Bearishness In Apple, 3D Systems And MannKind Dominate Value Investors

(Click on image to enlarge)

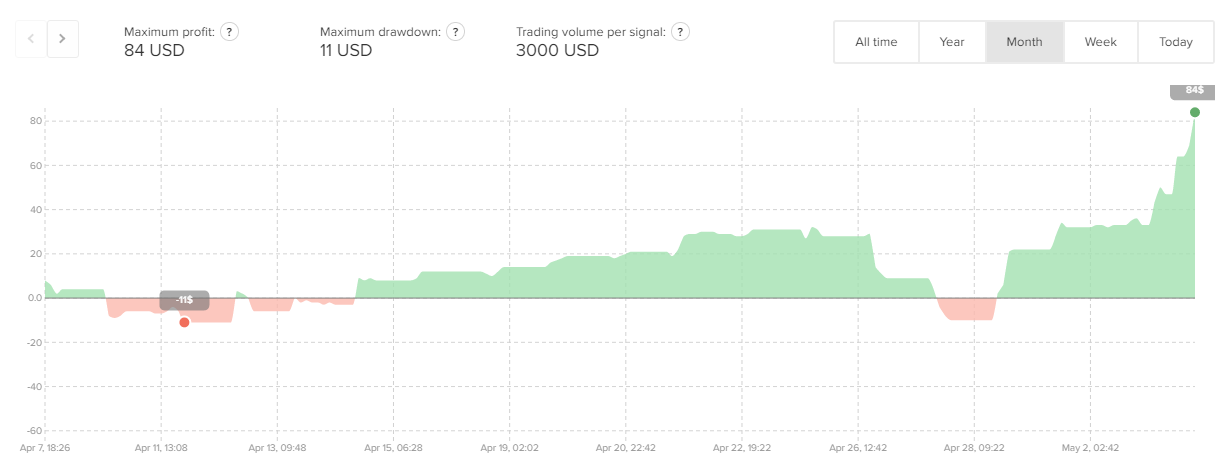

Bottom Fishing for Value by Chris Lau

The over 900 percent total ROI for Bottom fishing for value strategy benefited from the sell call on Cray Computers (CRAY). True to form of an overvalued supercomputer supplier, Cray dropped after reporting very weak quarterly results. In the same space, Nuance Communications (NUAN), best known for powering Apple Siri voice recognition, continued its fall. There are two fundamental problems with Nuance. First, Google is opening its API and code for its own voice recognition IP. Second, Nuance’s foray into health care is very slow. Both mean the stock fell from $17.36 to $16. This net an ROI of 42%. 3D Systems (DDD) surged after a great quarterly report, but profit-taking meant a 49.6% ROI for the bearish write-up.

Apple (AAPL), a value investor favorite, fell on two negative events. Quarterly results asserted growth is falling from this point. Carl Icahn “pumped” Apple and once gave an over $200 price target. He quietly sold the stock ahead of everyone else. AAPL is a sell idea at $104 and closed at $94.23.

The micro cap value stock ideas continues to recover. Bearish views on Cliffs Natural Resources (CLF), InvenSense (INVN), and MannKind (MNKD) played out. The bullish target price for Advanced Micro Devices (AMD) will take time to mature. The company’s Zen release and higher sales for graphics cards make a $4 stock price possible.

Disclosure: None.

To view details on all stock ideas and strategies discussed, click here. Access is free.