GSK: Robust Pipeline Supports Its 5.5% Dividend Yield

U.K. stocks have taken it on the chin in the past few months. There have been a number of factors for this, including the Brexit vote and the falling British pound.

But just like their U.S. counterparts, many companies in the U.K. have global business models, strong brands, and high dividend yields.

For example, GlaxoSmithKline (GSK) is a global health care giant. The stock is down 15% in the past three months. The decline has pushed its dividend yield up to 5.5%.

GlaxoSmithKline is not in the S&P 500, nor is it a Dividend Aristocrat.You can see the entire list of Dividend Aristocrats here.It doesn’t have the same pedigree of consecutive annual increases that many of the stocks I analyze have.

However, this does not necessarily mean income investors should avoid the stock. GlaxoSmithKline is highly profitable, with a rebuilt pipeline that should help the company support the dividend going forward.

This could make GlaxoSmithKline stock a high-yield opportunity for income investors.

Business Overview

GlaxoSmithKline is a major health care company. It generated $25 billion in sales last year.

At the same time, this is a transition period for the company. Its pharmaceutical business is under fire from the loss of patent protection on its flagship respiratory drug Advair and other products like Avodart. Sales of Advair fell 9% last quarter.

Fortunately, the company prepared for this. GlaxoSmithKline broadened is pharmaceutical portfolio with new respiratory products like Breo, to help replace Advair.

Source: November 2015 R&D Event Presentation, page 6

This has worked well. Total pharmaceutical sales increased 2% over the first three quarters of 2016, despite the patent protection losses.

More broadly, GlaxoSmithKline management has decided to reduce its exposure to pharmaceuticals, and strike a better balance between vaccines and consumer health products.

Going forward, GlaxoSmithKline will be more evenly split among the three businesses than it used to be. It will also be diversified geographically, among the U.S., the U.K., and the rest of the world.

Source: JP Morgan Health Care Conference presentation, page 2

GlaxoSmithKline made a major deal in 2014 to accelerate its transformation. It sold its oncology drug portfolio to Novartis (NVS) for $16 billion.

In return, GlaxoSmithKline received ownership of several of Novartis’ vaccine products for $7 billion. In addition, the two companies teamed up to collaborate on a consumer health joint venture.

It seems GlaxoSmithKline wants to become less reliant on pharmaceuticals going forward. This means the GlaxoSmithKline of the future will be much less exposed to generic competition.

Source: November 2015 R&D Event Presentation, page 5

This could be good news for GlaxoSmithKline shareholders, particularly those who consider the dividend to be the first priority. By balancing itself, GlaxoSmithKline is laying the groundwork for a more stable and consistent business.

Developing new pharmaceutical drugs can be a boom-and-bust business. The number one concern for companies that rely heavily on pharmaceuticals is the dreaded patent cliff. This is when top-selling branded products like Advair lose patent protection, which inevitably results in a flood of cheaper, generic competition.

New drugs can be a home run for pharmaceutical companies and provide explosive growth. But when a drug loses patent protection, the drop-off can be severe. Consider the case of Pfizer (PFE), one of GlaxoSmithKline’s closes competitors.

A detailed review of Pfizer stock can be found here.

Pfizer’s blockbuster cholesterol drug Lipitor at one point generated $10 billion in annual revenue all by itself. But now that it has lost patent protection, Lipitor sales were just $1.8 billion last year.

To its credit, both Pfizer and GlaxoSmithKline prepared for this by investing in new products to rebuild their pipelines. One difference is that GlaxoSmithKline intends to have a large consumer franchise, to add valuable stability.

GlaxoSmithKline has a number of strong consumer brands, some of which include Aquafresh, Flonase, Tums, Sensodyne, Pronamel, Excedrin, and more.

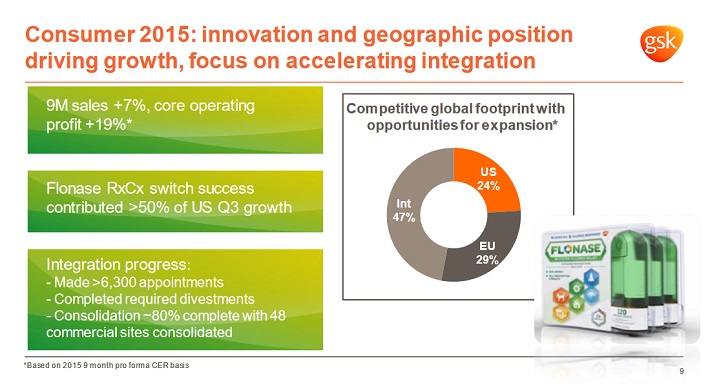

Source: JP Morgan Health Care Conference presentation, page 9

Consumer product sales rose 9% through the first three months of 2016. Consumer products aren’t nearly as flashy as pharmaceutical drugs, but they are very stable.

Growth Prospects

Future growth will come largely from new vaccines and pharmaceutical products.

GlaxoSmithKline’s diversified business model should help the company overcome its patent expirations. Going forward, it is focusing R&D investment on six key areas:

- HIV and infectious diseases

- Oncology

- Immuno-inflammation

- Vaccines

- Respiratory

- Rare Diseases

GlaxoSmithKline will still have a significant respiratory business, but it will not be nearly as reliant on its respiratory portfolio. This is why GlaxoSmithKline is allocating R&D spending to a variety of new areas.

First, it is targeting HIV. GlaxoSmithKline began investing in HIV therapies back in 2009, through a joint venture with Pfizer called ViiV Healthcare. GlaxoSmithKline owns 78% of the JV.

HIV is a focus area with great potential.

Source: ViiV presentation, page 11

According to the company, HIV is a $17 billion global market. With a leadership position in this category, GlaxoSmithKline has a huge opportunity in this area.

Led by its HIV products Tivicay and Triumeq, worldwide HIV sales rose 43% for GlaxoSmithKline over the first three quarters of the year.

Next, the company sees huge potential in global vaccines. For example, GlaxoSmithKline is working on vaccines for meningitis and shingles. The results are very promising thus far.

Source: JP Morgan Health Care Conference presentation, page 8

Vaccine sales increased 20% last quarter, including 23% growth in the U.S. And, revenue from vaccines increased 18% over the first three quarters of the year.

GlaxoSmithKline’s broad-based growth is thanks largely to its product innovation. Overall, GlaxoSmithKline spent $3.3 billion on research and development last year, and has a robust pipeline to show for it.

Of the 40 new assets profiled at the company’s R&D event last year, management believes up to 10 will start Phase III trials by next year. Another 20 will be in Phase II in that time. The company expects to achieve a 13% internal rate of return on its R&D spending last year.

Final Thoughts

GlaxoSmithKline investors have endured a stagnating share price since 2010. The company’s turnaround has been a prolonged process. But there is light at the end of the tunnel.

Management expects 2016 core earnings-per-share to rise double-digits. This will help GlaxoSmithKline to protect its 5.5% dividend, which is much higher than many other health care stocks in its peer group.

Disclosure:

more