Get A Manicure, Pedicure & Safe 14% Annual Return

Deal Target Description

Steiner Leisure (NASDAQ:STNR) is a global provider of spa services. The company is getting bought out for $65 per share and has a $1.57 net arbitrage spread in a deal that will probably close around year end.

Deal Terms

On August 21, 2015, Steiner Leisure (STNR) and Catterton Partners announced a definitive deal in which Catterton will buy Steiner Leisure for $65 per share in cash.

Deal Financing

The deal is not subject to a financing condition. Blackstone (NYSE:BX)'s GSO Capital Partners committed to provide debt financing for the deal, consisting of a $600 million senior secured term loan facility. The deal target is working with Jefferies (NYSE:LUK).

Deal Conditions

The deal is subject to HSR clearance and STNR shareholder approval. The deal received early termination of the HSR review on September 14.

Deal Price

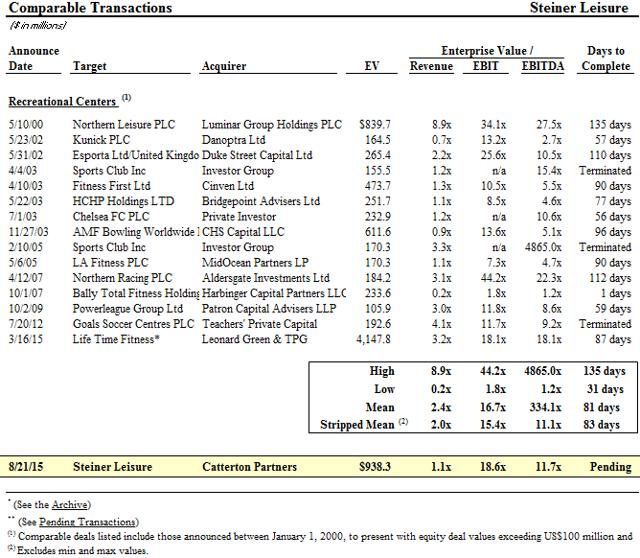

The deal price is within the range of historically comparable transactions.

Conclusion

This is a straightforward opportunity offering a reasonably good risk-adjusted return. For further reading about this investment, check out Steiner Leisure: A Top Merger Arbitrage Option-Tunity.

Disclosure: I am/we are long STNR. more