Bears In The Balance

Well, Wednesday was kind of a disappointment. It started off great, but once oil started firming (and, even moreso, energy stocks), things started to turn south. Gains from CMG and TLT ameliorated the damage, but on the whole, yet another “turnaround” day stunk up the place for the bears.

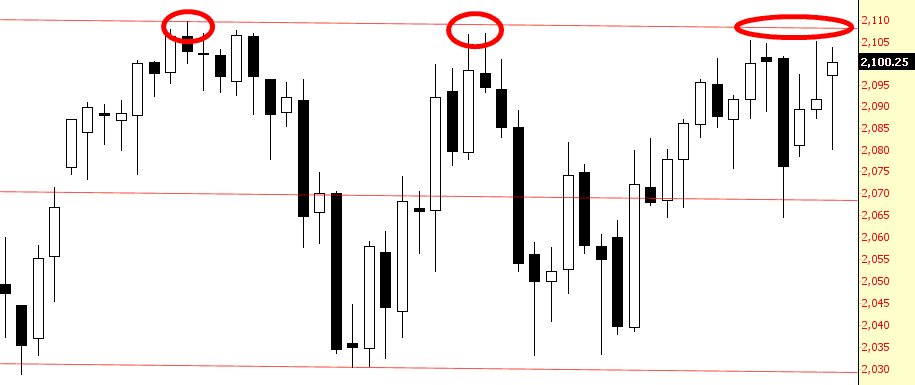

The more important risk, though, is where prices are relative to patterns. For the ES in particular, I am nervously eyeing a potential breakout above the channel which has been in place for nearly three solid months now. If it does, I may find myself exploring exciting opportunities in the world of vinyl home siding.

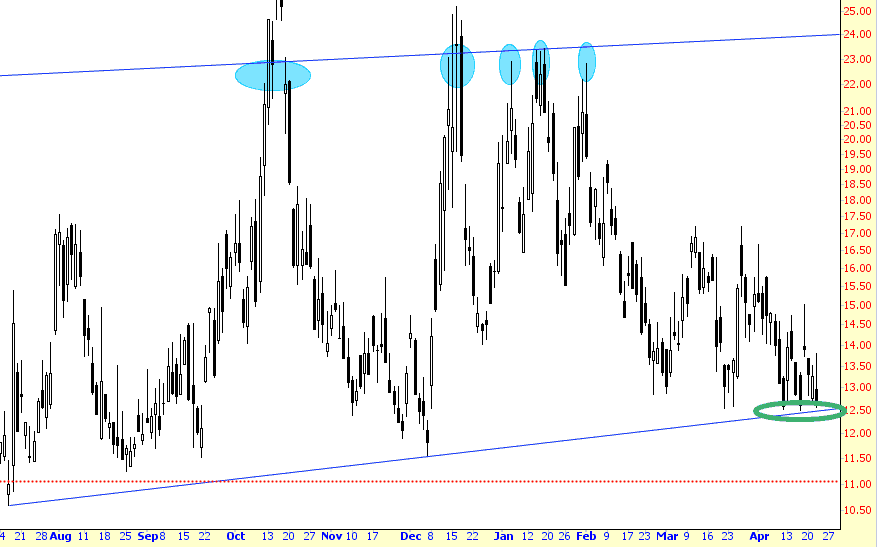

Were the asset-inflators to garner yet another victory in a long string of CB-fueled victories over the past six years, we can probably expect the poor, battered VIX to snap below its supporting trendline. It’s already sub-teens right now, but in this new world of utter complacency, even single digits could be possible.

The last meaningful sell-off……….not bear market, just a good sell-off……….was four freaking years ago. These days, it seems that the market can’t put together more than two or three down days, tops, in a row. The only persistent bear market these days is the graph measuring my interest in it.

This blog is not, and have never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more