Blue Apron: A Pricey Meal Ahead Of The IPO

Summary

Meal-kit service company Blue Apron Holdings Inc. (NYSE: APRN) filed an S-1/A with the Securities and Exchange Commission outlining the details of its upcoming initial public offering set for Thursday, June 29, 2017.

The company plans to sell 30 million shares at a marketed price range of $15 to $17, and it has an additional 4.5 million shares as an overallotment option for its underwriters. Assuming it prices at the mid-point of its proposed price range, it would command a fully generated market cap value of $3.06B and trade at a price/sales ratio of 3.57x.

We previewed the deal for our premium subscribers.

Underwriters include: Goldman Sachs & Co. LLC, Morgan Stanley, Citigroup, Barclays, RBC Capital Markets, SunTrust Robinson Humphrey, Stifel, Canaccord Genuity, Needham & Company, Oppenheimer & Co., Raymond James and William Blair.

We first covered the deal on our IPO Insights Platform. We were initially bearish on the deal due to high customer churn and no growth on a revenue-per-customer basis.

The recent acquisition of Whole Foods (NASDAQ:WFM) by Amazon (NASDAQ:AMZN) increases our bearish outlook; however, a 3.57x price-to-sales ratio is on the lower end for e-commerce start-ups. The company will need to show it can earn more money from customers and reduce churn in order to ease investor concern.

Business Overview

Blue Apron was founded in 2012 and pioneered in the now popular meal-kit delivery service. Based in New-York, NY, the company’s mission is to make incredible home-cooking accessible to everyone. The company delivers pre-portion ingredients and recipes to customers to then prepare a home-cooked meal. The goal is make cooking at home easier by eliminating the need to search for recipes or grocery shop, as well as reduce waste, as customers are given just the amount of each ingredient needed.

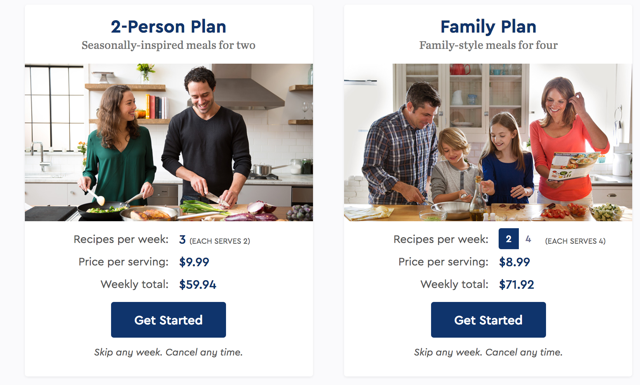

The company offers a 2-person meal plan and a family meal plan. The 2-person meal plan provides three meals a week for two people, for a price of $59.99 per month. The family plan provides two meals each week, for four people, for a price of $71.92. Customers provide food preferences and can make a selection each week from several meal options. In September 2015, the company launched Blue Apron Wine, a wine delivery service that sends six 500ml bottles per month for $65.99 per month. The wines made to pair with Blue Apron meals are purchased directly from vineyards and sent directly to customers

(Company Website)

Since inception, the company has delivered 159 million meals to homes throughout the U.S. for a total of 25 million paid orders.

The company has raised $193.8M in five rounds of financing. Notable investors include: Bessemer Venture Partners, Fidelity Investments, and Stripes Group.

Executive management overview

Matthew B. Salzberg co-founded Blue Apron and has serves as chief executive officer, president and a director of Blue Apron. Previously, Salzberg worked as a senior associate of Bessemer Venture Partners from June 2010 to Jan. 2012 and as an analyst with the Blackstone Group from June 2005 to June 2008. Salzberg holds an undergraduate degree in economics from Harvard College and a Master of Business Administration from Harvard Business School.

Bradley J. Dickerson is the chief financial officer of Blue Apron. He previously served as the CFO of Under Aromour Inc. from March 2008 to Feb. 2016 and as its vice president of accounting from Feb. 2006 to Feb. 2008. He has financial experience dating back to 1994 and holds a Bachelor of Science in accounting from the University of Akron and Master of Business Administration from Loyola University.

Financial highlights and risks

The company has shown tremendous revenue growth, increasing from: $77.8M, $340.8M, and $795.4M in 2014, 2015, and 2016, respectively. This growth has largely been fueled by new customers, as revenue per customers has remained flat. Operating margins are improving. In 2014 COGS represented 92% of revenue, versus 77% in 2015, and 70% of revenue in 2016. To grow at such a fast rate, Blue Apron has spent heavily on marketing. Marketing spend was $51M and $141M in 2015 and 2016, respectively. The company has generated a net loss every year since inception. Net loss was $47.0M and $54.9M in 2015 and 2016, respectively.

(S-1/A)

Conclusion: Consider Caution

Investors appear cautious on Blue Apron, particularly after the Whole Foods acquisition.

At its current valuation, Blue Apron is trading well below other recent tech IPOs. However, its valuation is well above if being compared to the grocery industry (Whole Foods was acquired from Amazon as a 0.9x price/sales ratio).

Blue Apron has proven itself successful at getting inside customer homes, and we predict it will continue to expand its offering with new products like the recent addition of wine.

At this time, we feel too many unknowns exist for both the industry and company; for that reason we recommend avoiding this IPO and waiting for further progress.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in APRN over the next 72 hours.

Disclaimer: I wrote this article myself, and it ...

more