Cowen Biotech Q1 Preview

With earnings season around the corner, analysts from Cowen & Co. are weighing in with expectations for some of the most notable names in biotech. While the firm acknowledges that this quarter will hardly be “biotech’s finest hour,” this earnings season will “highlight biotech’s favorable growth outlook and value proposition relative to other sectors.” Below, Cowen analysts shed light on Gilead Sciences, Inc. (GILD), Celgene Corporation (CELG), ACADIA Pharmaceuticals Inc. (ACAD), and Ariad Pharmaceuticals, Inc. (ARIA).

Gilead Sciences, Inc.

Biotech giant Gilead is one of Cowen’s “favorite names” ahead of earnings. The company will post results on April 28 after market close and analyst Phil Nadeau expects the company to post first quarter GAAP EPS of $2.88 on revenue of $8.48 billion, slightly higher than the analyst consensus of $2.82 and $7.96 billion, respectively. The analyst currently has an Outperform rating on the stock with a $130 price target.

Gilead is most known for its hepatitis C franchise as its blockbuster drugs, Harvoni and Sovaldi, which dominate the market. Nadeau estimates that Gilead’s entire HCV franchise will garner $4.86 billion in sales for the quarter, marking a 7% year-over-year increase. This figure is slightly above the analyst consensus of $4.48 billion because the analyst expects a strong showing from Japan, where Harvoni and Sovaldi were both launched in the fourth quarter. Furthermore, foreign exchange headwinds are lightening as the US dollar weakens, allowing for stronger international revenue streams.

The company also has a strong HIV franchise, which Nadeau expects to grow 23% year-over-year to $2.99 billion. Nadeau points to “the launch of the new-TAF-based pills, particularly Genvoya,” as a source of reinvigoration for the franchise. Although IMS script data is not the most reliable indicator of trends because 35% of Gilead’s HIV franchise sales are brokered through agencies that are not monitored by the IMS, Nadeau still believes there could be upside to his HIV franchise estimates.

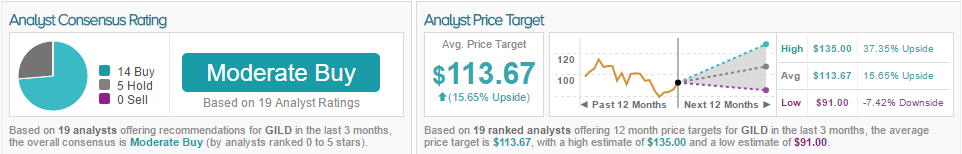

According to TipRanks, 75% of the analysts covering Gilead recommend buying shares 25% remain neutral on the stock. The average 12-month price target between these analysts is $113.67, marking a 16% potential upside from where shares last closed. Phil Nadeau has a 39% success rate recommending stocks with a 2.4% average one-year return per rating.

Celgene Corporation

Eric Schmidt of Cowen covers Celgene, which will be reporting earnings on April 28 before market open. Schmidt expects the company to post non-GAAP EPS of $1.27 and total revenue of $2,540 million with both figures in-line with the overall analyst estimate. The analyst explains that Celgene’s first quarter earnings tend to be “seasonally weak” due to “donut hole accounting, patient-level ‘shoeboxing,’ and wholesaler buying patterns.”

Celgene is most known for Revlimid, its FDA-approved drug for mantle cell lymphoma. Schmidt models a 17% year-over-year increase in sales for the drug, and he believes the drug will continue to thrive thanks to market share gains and a favorable pricing dynamic. Overall, the company will get a nice boost from newer products such as Pomalyst, Abraxane, and Otezla, and will continue to have catalysts thanks to its strong pipeline.

Looking forward, investors expect the company to provide an update on its 2017 EPS guidance of $7.25, as many believe this is too high. While management indicated that foreign exchange headwinds will cost the company about $800 million in sales in 2017, many are waiting for this to subside as the US dollar weakens. This will be important for Celgene as 39% of the company’s sales in the previous quarter were earned in foreign markets. Regardless, Schmidt believes “the widely anticipated revision will represent a clearing event for the stock and allow shares to resume an upward ascent over the remainder of 2016.”

