Fitbit Retrenches: The Bottoming Phase For A Hardware Company

“You want the truth; you can’t handle the truth”! I have been covering Fitbit (FIT) since January of 2016. I’ve found that most investors, institutional or otherwise, simply couldn’t handle the fact that Fitbit’s total addressable market (TAM) was far less than the company and investors had assumed. In my initial reporting and publication titled Fitbit's Total Addressable Market Hype May Leave Investors With Disappointment, I warned investors about this subject matter and how it would affect Fitbit and investors in the mid-term. While that publication launched in January, I reiterated this concern in April with an article titled Fitbit: Understanding The Value Of TAM When Investing In Consumer Goods. Unfortunately, the forecast and analysis have come to fruition with Fitbit’s management now forced to recognize that beyond early adopters and early stage technology consumers, there is a far lesser TAM available to the company. I say this even as Fitbit NOW touts the potential of acquiring an additional 40-80mm consumers henceforth. Firstly, with a gap from the low-end of the forecast to the high end of the forecast being that wide, I wouldn’t put much credence into the forecast. But more importantly, the already assumed TAM that has been found with great error discredits any newly introduced assumptions regarding TAM for Fitbit devices.

Having said that and taking a direct jab at management, the Fitbit story doesn’t end here with Fitbit releasing abysmal Q4 2016 results and a FY17 forecast for negative sales and earnings. The elementary fad taunting that comes with peak to trough gadget sales and earnings results is not unique to the Fitbit story. SodaStream (SODA), Keurig Green Mountain, GoPro (GPRO) and a host of other gadget/hardware suppliers have recorded it in history for decades. Most every single proposed fad is still in the marketplace with most having experienced exactly the same business cycle as Fitbit has experienced and will experience going forward. And all rebounding post the trough period which lasts anywhere between 12-18 months depending on the macroeconomic cycle to some degree. Now let’s take a look at some of Fitbit’s Q4 and FY17 results below:

- Fitbit sold 6.5 million units in the fourth quarter at an average selling price of $85 generating $574 million of revenue, down 19% year-over-year.

- Contraction in unit growth of 21% in the quarter and flat pricing year-over-year.

- Gross margins in the quarter were 22.4%.

- Recorded a $78 million write-down of tooling equipment and a component inventory and a $41 million increase in return reserves due to higher channel inventory.

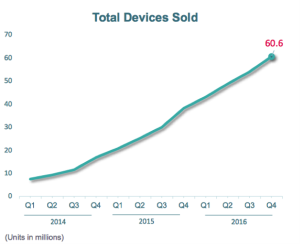

- Sold more than 22.3 million devices in 2016, the most in the company's history compared to 21.4million in 2015, representing 4% unit growth.

- In the fourth quarter, we had 23.2 million active users on our platform, up 37% year-over-year and 50.2 million registered device users.

- For the full year revenue grew 17% at $2.17 billion. In the United States revenue grew 11%, but declined 28% in the fourth quarter. APAC revenue dominated by the Australian market that comprised nearly half of the regions revenue contracted 26% for the full year and 56% in the fourth quarter. Excluding Australia, APAC revenue. India revenue grew 248% for the full year. EMEA, a region of the world that is less penetrated in terms of overall wearable's category, produced strong growth up 86% for the full year and 58% in the fourth quarter.

- The United States comprised 71% of full year 2016 revenue, EMEA 18%, APAC 6%, and the other Americans 5%.

- Increased our warranty reserves by $17 million for legacy products.

- On a full year basis, gross margin declined 9 points year-over-year to 39% and was below the previous 46% target. 3.9 points of the decline can be attributed to the increase in warranty costs, primarily associated with legacy products.

Take notice of the warranty costs investors.In performing my early stage analytics on Fitbit I had recognized a higher than usual return to vendor rate (RTV) for its devices.As such I warned investors about this metric because it greatly concerned me. I offered investors the following in a publication titled Fitbit Q1: Expect A Beat.

However, at a current warranty reserve rate equal to 2% of revenues, Capital Ladder Advisory Group expects this metric to increase over the next 12-month period and impact profits to a greater degree.

Not only did Fitbit exhibit a beat across the board in Q1 2016, but the company announced an increase in its warranty reserve rate that stuck with it through year-end. And now Fitbit goes about the difficult task of lowering operating costs, streamlining the business to align with true sell-through demand and returning to stable growth.

