Dividends By The Numbers For April 2018

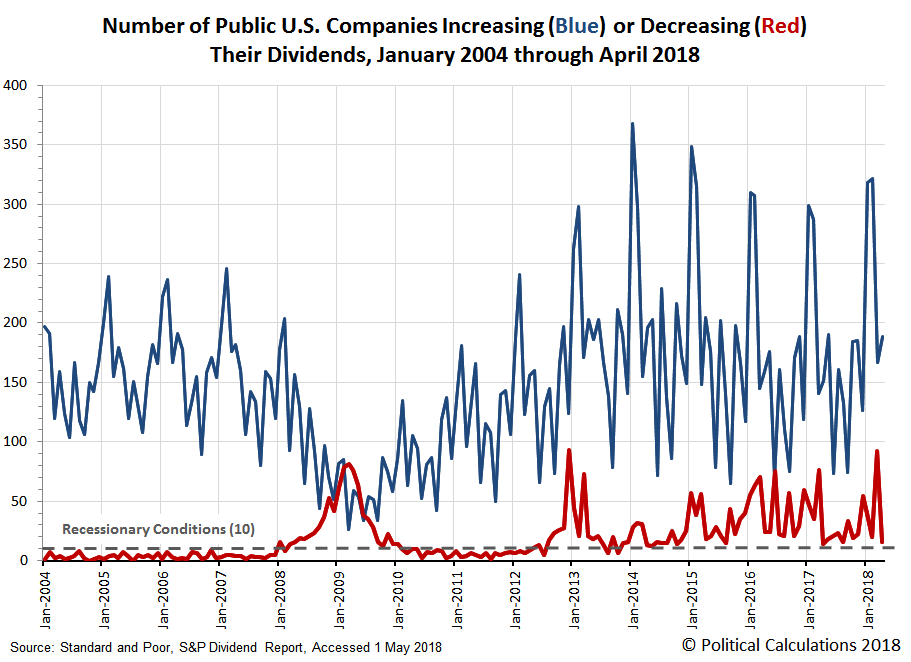

April 2018 saw the return of more normal dividend numbers where the quantity of U.S. firms increasing or decreasing their dividends was concerned, where Standard & Poor's topline numbers for the entire U.S. stock market had 189 firms announce that they were increasing their dividends and just 20 firms declare that they would either reduce their dividends or omit paying them during the month - far below the 101 firms that either cut or omitted paying their dividends as Standard and Poor reported for March 2018.

(Click on image to enlarge)

It's a better picture than March 2018 was, so let's get to the metadata for dividends in April 2018!

- There were 3,388 U.S. firms that issued some kind of declaration regarding their dividends in April 2018, which is down from the previous month's 4,392. It is also down year-over-year from April 2017's 4,017.

- In March 2018, there were 34 U.S. firms that announced that they would pay an extra, or special, dividend. That figure is down from the 36 firms that paid special dividends in March 2018, but up from the 27 that paid out an extra dividend in April 2017.

- We already touched on this number, but there were 189 U.S. companies that announced that they would increase their dividends in April 2018. This figure is up from the 167 dividend hikes in March 2018, and is also up significantly from the 152 firms that boosted their dividends back in April 2017.

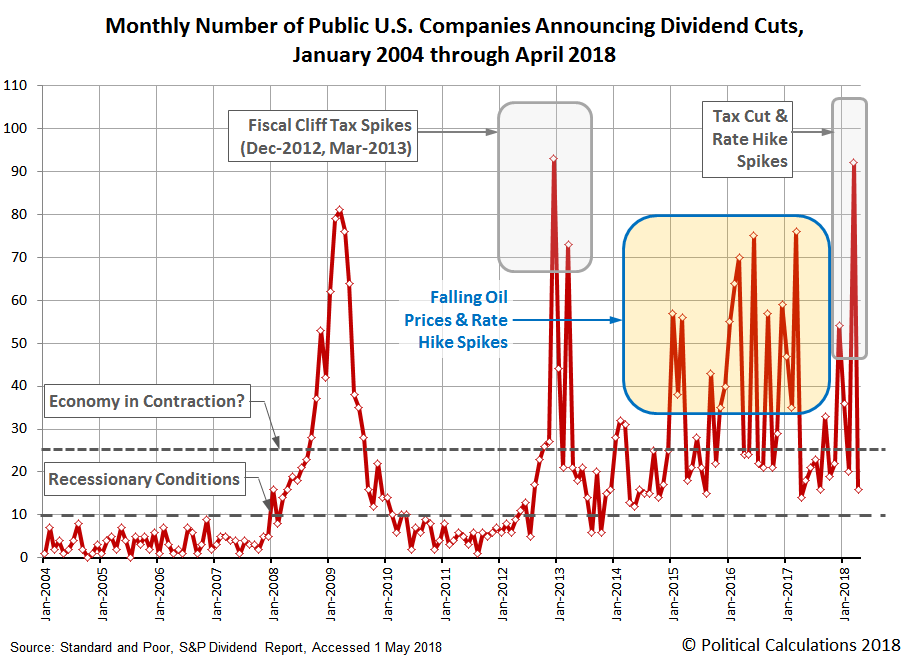

- There were only 16 dividend cuts declared in April 2018, down dramatcially from the 92 dividend cuts that S&P reported for March 2018. Compared to April 2017 however, this number is a small increase over the 14 dividend cut announcements that were recorded in the same month a year ago.

- Finally, there were 4 U.S. firm omitted paying dividends in April 2018, which is down from the 9 that omitted paying dividends in March 2018, but also up from the 2 that omitted paying dividends in the same month a year earlier.

The next chart focuses more closely on the monthly data for dividend cuts, where we confirm that the number of decreases plunged from March 2018's near-record monthly total.

(Click on image to enlarge)

Here's the full sample of 12 of the 16 dividend cutting firms from April 2018 that were identified as such by our near real-time sources for dividend declarations:

- Paradise (OTC: PARF)

- Franklin Street Properties (NYSE: FSP)

- Mesabi Trust (NYSE: MSB)

- Alliant Energy (NYSE: LNT)

- Mesa Royalty Trust (NYSE: MTR)

- Blackstone Group (NYSE: BX)

- Permian Basin Royalty Trust (NYSE: PBT)

- Dynagas LNG Partners LP (NYSE: DLNG)

- SandRidge Mississippian Trust II (NYSE: SDR)

- SunCoke Energy Partners (NYSE: SXCP)

- NuSTAR Energy (NYSE: NS)

- NuSTAR GP (NYSE: NSH)

We find that the list of dividend cutting firms for April 2018 is predominantly made up of firms from the oil and gas industry, the financial sector and also a handful of Real Estate Investment Trusts (REITs). Among the oil and gas industry firms, we note a high number of Master Limited Partnerships (MLPs), which were recently negatively impacted by a change in U.S. tax regulations, which would prompt many to cut their dividends. Otherwise, much of what we see is the result of the typical month-to-month noise in the oil trusts that pay out monthly dividend distributions.

For the finance and REIT sector, we recognize that a lot of these firms are sensitive to interest rate changes, where the Federal Reserve's recent series of rate hikes is negatively impacting their ability to continue paying dividends at their previous levels.

There's also a single firm from the food industry, Paradise (OTC: PARF), which is perhaps best known as a candied fruit maker (the kind that is baked into fruitcakes), but which also manufactures molded plastic containers. We don't view this particular dividend cut as indicating any kind of trend for the fruitcake industrial complex.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more