Consolidated Edison For Retirement Income

If you listen to some market prognosticators, good dividend yields from great companies are nearly impossible to find these days. But if you look hard enough, you can still find great dividend payers that will make your retirement much easier.

Consolidated Edison

One of my favorite dividend payers for my retirement portfolio is Consolidated Edison (ED). This utility company has been paying a dividend since 1992 and has never cut their dividend.

Interest rates are still very, very low. Because of this many investors are turning to solid utility stocks such as Consolidated Edison. Bonds will no longer cut it for retirement income so we need to find solid dividend payers to make up for the lost income.

Bonds For Retirement Income

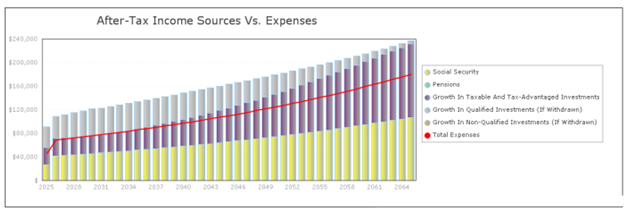

It used to make sense to invest a good portion of your retirement money into bonds when interest rates were above 5%. Ten years ago many people could retire on bonds alone. Let’s look at a sample case in 2007:

|

Things are looking pretty good for this couple.

In terms of generating enough income in retirement, this couple is all set. I ran this retirement plan in the WealthTrace Financial Planner and their income always covers their retirement expenses.

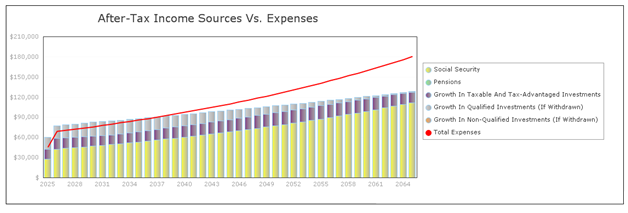

But what about in today’s low interest rate era? Take a look at the chart below.

Interest rates are just too low to cover expenses. This couple will eat into their principal and will eventually run out of money.

Dividend Payers Instead Of Bonds For Retirement

A 10 year treasury bond barely covers inflation today. So how can we expect treasuries to generate enough income in retirement? It simply won’t happen.

So let’s use solid dividend payers, such as Consolidated Edison, instead of treasuries.

What we want is a basket of stocks with similar characteristics as Consolidated Edison. Others that make the cut are Altria (MO), Wal-Mart (WMT), and Procter & Gamble (PG).

Here is Consolidated Edison’s most recent dividend profile:

|

Div. Yield |

Div. Growth |

Div. Growth |

|

|

3.3% |

2.9% |

2.2% |

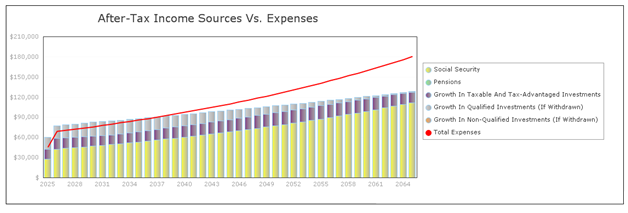

Let’s take a look at what happens if this couple places half of their investments into our dividend payers rather than all in treasuries:

Ah, that’s more like it. Now they are once again covering retirement expenses with income, all due to the dividends they are seeing.

It’s not easy to find great dividend payers who can help you cover your expenses. But there are still great companies out there who have a long history of never cutting their dividends, even through recessions.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find out. ...

more