How General Electric Is Re-Positioning Itself For Dividend Growth

The U.S. is now seven years out from the official end of the Great Recession. But despite this, bad memories still linger for General Electric (GE) investors.

That’s because – due to its massive financing operation known as GE Capital – GE was one of the hardest-hit companies by the financial crisis. Things got so bad that in 2009, the company slashed its quarterly dividend from $0.31 to just $0.10 per share.

To be sure, GE has come a long way since then. It has steadily increased its quarterly payout back to $0.23 per share. But this is hardly comforting for long-term shareholders. The dividend payment has still not been restored to its pre-financial crisis level.

The good news is that, thanks to GE selling off GE Capital to focus on its industrial operations, the company is on more solid ground. If the company raises its dividend in the 4th quarter of 2016, it will mark the 7th consecutive year of dividend increases.

If it continues increasing dividends (which is likely), GE will become a Dividend Achiever in 2019. Dividend Achievers are stocks with 10+ consecutive years of dividend increases.You can see the entire list of all 273 Dividend Achievers here.

Business Overview

It should not be understated how massive GE’s transformation has been. Last year alone, GE realized $104 billion in asset sales. The goal is to reach $200 billion for GE Capital asset dispositions.

Given what a huge restructuring this is, it may rattle the nerves of GE investors a bit. GE Capital was a major contributor to GE over the years. But this is about to change in a big way.

Source: 2015 Annual Report, Letter to Shareholders

Going forward, GE Capital will generate less than 10% of GE’s annual earnings. Clearly, GE will be a vastly different company as a result of the divestment of its financing arm. But this isn’t necessarily a bad thing.

While reducing the impact of GE Capital may reduce GE’s growth potential, it will also significantly reduce GE’s risk profile. And that is great news for shareholders who prioritize dividends.

It is not an exaggeration to say that GE Capital nearly bankrupted GE . The explosive growth of GE’s financing business in the early 2000's also saddled the company with more than $500 billion of debt, just before the Great Recession hit.

Moreover, the post-recession era is one likely to be defined by stricter regulations. GE will still retain a small financial services arm, to promote growth within the industrials core. At the same time, GE’s smaller financial segment will allow the company to apply to de-designate GE Capital as a “systemically important financial institution”. This would be an added step toward reducing regulatory risk.

As a result, this is the right time to exit financial services.

Now, GE will be able to concentrate on what it does best—manufacturing. GE spends significantly on R&D each year. R&D spending over the past three years is as follows:

- 2015 R&D expense of $5.2 billion

- 2014 R&D expense of $5.2 billion

- 2013 R&D expense of $5.4 billion

Going forward, this spending will be allocated toward the most attractive opportunities.

Growth Catalysts

GE’s industrial businesses are performing well and have a lot of momentum heading into 2017 and beyond.

Last year, industrial earnings per share increased 19%. Segment profit margin expanded by 80 basis points, and return on capital expanded 290 basis points.

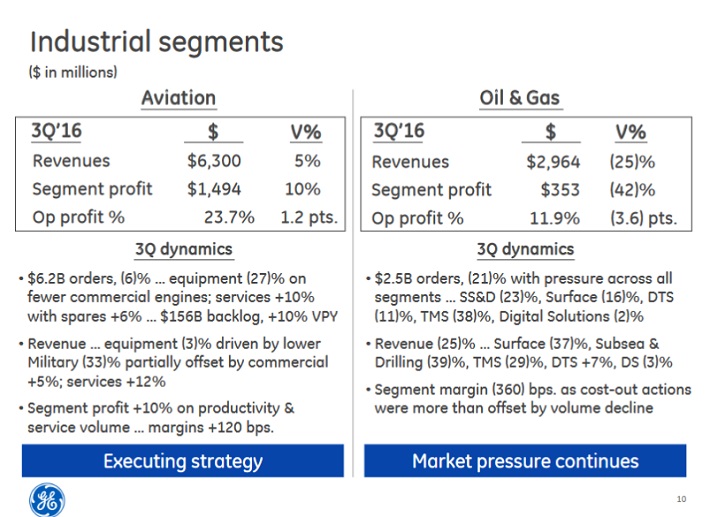

Focusing on the industrials segments not only de-risks GE, but gives the company a clear path for growth going forward. There are several major segments still performing very well for GE. GE’s operating profit, excluding its oil and gas segment rose 8% through the first three quarters of 2016. Future growth is likely to be led by health care, industrials, and power.

When it comes to health care, the demographics for GE are very favorable. Aging populations across the world will result in national health care spending to outpace GDP growth in the years ahead.

Source: Goldman Sachs Investor Meeting, page 4

Through the first three quarters of 2016, health care revenue rose 4% while operating profit rose 10% due to margin expansion. Another area of future growth is GE’s power business.

Source: GE Power Presentation, page 4

Power is a particular area of focus in the emerging markets, where millions of people still lack basic electricity. This will open up new markets for growth. One market ripe for entry is China, which has a high-growth economy and a population of 1 billion.

GE is making huge investment into China, made easier by its focus on industrial operations. GE is eyeing significant growth in China moving forward, across its various businesses.

Source: GE China Investor Forum, page 8

GE generated 17% of its revenue from China last year, and this only stands to grow in the future.

GE’s oil and gas segment continues to weigh on the company. The steep drop in commodity prices over the past two years has resulted in deep cost cuts from major oil and gas customers. Oil and gas segment revenue declined 25% last quarter. Fortunately, GE’s successful aviation business is helping to offset weakness in oil and gas markets.

Source: Third-Quarter Earnings Presentation, page 10

Dividend Analysis

Now that GE is a more streamlined, efficient company, its growth is expected to accelerate. Analysts currently expect GE’s earnings-per-share to increase 16.7% next year, to $1.75.

If GE meets these forecasts, its earnings-per-share will sufficiently cover its dividend with room to spare. GE’s current annualized dividend is $0.92 per share. This represents 52% of next year’s projected earnings-per-share. A payout ratio close to half of earnings is comfortable enough to support a return to steadier dividend growth. And, a side benefit is that when the next recession does occur, GE will be far more capable of maintaining its dividend without its risky capital arm.

At its current share price, GE stock offers a 2.9% dividend yield. This is above the 2% average dividend yield of the S&P 500 Index.

Final Thoughts

GE has had an uneven recovery since the Great Recession brought it to the brink. It has raised its dividend since, but has still not reached pre-crisis levels. That being said, GE stock has an above-average dividend yield. And, thanks to its decision to sell GE Capital, it is on a firmer path for steadier, sustained dividend growth each year.

Disclosure:

more

I continue to enjoy and be informed. Thanks