Fitbit aiming to achieve the aforementioned objectives has already put in place several initiatives to reduce headcount, reduce marketing expenses (A&P) and move to a more constructive demand populating operating platform like SAP. Keurig Green Mountain did this, SodaStream did this, GoPro is doing this and Skullcandy did this. All hardware companies do the same thing post market saturation. Too bad these hardware companies don’t perform these course corrective activities from the beginning, but “whatareyagonnado”!

By now, my readers and followers know I carry a more subdued sentiment concerning Fitbit’s foray/venture into the digital health and healthcare industry. Some of my thoughts are offered in the publications noted below for easy access:

- Fitbit Will Witness Hardships In 2017 That Pave The Way For Share Price Appreciation

- Fitbit And Medtronic: Headlines Vs. Reality

Don’t get me wrong, I laud the company for its transformational efforts and recognition of the technology applications in adjacent sales channels, but investors need to recognize the TAM for these industries/categories.Moreover, where Fitbit found itself the leading innovator in the fitness tracker consumer market, it is entering the healthcare industry as a laggard and competing with greater companies, far ahead of Fitbit’s technology reach. For these reasons among others articulated in the listed publications, I would forecast the revenues from the digital healthcare initiatives not to exceed 10% of total net revenues over the next 2-year period. Unless, of course, the consumer market revenues experience a prolonged and deeper contraction than Fitbit and analysts are forecasting. Much like Fitbit’s other recent partnerships, investors would be wise to recognize the TAM for any industry product that Fitbit chooses to develop. As many touted Fitbit’s partnership with Peloton, they failed to recognize that Peloton has only sold roughly 50,000 units.Such a partnership is meaningless to Fitbit’s 2017 to say the least. It would be statistically/metrically impossible to stimulate growth for Fitbit even 5 years out assuming a most advantaged CAGR for Peloton unit sales. Remember, Fitbit sold over 22mm devices in 2016. Even if every Peloton user bought a Fitbit device to sync with their exercise bike routine it would represent less than 2% of units sold in 2016. Know your TAM, know your TAM, know your TAM!

App store, smartwatch and digital services on deck!All of these product efforts aimed toward improving revenues and earnings will move forward in 2017. But as it were with digital health and the existing consumer product assortment, investors should have a more sound understanding of the potential for these products and efforts. Let’s start this portion of analyzing Fitbit’s newer efforts with the App store. Firstly this comes a tad, sarcasm implied, late to the market and likely with little relevance. An app store for Fitbit is the equivalent of using bubble gum to plug a hole in the Hoover Dam. Secondly, let’s think about the conceptual revenue capability of apps in general. Most people download an app and use it, drum roll…one time! Andrew Chen notes the following on his website:

In an article published on his website, Silicon Valley analyst Andrew Chen attests that the average app loses 77 percent of its users in the three days after they install it. After a month, 90 percent of users eventually stop using the app, and by the 90-day mark, only 5 percent of users continue using a given app. These crushing figures mean that app creators are having to make sure that their users stay connected (but not annoyed by) their apps from minute one to three months down the line.

As I always say, know the potential of you product and platform for which that product aims to be offered. Most people are aware of the failure for app stores, as the landscape has been littered with them over the many years. Fitbit’s biggest issue will be getting developers to buy into the Fitbit “active user base” and the leverage the company can create from that user base. Seeing how the attrition rate is so high amongst Fitbit users, developers are more likely to work with mainstream platforms that have proven active users of more significant scale. Blackberry has been trying to grow its services businesses and app store for years now and has found it irrelevant due to the hefty competition in the market. The fact is that the apps with the greatest attachment rate are those that pay or reward their users. Fitbit doesn’t find itself in such a position where it can garner such offerings in my educated opinion. And don’t get me started on the refurbished FitStar community app that Fitbit suggests has received early success. If you thought my numerous “nobody needs a Fitbit” comments weren’t annoying then carry that sentiment through the updated FitStar app to realize the relevancy for this product.

Need is the defining characteristic of how far a company can extend their product or service into the marketplace and helps to aid in the capturing of household penetration. Non-essential goods always have a lesser TAM than essential goods. In reading my former publications I stressed this point numerous times. Fitbit’s CEO has finally come to realize that making Fitbit a more needs based product will aid in capturing a higher household penetration rate, capture more consumers.

