Dividend Growth Portfolio 2017 Year-End Letter To Investors

For the full-year 2017, the Dividend Growth portfolio returned 8.5%, trailing the S&P 500’s 19.4% by a wide margin [returns figures calculated by Interactive Brokers].

While I probably shouldn’t consider an 8.5% annual return a “failure,” it’s certainly frustrating to me to trail my benchmark like this. So, we’re going to take a long, hard look at what went right and what went wrong in 2017.

To start, it’s important to remember that, by design, my returns will deviate from the indexes. In my view, an active manager whose return closely mirrors that of the S&P 500 (or any benchmark) is a closet indexer that isn’t offering much in the way of value. If a manager is too timid to deviate from the S&P 500, then frankly, the client would be better served by firing the manager and opting for a cheaper index fund.

An actively manager should be truly active. This means that, if they are doing their jobs, there will be years where they beat the pants off of the S&P 500, but there will also be years when they don’t. Over time, an active managers’ returns should be as good or better than their benchmark index’s returns. But just as importantly, their returns shouldnot be highly correlated. And here, I can confidently say that my returns are not highly correlated to those to the S&P 500. The Dividend Growth portfolio consistently produces an R-Squared of 0.5 to 0.6.

In plain English, this means that only about half of the portfolio’s returns are explained by the S&P 500. The rest is explained by stock picking. That is exceptionally high diversification for a long-only stock portfolio.

In 2016, the Dividend Growth portfolio beat the S&P 500 by a wide margin, 26.0% vs. 9.5%. Last year, it underperformed, 8.5% vs. 19.4%. That is the nature of a truly actively-managed portfolio. There will be years of outperformance, and there will be years of underperformance.

Growth vs. Value

While the Dividend Growth portfolio has “growth” in its name, this refers to dividend growth and distinctly not “growth investing.” My mandate is to find undervalued stocks that are raising their dividend payouts. I am, by temperament, a value investor. You will never see me chasing hot, faddish stocks in this portfolio.

Well, 2017 was a year that favored glitzy growth investing over sober value investing. The S&P 500 Value index returned 11.5% last year, whereas the S&P 500 Growth index returned an eye-popping 24.4%, reminiscent of the go-go days of the late 1990s.

No style of investing works best in every single year, but over time value investing with a focus on dividends has proven to be a winning strategy. In the late 1990s, growth stocks left value stocks in the dust. But from 2000-2008, it was the value sectors that outperformed. And while I cannot guarantee a similar shift to value outperformance is imminent, I believe that day is getting close.

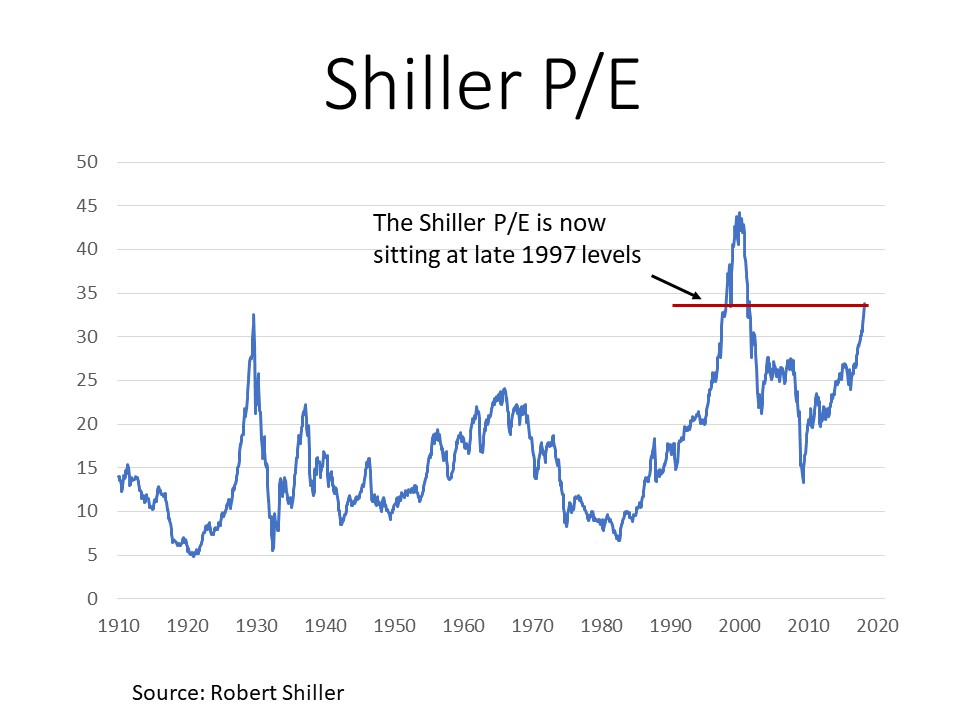

As I write this, the S&P 500 sports a cyclically-adjusted price/earnings ratio (“CAPE” or “Shiller P/E”) of nearly 34. That puts current valuations on par with late 1997, as dot-com mania was entering its final blow-off stages. And as was the case in the late 1990s, we’re starting to see the excesses you see near a major top, particularly in cryptocurrencies like Bitcoin and in stocks purporting to be using blockchain technology.

Again, this doesn’t mean the market is topping today, tomorrow, or even next month. As we saw in the 1990s, an expensive, bubbly market can get a lot more expensive and bubbly before reaching its ultimate top. But I very emphatically believe that staying the course with an income and value strategy makes sense at this stage.

Where We Are Investing in 2018

Our largest exposures as of this writing are in midstream oil and gas pipelines, automakers, alternative asset managers and REITs.

After a mixed year in 2017, pipeline stocks, automakers and alternative asset managers have all enjoyed a very strong start to 2018. I expect these sectors to be very strong drivers of our returns this year.

REITs, however, have had a rough start this year. And while it’s impossible to ever truly know “why” a sector falls out of favor, it appears that worries over rising bond yields is what is depressing REITs at the moment.

Rising bond yields affect REITs in two ways. To start, REITs tend to borrow a lot of money, so every additional dollar paid out in interest due to rising yields is a dollar that comes out of profit. But secondly, REITs, as high-yield investments, are also priced relative to bonds. So, rising bond yields (and falling bond prices) mean rising REIT yields (and falling REIT prices), all else equal.

With U.S. economic growth picking up, there is widespread belief that inflation is just around the corner. And higher inflation, were it to happen, would almost certainly mean higher yields.

I’m not convinced that higher inflation rates are imminent, however. Inflation remains very subdued globally, and this is reinforced by the aging of the baby boomers and by technology trends. All else equal, older consumers borrow and spend less than younger consumers. So, the aging of the baby boomers creates a deflationary anchor that should keep inflation rates low for a long time to come.

Furthermore, the wage inflation that has been so hard to come by over the past 10 years isn’t likely to come roaring back, even with a strong economy. In virtually every customer facing industry, kiosks and smartphone apps have effectively replaced human labor. As soon as higher labor costs start to cut into profits, companies react by replacing expendable labor with cheaper technology. And while this trend has been with us since the dawn of human history, today it is accelerating at the fasted rate since the Industrial Revolution.

So again, inflation is not something I’m particularly concerned about, and I believe that the current spike in yields will recede within a few months.

I may prune our REIT portfolio slightly in the first quarter, but I believe the overall bearishness towards the sector is unwarranted, and I continue to view the sector as a good “fishing pond” for stable, dividend-paying stocks.

Disclosure: Charles Sizemore is the author of the Sizemore Insights financial blog and is based in Dallas, Texas.

more