Genesis Energy: Huge 9% Dividend Yield Is Attractive, But Weak Coverage A Concern

Genesis Energy (GEL) is a high yielding Master Limited Partnership, with a long history of steady dividends.

There are currently only ~130 publicly traded MLPs available today.The unique tax structure of MLPs allows these vehicles to return more distributions to shareholders than a corporation could.

And Genesis Energy is no exception.It has a current dividend yield of 9.2%.This is an extremely high yield. Genesis is one of 416 stocks with a 5%+ dividend yield.

Not only that, but Genesis has increased its dividend for 47 quarters in a row. It is one of the highest-yielding Dividend Achievers, a group of stocks with 10+ years of consecutive dividend increases.

Genesis is a rare MLP, because it combines a very high dividend yield, with a high dividend growth rate as well. At the same time, there are some concerns regarding the sustainability of the dividend.

Business Overview

Genesis is a midstream oil and gas energy transportation company. It operates primarily in the Gulf Coast region of the U.S.

Genesis operates four individual segments:

- Offshore Pipeline Transportation (59% of earnings)

- Supply & Logistics (18% of earnings)

- Refinery Services (12% of earnings)

- Marine Transportation (11% of earnings)

Genesis’ offshore business provides services primarily to deep-water producers in the Gulf of Mexico, where economic fundamentals remain strong.

Gulf production continues to increase, which means demand for Genesis’ services remains steady.

Source: May 2017 Investor Presentation, page 9

The company’s offshore and onshore pipeline businesses, as well as the marine transportation business, have no direct commodity price exposure. This is because Genesis operates primarily fee-based assets.

Genesis performed well in 2016, even with weak commodity prices.

Adjusted EBITDA increased 23% for the year, to $532.2 million, thanks to higher fees and development of new projects.

Genesis is off to a mixed start to 2017, as the company navigates through a period of very high investment.

The Offshore Pipeline Transportation segment continues to be a strong performer, which is a good sign because it is the company’s largest business.

Segment earnings increased 11% for the first quarter, due to new production resulting from higher drilling activity. This resulted in higher rates for Genesis’ pipelines.

However, this growth was offset by a 17% decline in the Refinery Services business, as the company had to rework contracts for certain customers. And, Supply and Logistics segment earnings declined by 19% year over year, due to lower volumes.

Lastly, earnings for the Marine Transportation segment declined 31% from the 2016 first quarter. This decline was due to lower utilization and day rates for Genesis’ inland fleet, and lower day rates for its offshore fleet.

Fortunately, the Marine Transportation segment is Genesis’ smallest business, which mitigated the overall impact of last quarter’s poor performance.

Going forward, Genesis has several new projects under development, that will help grow cash flow moving forward.

Growth Prospects

Genesis relies on new projects for growth. Fortunately, the company has a long runway of growth opportunities moving forward.

For example, even though the Gulf of Mexico already plays a huge role for Genesis, the region still holds great untapped potential.

That is because the Gulf of Mexico has tremendous deep-water discoveries that have not yet been developed, and are serviceable by Genesis’ platforms and pipelines.

For example, in 2017 integrated major BP (BP) discovered that the Atlantis field, which Genesis services, held 200 million additional barrels of oil that were previously undiscovered.

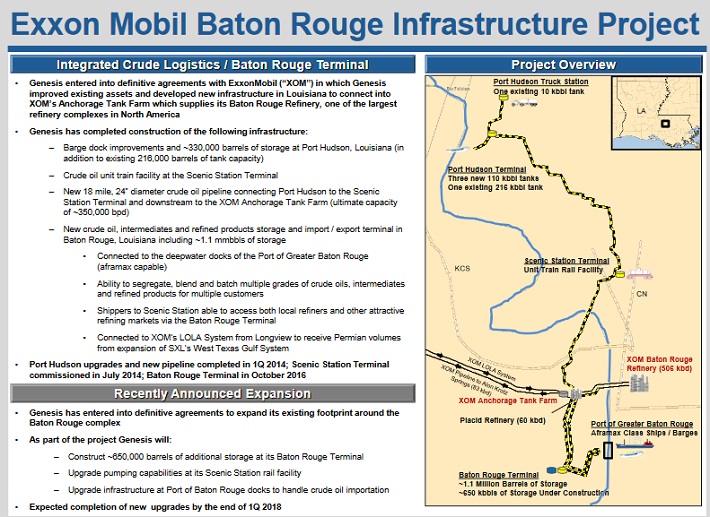

Another key growth project for Genesis is the Baton Rouge Infrastructure Project, which was completed in October 2016.

Source: May 2017 Investor Presentation, page 20

Genesis renovated existing assets and developed new infrastructure to connect to the Anchorage Tank Farm, which is owned by Exxon Mobil (XOM).

The Baton Rouge project has storage capacity of 1.1 million barrels. In the first quarter of 2017, Genesis announced it has contracted $100 million of new growth opportunities, most of which are located in Baton Rouge.

Separately, Genesis recently completed the expansion of its Houston logistics services, including new pipelines and terminals infrastructure.

Genesis has made long-term contract agreements with Exxon Mobil. Exxon will use Genesis’ Houston logistics services to support its Baytown refinery. Baytown is Exxon’s largest refinery in North America.

This helps explain why Genesis continually raises its dividend, even though oil and gas prices have declined throughout 2017.

Dividend Analysis

On April 11th, Genesis raised its quarterly distribution to $0.72 per unit, a 7.1% increase from the same quarterly distribution last year.

With a 9% dividend yield and 7% dividend growth, Genesis looks very attractive for income and dividend growth investors.

Source: May 2017 Investor Presentation, page 26

Genesis has a long history of dividend growth, but it is important for investors to assess the sustainability of Genesis’ dividend.

In 2016, Genesis generated distributable-cash-flow-per-share of $3.26, which covers its annualized distribution of $2.88 per unit.

However, conditions tightened in the first quarter of 2017.

Genesis reports its available cash flow for distributions in terms of “available cash before reserves.” According to the company, available cash before reserves consists of net income, adjusted for various items such as depreciation, maintenance capital utilized, and gains or losses on asset sales.

On this basis, Genesis maintained a distribution coverage ratio of just 1.05 for the first quarter. This means the company generated only 5% more cash flow than it needed for the dividend payout.

The dividend payout ratio has worsened over time. Genesis held a distribution coverage ratio of 1.2 in 2015 and 2016.

One of the reasons for Genesis’ deteriorating coverage metrics, is that the company issued equity over the past year, to help finance its growth projects.

Diluted units outstanding rose by 7.6% in the first quarter, from the same quarter in 2016.

This is a period of elevated investment for Genesis, but once its new projects are online, necessary spending could decline. Plus, these projects will begin generating cash flow.

Still, Genesis has little margin for error.

Add to this, the fact that Genesis has a debt-to-EBITDA ratio of 5.25, which is on the high side for an MLP. The company’s debt ratio has risen from 5.22 in 2016, and 5.08 in 2015.

The combination of a tight payout ratio and relatively high level of debt, means Genesis must continue growing cash flow in order to sustain its dividend growth.

It could do this, if everything goes according to plan. As a result, investors should closely monitor the company’s financial results going forward.

Final Thoughts

Genesis is a highly appealing stock for income investors, because it offers a mix of a high yield and high dividend growth rate.

And, MLPs have certain tax advantages as well.

The potential returns for Genesis are compelling. Investors buying at current prices will receive a nearly double-digit annual return, just from dividends.

However, Genesis is not without risk. The company is distributing nearly has a 100% payout ratio in terms of available cash.

For now, Genesis appears to have a sustainable dividend payout.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more