at 16.78 , and the PEG ratio is at 1.75..

In addition, most AAPL's Margins and Return on Capital parameters have been much better than its industry median, its sector median and the S&P 500 median as shown in the tables below.

Source: Portfolio123

Ranking

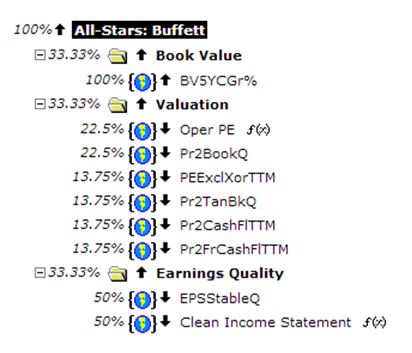

According to Portfolio123’s "All-Stars: Buffett" ranking system AAPL's stock is ranked first among all 66 S&P 500 tech stocks. The "All-Stars: Buffett " ranking system is based on investing principles of the well-known investor Warren Buffett. The 20 top-ranked S&P 500 tech companies according to the ranking system are shown in the table below:

The ranking system is quite complex, and it takes into account many factors like book value growth, operational P/E, price-to-book value, trailing P/E, price-to-tangible book value, price-to-cash flow and EPS stability, as shown in Portfolio123's chart below.

Back-testing over seventeen years has proved that this ranking system is very useful.

Summary

Apple is scheduled to report its fiscal fourth quarter financial results on Tuesday, October 25, after market close. According to 37 analysts' average estimate, AAPL is expected to post a profit of $1.65 a share, a 15.8% decline from its actual earnings for the same quarter a year ago. Since AAPL has shown earnings per share surprise in nine of its last ten quarters, there is a good chance that the company will beat estimates also in the fourth quarter. In my view, since the new iPhone 7 and iPhone 7 Plus seem to gain significant success, Apple is poised to offer a better outlook for the next quarters, and its shares could surge. The average target price of the top analysts is at $131.07, indicating an upside of 11.9% from its October 19 price. However, in my opinion, shares could go higher than that.

Disclosure: I am long AAPL stock.

thanks for sharing

Thanks for sharing

Perhaps Apple benefited from the Samsung Note debacle. Perhaps the Note's self destruction hurt Samsung's image and helped customers look to Apple's newest 7 as an alternative. Despite this unfortunate occurrence, and its vast war chest of cash, Apple is overly relying on the successes of only a few products, therefore it comes as a timely piece of good news that Apple confirmed plans to release a new version of its beloved Macbook. Is it enough to keep the company competitive? I think its just a matter a time before we see Apple missing its earning targets. Next Tuesday we will see.