Five Point Holdings Could See Shares Rise This Week

The 25-day quiet period on Five Point Holdings (Pending:FPH) will end on June 5, allowing the firm's IPO underwriters to publish reports and recommendations on Five Point Holdings for the first time since the IPO.

First Point Holdings is the largest owner and developer of mixed-use, master-planned communities along the California coast. The company is backed by a strong team of underwriters. We expect shares of this recently public company have further to climb, after just so-so performance since the IPO, and that underwriters will be eager to spread news about the investment opportunity once restrictions are lifted.

Our firm has studied price movement around quiet period expiration events and have found above market returns in a short window of time around the event. We expect First Point Holdings shares to increase 2%-3% in a five-day window surrounding the expiration.

An influential team of underwriters includes: Citigroup Global Markets, J.P. Morgan Securities, Deutsche Bank Securities, Evercore Securities, JMP Securities, RBC Securities, Wells Fargo Securities, and Zellman Partners.

Early Market Performance

Five Point Holdings LLC made its debut on 5.9 and raised $294M through the offer of 21M. Shares initially priced at $14, which was well below the expected price range of $18 to $20. Shares climbed during the first day of trading and finished up 7%. Since then the stock hit a high of $16.47 on May 15. Current stock price is approximately $15.85 (market session 5.30).

Business Overview

Five Point Holdings is the largest owner and developer of master-planned communities with mixed use construction in coastal California. Its three developments are located in areas with some of the highest real estate demand in California, including: San Francisco County, Los Angeles County and Orange County. Together, these communities include approximately 40,000 residential homes and 21 million square feet of commercial space.

The company generates the majority of revenue through the sale or leasing of residential and commercial land sites to homebuilders, commercial developers and commercial buyers. A small portion of revenue is also generated through management services.

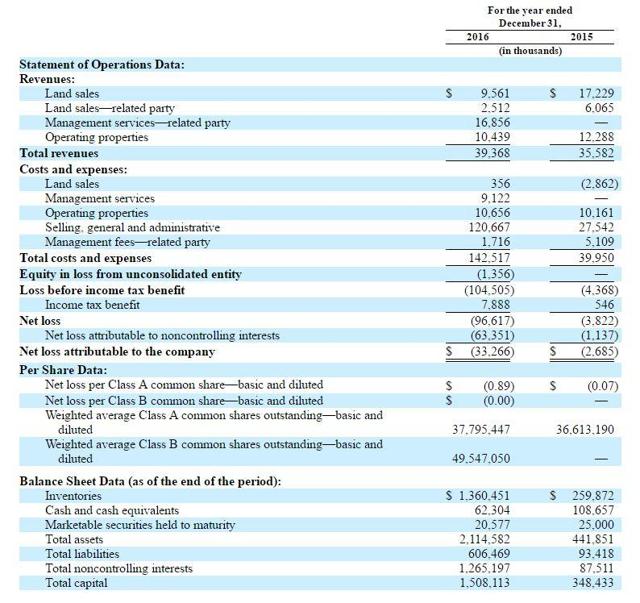

Five Point Holdings reported the following financial data in its SEC filing:

- Revenue grew to $39.37M in 2016, from $35.58M in 2015.

- Net loss increased to ($96,61M) in 2016 from ($3.82M) in 2015.

- Inventories increased to 1.36B in 2016, from $259.8M in 2015.

Management Team

President, CEO, and Chairman Emile Haddad has served in his position since May 2016. He previously served as the Chief Investment Officer for Lennar, which is one of the largest homebuilders in the U.S and a large stakeholder in First Point Holdings. Mr. Haddad received a civil engineering degree from the American University of Beirut.

CFO and VP Erik Higgins has served in his positions since May 2016. Previously, he was Senior Vice President of Lennar. Mr. Higgins holds Bachelor of Arts degree in Economics from the University of California at Santa Barbara and MBA from the University of Southern California.

Conclusion: Buy Prior to 6.6 For Full Gains

The California market has continued to grow, and housing is poised for expansion in 2017.

After a generally flat IPO, First Point Holdings has room to climb further. The company has strong backing from investors; Lennar bought $100M at the IPO for a 40% stake; and evidence supports a quick buildup of inventory and growing revenue.

Despite some concerns about high spending and losses, there is a lot to like about this company. At its current valuation, First Point Holdings presents a good buying opportunity, particularly ahead of the quiet period expiration catalyst.

Disclosure: I am/we are long FPH.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more