Can This Retailer Possibly Pay Its 5.2% Dividend?

Retail is a tough business these days. Amazon is a big bully, taking a lot of retailers’ lunch money. Other online stores are also making it tough for their brick-and-mortar competitors.

That’s why store closures are on record pace. So far this year, there have been 2,880 announced closures. Ten retailers have declared bankruptcy.

Macy’s (NYSE: M) makes up some of those 2,880. The department store operator has announced 68 store closures, and another 30 are expected.

Macy’s pays a fat 5.2% dividend yield, in large part because of the stock’s dismal performance. It’s fallen 27% in the past year.

Net income was nearly cut in half last year and was down 60% compared to 2014.

So can Macy’s continue to pay that juicy $1.51 per share in dividends each year?

The good news is that, according to cash flow, it can.

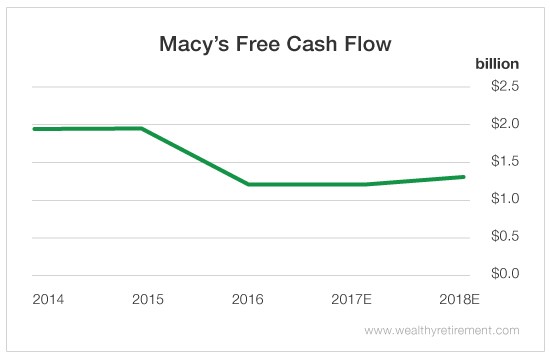

In 2016, the company generated $1.2 billion in free cash flow, while paying out $489 million in dividends, for a payout ratio of just 41%. That gives Macy’s plenty of room to pay the dividend, even if cash flow continues to fall.

It’s not expected to fall, however. This year, free cash flow is projected to be flat. In 2018, it should inch up to $1.3 billion.

Even though free cash flow can sustain the dividend, it has been heading in the wrong direction over the years, and SafetyNet Pro doesn’t like that. We want to see cash flow growing, not contracting.

Macy’s recent dividend history is solid. It has raised the dividend every year since 2011. However, it cut the payout in 2009, which earns it a penalty from SafetyNet Pro. Dividend cuts are an unforgivable sin in my book (and SafetyNet Pro’s).

So although the company can afford the dividend at current rates, the declining cash flow and 2009 dividend cut make the dividend safety rating poor.

If free cash flow rises this year, Macy’s could get an upgrade early next year.

For now, the dividend must be considered rather unsafe.

Dividend Safety Rating: D

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

Good investing,

Marc

Disclaimer: Nothing published by Wealthy Retirement should be considered ...

more