Are Berkshire Hathaway's Portfolio Modifications In Accordance With Warren Buffett's Principles?

Investors seeking diversified low-risk investment with a significant return might consider Berkshire Hathaway (BRK-B) stock. The main reason to consider Berkshire's stock is the company's legendary chairman Warren Buffett, who has achieved tremendous success in the past. However, is Mr. Buffett's past success has been repeated in the last few years? Is it not better to invest in the S&P 500 index, after all, it is more diversified than Berkshire's portfolio?

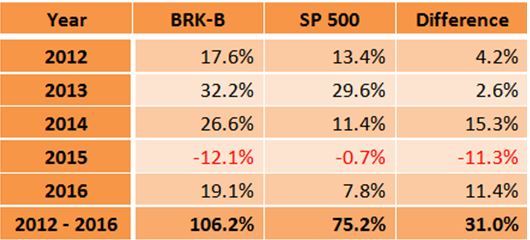

Let's see the last five years results. BRK-B stock has outperformed the S&P 500 index in four of the last five years, except in 2015. Since the beginning of 2012, BRK-B stock has gained 106.2%, while the S&P 500 Index has increased 75.2%, as shown in the table below. That is clearly good results for a diversified portfolio that Berkshire holds.

Yearly Price Change

Investors might wonder if Berkshire's portfolio of public companies can continue to outperform the market? Meanwhile, on November 14, the company reported in its 13-F filing its holding as of September 30, 2016. There were some interesting changes in Berkshire's holdings from the previous report referring to its holdings on June 30. As such, I will try in this article to evaluate if the modifications are in accordance with Warren Buffett's principles of the disciplined method of value investing. Although there were changes in 19 different shares holdings, I will focus only on the most significant modifications.

Sell

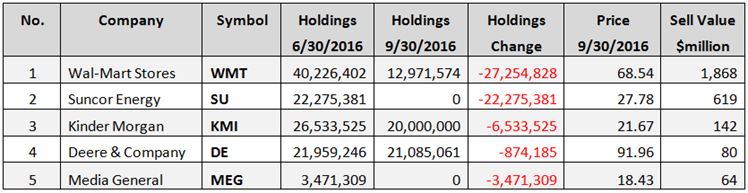

The table below shows the five largest sells-of different stocks in the quarter, the number of shares on June 30, and September 30, the number of shares sold, and the value of the transactions if they were sold on September 30.

(Click on image to enlarge)

The largest transaction was at Wal-Mart Stores (WMT) valued about $1.9 billion, Berkshire sold about 68% of its holding in that company. The second largest was at Suncor Energy (SU) where Berkshire liquidated all its holdings. Berkshire also liquidated all its holdings at Media General (MEG). The company also decreased its holdings in Kinder Morgan (KMI) by 24.6%, and in Deere & Company (DE) by 4%.

Buy

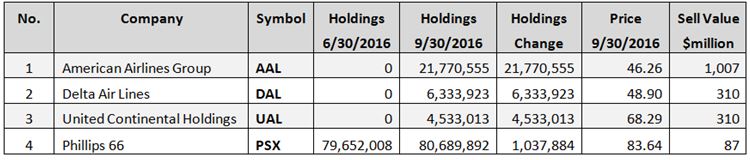

The table below shows the new investments in three airline companies and the addition of shares in the refining company Phillips 66 (PSX).

(Click on image to enlarge)

Berkshire invested about $1 billion in American Airlines Group (AAL), about $310 million in Delta Air Lines (DAL) and in United Continental Holdings (UAL), and about $87 million to add shares of Phillips 66.

Valuation Comparison

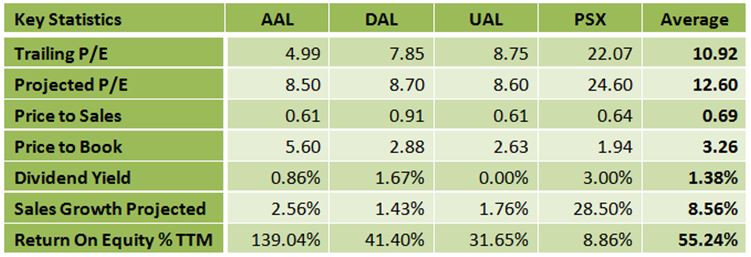

The tables below show some important valuation metrics for the shares bought and sold in the recent quarter.

Stocks Bought

(Click on image to enlarge)

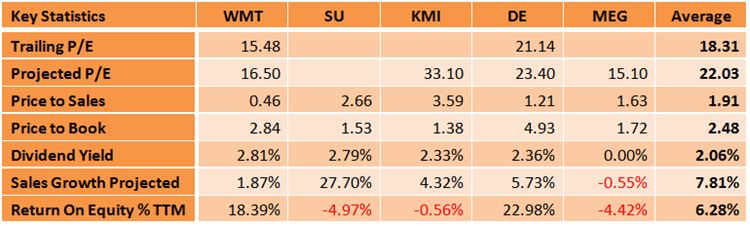

Stocks Sold

(Click on image to enlarge)

Source: Portfolio123

The tables clearly show that Berkshire has continued to react according to Warren Buffett's principles of the disciplined method of value investing. The bought new stocks have low P/E ratio and low price to sales ratio, while three of the five sold companies have suffered a loss in the last four quarters. Also, the return on equity of the bought companies was significantly higher for the purchased stocks.

Conclusion

BRK-B stock has outperformed the S&P 500 index in four of the last five years, except in 2015. As I see it, Berkshire Hathaway can continue to beat the market due to its consistent method of smart stock picking based on value parameters and holding the stocks for the long run. The new changes in its portfolio were done in accordance with Warren Buffett's principles of the disciplined method of value investing. In my view, investing in BRK.B's stock could be an excellent solution for investors looking for a diversified low-risk investment with a substantial capital appreciation potential.