CVR Medical: A New Approach To Cardiovascular Care

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

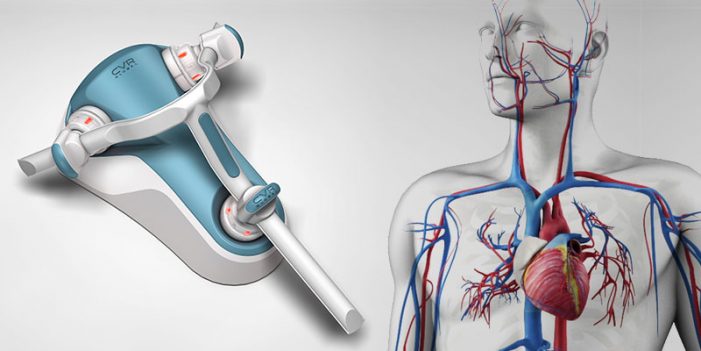

CVR Medical (CRRVF) (TSX-V:CVM) is a medical device company whose primary product, the Carotid Stenotic Scan (CSS), is on track for FDA market clearance. The device uses patent-protected science to detect ischemia of the carotid artery, a direct risk factor for ischemic stroke. In what the company calls "game-changing technology," the CSS is able to identify blockage within the arterial system and arm the clinician with the information necessary to potentially deter catastrophic events such as stroke in the future.

Technology

CVR’s Carotid Stenotic Scan utilizes patented subsonic sound analysis to determine the presence of arterial disease/blockage in the patient by analyzing the link between fluid flow and subsonic frequencies. More specifically, the device analyzes and takes into consideration the low frequency vibrations that radiate from the carotid arteries. When the blood is flowing through the arteries there is a production of wave patterns. These wave patterns are read by the machine and mathematically analyzed through CVR’s patented algorithm. This algorithm then determines an accurate percentage of stenosis with a range. This allows the immediate interpretation by doctors of what's happening inside the arteries.

Opportunity

While new science and new technology is always what gets people excited, it's the pragmatics that often ultimately dictate success or failure. As company COO/EVP Tony Robinson told us,

Currently, there are other devices on the market which can detect this disease, but none which can act as a cost-effective tool to detect this presence early on when actions can be taken to prevent the negative outcomes. The CSS will empower the Primary Care Physician with the information necessary to either implement the proper treatment themselves, or refer onto a cardiovascular specialist. The overall goal is to not rival other modalities on the market, but instead streamline the process and ensure that the patients who most need medical care are able to receive it.

As company literature notes, noninvasive screenings that can be done by the primary care physician are currently unavailable to patient, provider and payor. At present, carotid artery screening is not standard. If risk indicates and/or blockage is suspected, the current available modalities are Duplex Doppler ultrasound (DUS), magnetic resonance angiography (MRA), and computed tomography angiography (CTA). All use expensive equipment and require specialized technicians to operate. In contrast, the CSS is aimed to doctors' offices, with a price under $50,000 a machine and not requiring an additional technician to operate. Once FDA-approved, there should be no barriers to insurability.

There's an additional potential motivator for physician acquisition that I find interesting: we live in a litigious society. As Paul Blunden, M.D., who is a medical advisor on the company's board, notes, "Delayed stroke diagnosis is a liability problem for the physician/health care provider." Transient ischemic attacks, or TIAs, can present with a multitude of symptoms that can be non-specific. If the CSS can establish itself as a standard of care akin to the cardiogram, readily available in a doctor's office as a diagnostic tool, then the risk of liability for NOT using such a tool increases, which can motivate acquisition.

Catalysts

CVR Medical has a couple of catalyst opportunities in play that might help bring its stock price higher in the coming year. The company is in the process of completing its initial trials and moving into pivotal trials. With that said the company is preparing to submit and possibly receive approval for FDA 510(k) clearance, and market its product by the end of 1st half of 2018.

Market Opportunity

The company is in good shape to get its launch out by the end of 1st half of 2018, should the FDA approve clearance for marketing of the CSS product. It has signed a letter of intent with Canon for production and distribution. If just one CSS were bought by each medical practice and hospital in the U.S., the total U.S. market opportunity alone is $11.4 billion. The company, which has already invested $20M, currently has $2 to $3 million in the bank. That should be sufficient for now to get the company close enough to launch its product for revenue.

Split Revenue Upon Clearance

CVR Medical is in a joint venture with CVR Global. This is an important thing to note. The joint venture was put together as each separate entity brings its own expertise to the table. The goal of this JV is to be able to collaborate and bring the CSS to market. The way the JV works is that the profit will be split up. At least 50% of the profit goes to CVR Medical, while the other 50% goes to CVR Global Incorporated. Since CVR Global is privately held and has most of the same officers, investors should take note.

Conclusion

CVR Medical has a good device in place to bring value for its shareholders. The amount of advantages that CSS brings, and the way it can broaden the availability of earlier carotid scans, make it a good choice for all medical offices. The company has no current plans at the moment to partner with a larger company. Right now it is highly focused on getting its CSS to market to start generating revenue. The CSS can eventually be for additional cardiovascular screenings. It even has potential to be used in industrial and military applications. If it can receive FDA 510(k) clearance and reach the market, then the company should be able to raise its market cap, which currently stands at $16.36 million, accordingly.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

Good stuff @[Terry Chrisomalis](user:5023). When will we see more by you?

What kind of time frame are we looking at here?

I've got to say, #CVR definitely seems like it has a lot of potential. I don't know too much about the industry, however. This article has definitely inspired me to do my homework. $CRRVF

Impressed with what I see here about $CRRVF. Thanks.

Impressive indeed. But I want to know more about what advancements the competition may have up their sleeves as well. Intrigued but cautious on $CRRVF.

I've added $CRRVF to my list of stocks to follow here. Would love an update.

This sounds like it could really extend people's lives!

This sounds very promising. I admit I was not previously familiar with this company. I'll be doing some more research on them.

Looks good, thanks.

Very impressed with these innovations and medical advancements. Bullish on $CRRVF.

I like the idea that this could become the indispensable EKG of stroke prevention. In our litigious society once there is something a doctor COULD do, they can be sued if they don't....

Loading comments, please wait...