James Park

Yes. I think what makes the most excited is that people know Fitbit as a consumer company and consumer brand and people might perceive us as kind of a nice to have. I think what I’m most excited about is really transforming Fitbit in its products into a “must-have

Working within the healthcare industry is a positive step toward dropping the non-essential good vendor label and becoming a need based good, but the task is a difficult one and it will be a long journey. The attrition rate for these fitness tracker devices is akin to apps to say the least. Fitbit has sold 43.7mm devices since Jan 1, 2015. One more time folks, 43.7mm devices!And yet since 2015 the company has only added 16.3mm active users. On a percentage basis, growing the user base 37% in 2016 seems like an attractive number. But that is why the company doesn’t discuss the reality of why these devices are hard to sell and why when they are used, the consumer quickly discontinues usage. When you sell 43.7mm units but only grow your user base by 16.3mm units…well you see the problem. Fitbit needs to find a way to increase the stickiness of its devices. That’s not me talking, that’s the consumer.

The smartwatch is another product initiative likely to launch this fall, as its chief competition in the sub-category of wearables is likely to offer a new iteration during this time as well. For all intended purposes, the smartwatch has been a colossal failure as sales in the category have fallen precipitously YOY. In fact, the only time smartwatches, as a category, grow sales is when a new product launches in conjunction with a previous product shipment. For example: Apple (AAPL) has touted the Q4 2016 period as having shown its greatest sales for the Apple Watch. Mind you, the company has made absolutely no mention of the profitability of the Apple Watch, the average selling price (ASP) or sell-through statistics…and why would they?Here is what really happened with the Apple Watch Series 1 and 2 during the holiday period. In 2015, Apple only had one Apple Watch for which sales were so poor the company reduced the price nearly a year before the company released a new iteration. This hasn’t happened with an Apple product since the company launched the iPod product line. In Q4 2016, the company had two versions of the Apple Watch it sold-in to retailers, a sky increase of 100 percent. Apple only reports sell-in metrics per SEC regulations, like Fitbit. So as one can see, the sku count for the Apple Watch increased 100% YOY, thus boosting sales for the Apple Watch. But the sell-through, meaning from the retailer to the consumer, has been paltry. It’s why the consumer could find door buster deals on the Apple Watch Series 1 for $199 on Black Friday. Truth be told, that door buster became the ASP for the Apple Watch throughout the December period. Truth be told, that sale price is still being offered at various retailers every month since. Truth be told again, that’s why Apple’s CEO, Tim Cook, won’t discuss the ASP or the sell-through of the Apple Watch. Hard not to grow sales for the Watch when you are offering two Apple Watches in 2016; a 100% increase in sku count YOY.But hey, that’s just analytics and why investors should better scrutinize what they are being told by management teams. The same goes for Fitbit’s management team by the way.

Fitbit is going to have its fare share of bumps and bruises with the smartwatch. Initial sales will obviously be spectacular with retailers circling the wagon for inventory, because it’s Fitbit. But like all other smartwatches, sell-through will be underwhelming. Garmin (GRMN) launched two smartwatches in the fall and broadened distribution/sell-in during the holiday period thus it also experienced good sales during the reported period. Having said that, Garmin’s already experiencing rough sell-through results for its smartwatches as reported by NPD Group recently. One of the positives, in terms of metrics, the smartwatch will serve to increase Fitbit’s ASP. The drawback, however, is smartwatches have terrible profit margins.

William Zerella

It's Bill. So we would expect that our smart watch margins will be somewhat less than our tracker margins and we've baked that into our adjusted long-term gross margin target.

While Fitbit’s CFO suggests smartwatches have a lesser profit margin than its traditional fitness trackers, wait until they actually try selling units at scale. In short, Fitbit’s smartwatch will not likely be a good response to its faltering sales long-term, but a Band-Aid wanting for a better cure. Nonetheless, where there is an existing market to capture the consumer’s dollar, Fitbit should find itself competing.

Everything Fitbit will be implementing going forward should be viewed as an attempt to improve its metric performance. All of its hardware contemporaries named have been through the same business cycle. Unfortunately every one of these peers has had similar go forward strategies with introducing new products and better utility for those products. None of the efforts really amounted to much of anything and in most cases the efforts actually failed.In the case of Keurig Green Mountain, SodaStream and Skullcandy, the only thing that helped to improve their metrics was time, the time it took for metrics to bottom out before establishing a low bar for which to hurdle over in subsequent years. At the crux of Fitbit’s product the company has managed to sell far more product than most of there hardware peers named. Clearly, Fitbit is no fad and it would behoove the CEO not to mention that word in the future as the mere mention serves to fuel uncertainties with its shareholder base. The number of units sold and years in the marketplace speak loudly and clearly to the mainstream nature of the products.

Fitbit sold more units in Q4 2016 than Keurig Green Mountain had sold its coffee makers for any quarter in its existence. Just as Keurig Green Mountain isn’t going away and GoPro is still around, Fitbit will simply go through its business model mandated downturn before ultimately resurfacing as a leaner, more profitable company.