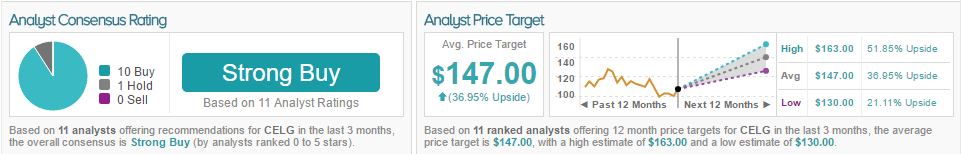

According to TipRanks, 90% of analysts covering Celgene recommend buying shares while 10% of analysts remain neutral. The average 12-month price target between these analysts is $147, marking a 37% potential upside from where shares last closed. Schmidt has a 47% success rate recommending stocks with a 16.1% average one-year return per rating.

ACADIA Pharmaceuticals Inc.

Acadia will report earnings in early May and Ritu Baral expects the company to post a GAAP EPS loss of $(0.39), slightly narrower than the analyst estimate of $(0.42). While the company does not have any approved drugs, all eyes will be on Nuplazid, the company’s lead product candidate to treat psychosis associated with Parkinson’s disease. The FDA has accepted the New Drug Application for the therapy with a decision expected by the beginning of May.

Baral expects a “straightforward approval with a label that allows use in a relatively wide patient population” and “safety language in the label to be largely comparable to current antipsychotics.” Safety concerns surrounding Nuplazid garnered attention as trials for the drug led to patient deaths, though the FDA’s advisory committee recently ruled that the deaths could not be directly correlated to the treatment. The advisory committee voted 12 to 2 in favor of the drug’s acceptable risk/reward profile. While the FDA does not have to follow the recommendation of the advisory committee, it usually does. If approved, Nuplazid is likely to come with a black box warning.

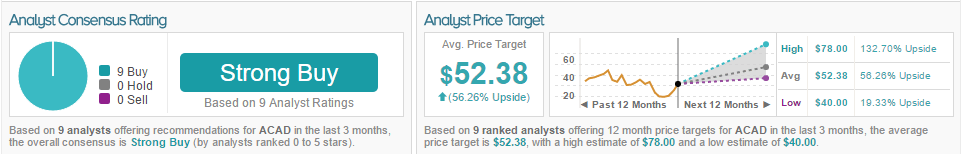

According to TipRanks, 100% of the analysts who have recently covered the stock are bullish with an average 12-month price target of $52.38, marking a 56% potential upside from where shares last closed. Ritu Baral has a 41% success rate recommending stocks with a 6.7% average return per rating.

Ariad Pharmaceuticals, Inc.

Ariad will report earnings in early May and Cowen analyst Phil Nadeau estimates the company will post a GAAP EPS loss of $(0.30), slightly wider than the analyst consensus of $(0.27). Iclusig is the company’s only FDA-approved drug indicated to treat adults with specific forms of chronic myeloid leukemia. The analyst expects the company to garner $37 million in quarterly sales for the drug, marking a 55% year-over-year increase.

Looking forward, the analyst points to data from brigatinib’s pivotal Phase 2 trial as the “most important pipeline event” in the second quarter. Brigatinib is in development to treat patients with specific forms of anaplastic lymphoma.

Overall, the Nadeau believes Ariad shares are “fairly valued.” With new management in place, the analyst expects the company to review all corporate strategies and take “a fresh look at the ways that patient and shareholder value can be maximized.” This will culminate with an investor day in June.

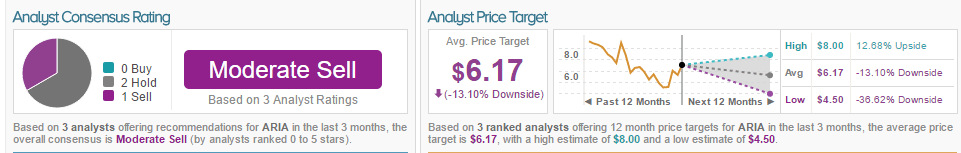

According to TipRanks, 2 analysts remain neutral on Ariad and 1 is bearish. The average 12-month price target between these 3 analysts is $6.17, marking a 13% downside from where shares last closed.

Disclaimer: Tip more