Does Amazon Create Jobs? Well, It Hired 75,000 Robots In 2017

There are 170,000 fewer retail jobs in 2017 – and 75,000 more Amazon robots.

An Amazon machine employee (Reuters/Noah Berger)

Amazon’s headcount is growing by 40% year-over-year. It was the eighth-largest private employer in the US at the end of 2016, and it’s poised to climb those ranks quickly. The online retailer also announced plans to build a second US headquarters that will employ 50,000 employees.

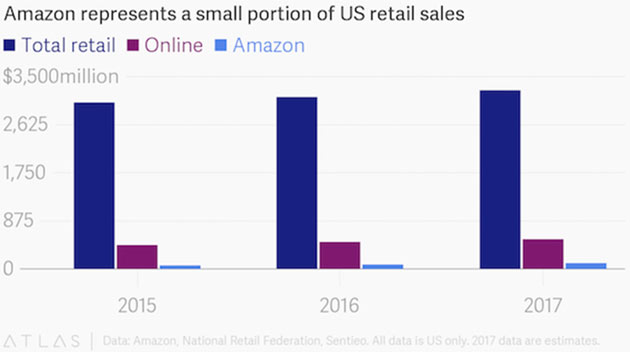

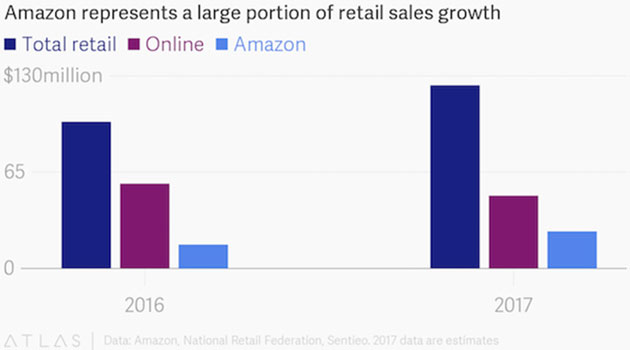

But Amazon’s growth comes at a cost. It has a well-earned reputation for overwhelming competitors. Even though Amazon represents a small portion of the overall retail industry, it dominates the industry’s sales growth.

We wondered: Does Amazon create more jobs than it destroys?

It depends – on whether you are a robot

We assembled employment data for the retail industry as a whole, and for Amazon in particular. We estimated year-end results for 2017, based on current trends.

Source: Quartz Media, LLC

Here’s what our analysis says:

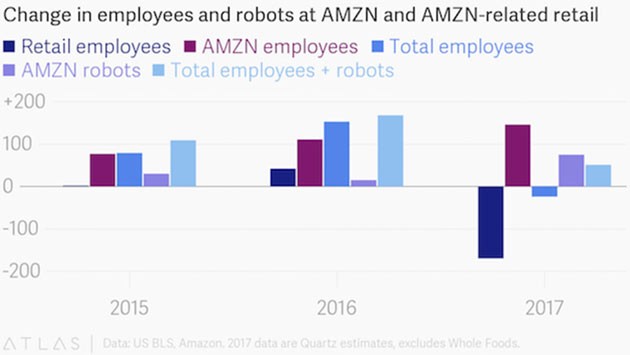

- Assuming the current industry trends continue through the end of the year, the number of employees in Amazon-related retail (that is, retail that Amazon competes with, such as book stores, as opposed to areas it doesn’t compete with, like gas stations) will decline by about 1% year-over-year. While that’s a small percentage, the number of job losses would be 170,000. That would be the first annual decline since 2009.

- Amazon’s employment increases won’t be enough to cover the losses in the rest of the industry. We have assumed Amazon will maintain its current year-over-year headcount growth rate and will add 146,000 employees worldwide in 2017, a 43% increase (excluding Whole Foods employees). Even with that aggressive growth assumption, and including Amazon employees worldwide, the combined employment at Amazon and Amazon-related retail would still decline by 24,000.

- Amazon has already added 55,000 robots this year and its growth rate is accelerating. The company stated it had 45,000 robots at the end of 2016, added 35,000 robots by the end of the first half of 2017, and then another 20,000 in the third quarter. We’ve assumed another 20,000 in the fourth quarter for a total of 75,000 new robots in 2017. While it may be difficult to prove causality, it’s not difficult to see the correlation between a decline of 24,000 human employees and an increase of 75,000 robot employees.