I wouldn’t be terribly concerned with Fitbit’s 2017 guidance as an investor.By and large I believe the company is simply taking a “shot in the dark” with their stated guidance for revenues and earnings. The Q1 period will be quite difficult and find the company begging for outperformance, as the Q2 comp is extremely high due to last year’s product launches during the period. But most important is that Q1 result.Most investors haven’t taken a careful look at what would happen if Fitbit meets the Q1 guidance. If Fitbit does meet the guidance or even beat by a couple percent, the stock valuation will react to the unfavorable position that Fitbit will find itself with regards to the full year guidance. With that being said, the company is hoping to achieve between $1.5-$1.7bn in sales for 2017.

History has proven that during years of metric contraction, post market saturation, hardware-centric companies with one product category offering tend not to achieve their stated guidance. It happened to SodaStream, Keurig Green Mountain, GoPro and Skullcandy just to name a few. The good news for investors from this point in the share price valuation is that the risk/reward equation is favorable long-term. With the share price trading as closely to book value as it has in recent weeks, investors will just have to stand pat for the better part of 2017. Investors should also review the historic valuation of Fitbit’s hardware peers that all have traded below book value in the past. Having said that, adding shares to one’s portfolio near book value offers investors the greatest profit potential when Fitbit turns the corner and jumps over low bar metrics.

Shares of FIT likely won’t appreciate or maintain any meaningful appreciation in 2017 as the stock has been placed in “show me” status. Again, in the $5 price level shares are already baking in 2017 metric declines. This is rather unusual, to find a stock exhibiting a restructuring valuation so quickly.I placed J.C. Penney into show me status back on May 16, 2016 in the article J.C. Penney Shares Fall Back Into 'Show Me' Status and when the company’s metric performance became a concern for me. Since that time the stock and metric performance has only deteriorated. Shares of JCP still maintained a premium early in 2016, but have now baked in restructuring efforts to some degree. I guess what I’m trying to say with regards to Fitbit’s share price activity in 2017 is that it will go through fits and starts, but likely not exhibit stability at any upper end of a trading range and as it maintains its show me status. It won’t be until the company’s metrics bottom and a more favorable performance is viewed on the horizon that the share price will appreciate and maintain an upward trajectory.

Moreover, it’s extremely improbable that Fitbit will be acquired. There is actually not a single like example of a publicly traded company being acquired less than two years after the IPO and less than 50% from the IPO price. The SEC forces upon underwriters, corporates and exchanges certain rules and regulations to ensure the stability of the securities markets. Could you imagine what would happen if the SEC allowed for an entity to acquire a publicly traded company at 50% less than the IPO in such a short period of time?Private companies would flood the IPO market and fleece would-be investors if this exampled activity were permitted. And that is why such activity is prevented, to preserve capital markets and the integrity of the securities markets. Unfortunately, some investors spend more time proliferating the improbable rather than reading through SEC and market exchange rules and regulations. It’s an interesting read, the qualifications, rules and standards for listing as a public company and participating on any given exchange. If investors have time to do so, I would certainly recommend it for one’s knowledge base.

The Final Word

Fitbit is a good company with a good product. To date, the product line has not been diversified to the extent the company could experience long-term, stable growth rates. As such, it has succumbed to the exact same business cyclicality pressures of its peers named within. During this time of contracting margins, sales and profits the company will be streamlining its business operations and cutting costs in order to emerge from this period of contraction. While Fitbit has offered an optimistic action plan to diversify its products and industry reach, its peers have written the exact same playbook. These companies emerged from their trough periods to represent that the core business product line that brought the company great early growth and eventual contractions, continued to be the driver of sales and profits, not the proposed initiatives and action plans. With 23mm active users, Fitbit has accomplished a great deal in the last 9 years with a product that is not essential to everyday life.The product has both benefits and detractions, but ultimately 23mm people have found themselves with a use for the device. I expect the user base to continue to grow, albeit to a lesser degree over the next two years and despite Fitbit’s profits contracting. Over this time, sales will also bottom out before returning to a more normalized growth rate. If Fitbit can manage to introduce a recurring revenue business into its core consumer products business, this two-year expectation can be curtailed. Fitbit’s share price performance will likely moderate around its present valuation, slightly higher and/or slightly lower for the better part of 2017 and as the company bases its sales performance. In 2018 the company will begin to experience much easier YOY comparisons that create a more favorable share price sentiment and price to earnings ratio. Lastly, as an investor, I would review the Q1 guidance with respect to full year revenue expectations to best understand the implications for the remainder of the fiscal year.

Disclosure: I am long FIT.