Consumer Discretionary Sector Looking Strong

In a prior post I wrote about the importance of consumer spending for the U.S. economy. I also showed a very bullish chart of the S&P 500 Retailing Index ($SRLX). The retail industry can be split up into two consumer groups, discretionary and staples, depending on what type of goods/services they provide.

Two consumer groups

Companies in the discretionary group offer goods and services which are optional for the consumer, like new TVs or cars and vacations, and consumers can cut back on these in their spending, Internet retailers, media companies, restaurants, apparel retailers and automobiles are examples of industries in the consumer discretionary sector.

In the staples group, companies provide goods and services which people use daily and are considered “necessary” for consumers; goods/services that consumers “cannot be without” or “have to” or “must” use in both good and bad economic times. Items such as beverages, food, household and personal products, and tobacco. I am placing quotation marks around these words since one can argue whether toothpaste or tobacco is a necessity or not.

To be stricter, one can categorize discretionary items as being more cyclical and having variable demand, while staples are less sensitive to changes in the economic cycle and have relatively stable demand.

The direction of consumer spending within the retail group gives important clues to the health of the stock market and the economy. Stock prices of companies in the discretionary sector tend to do better than staples stocks when consumers are more confident and optimistic about the economy and are more willing to spend money on items they want but do not necessarily need. When the economy is weak and consumers are less confident in the economic outlook, discretionary stocks tend to do worse than staples stocks.

Discretionary stocks are, in general, more growth oriented, thus more aggressive and speculative (a.k.a. riskier, more volatile) compared to the more conservative and safer (less risky/volatile) staples stocks. The latter usually hold up better during market downturns and many consumer staples companies pay relatively high dividends to their shareholders.

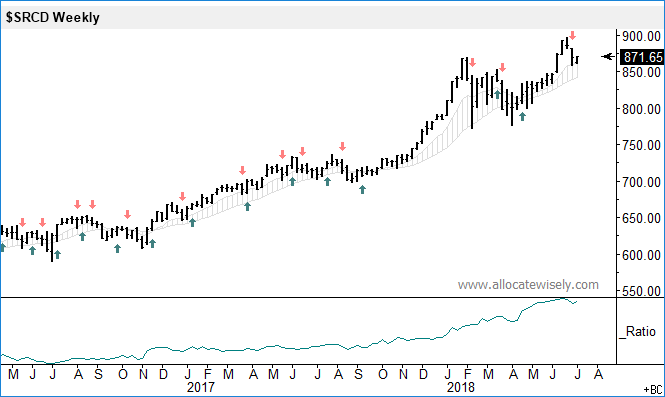

The chart below shows the performance of the S&P 500 Consumer Discretionary Sector Index ($SRCD) on a weekly basis. On June 20, the index reached a historical high and the trend is clearly to the upside. In the lower window is a line showing the ratio between the $SRCD and the S&P 500 Consumer Staples Sector Index ($SRCS), one divided by the other.

The ratio line can be viewed as a sentiment indicator. It has been steadily rising from the bottom in March 2009, meaning discretionary stocks have been outperforming staples stocks, which is bullish for the market as a whole. It has risen very fast since last September and is at all-time highs. Perhaps the ratio line has run up too far, too fast and needs a little breather.

Disclosure: The analysis provided here is usually part of the analysis the author uses when he is designing and managing his investment portfolios.

Disclaimer: The analysis presented ...

more