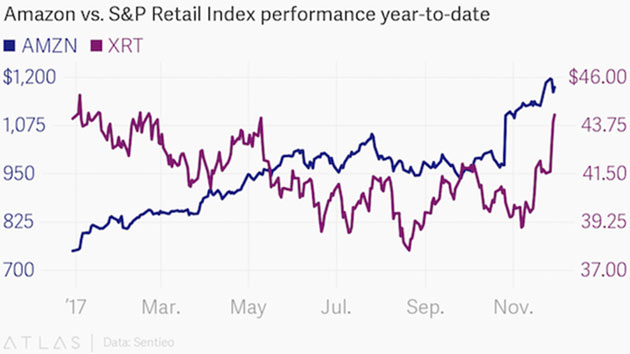

Amazon’s growth and efficiency (driven by AI and automation) are key to why its stock has performed so well. The company is increasing its investment in robotics and, in our assumptions, machines could represent 20% of the total employee base by the end of the year. That increase in automation drives efficiency and growth and makes Amazon investors happy—especially relative to the retail industry as a whole. While the S&P Retail Index is flat this year, Amazon’s stock is up 57%.

Source: Quartz Media, LLC

The National Retail Federation (NRF) has forecast that retail-industry sales will grow by around 4% in 2017. (US Census Bureau data also confirms that growth rate through the first nine months of the year.) Online shopping is growing even faster—at 10% so far this year. Amazon’s US business represents 35% of that growth. And Wall Street analysts estimate that the company will represent 51% of all US online sales growth by the end of the year.

Source: Quartz Media, LLC

Source: Quartz Media, LLC

That means that Amazon will represent 20% of the entire US retail industry’s growth in 2017—even though it only represents 3% of overall US retail sales. Amazon’s growing army of robots may seem helpful and benign but they are also highly effective at terminating human retail employees.

Amazon may have patented the next big thing in online shopping

“How much do I get paid for watching this?” (Reuters/Elijah Nouvelage)

User-generated Amazon reviews are one of the most important ways that consumers find products and decide what to buy. So much so that Amazon has consistently shown itself to be Google’s competitor in e-commerce search. Almost all Amazon product reviews are written but, as business research firm L2 wrote, Amazon is now pivoting to video.

It’s a broad strategy with Amazon inviting some of its 2 million merchant partners to join the test program, where videos will be posted to the site in mid-December. According to L2, “this feature is a logical step given how often consumers watch how-to and product review videos before making purchases. By adding the feature, Amazon clearly aims to keep shoppers on its own site, preventing them from migrating to YouTube or social media platforms.”

There’s potentially another reason for Amazon to promote the use of video in e-commerce. It now has a way to offer customers discounts for watching ads. In October, Amazon was awarded a patent for “content-based price reductions and incentives.” The patent says that “customers in an electronic environment can be presented with the option to receive advertising, such as audio, video, or interactive content, in order to receive discounted pricing or similar benefits.”

One example of how Amazon sees this working is that a customer can watch a video ad on an item’s detail page, such as a product review. As the customer watches more of the ad, the displayed price for the item drops.

Depending on how strong Amazon’s patent is, no online retailer outside of Amazon’s ecosystem can offer this benefit to customers.

The background to this patent is informative as it helps explain how far reaching Amazon’s thinking could be, and how they plan to keep lowering prices for consumers. One major difference between e-commerce and in-store purchasing is that loss-leading—selling goods cheaper than what they cost—doesn’t work in e-commerce. When customers visit a physical store, they have invested their time to get there so stocking up on additional items is worth it. This doesn’t happen online. So this patent levels the playing field, allowing sellers to offer discounts to online customers based on their investment in time.

With this patent, Amazon has signaled that it is taking on YouTube, Facebook, Instagram, Snap, and other media platforms for digital ad spend. And customers will now also know the value of their time. And potentially whether their time gets more or less valuable depending on their purchasing behavior. One person’s time is inevitably more valuable than another’s, so with dynamic pricing, it’s not hard to imagine a personalized price based on a customer’s attention span and spending behavior.

Perhaps most importantly, Amazon had a lock on low-friction e-commerce with its original patent for one-click checkout, which has expired this year. The question is, with the shift to video-enabled e-commerce, is dynamically priced, attention-incentivized video advertising the next big thing that secures Amazon’s advantage for years to come?

Disclosure: Follow Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts ...

more