Applied Materials Is A Buy

Applied Materials (AMAT) is a stock we consider attractive under $50. We have successfully traded this name in the past for nice returns around the $50 level in just a few days to weeks. We see that situation setting up again as the company is taking another BAD BEAT following daily news out of China, including trade and tariffs, as well as a hawkish Federal Reserve, which was leading to a little more selling here, and a little more selling there. Guess what? Shares are back to $49.02 at the time of this writing, so we have got to discuss the name again.

Source: Applied Materials Website

We still believe any time under $50 this name is a buy. Today, shares are facing pressure over ongoing concerns with China, and outlook concerns, despite the outlook being positive, and the stock delivering earnings that were a top and bottom line BEAT.

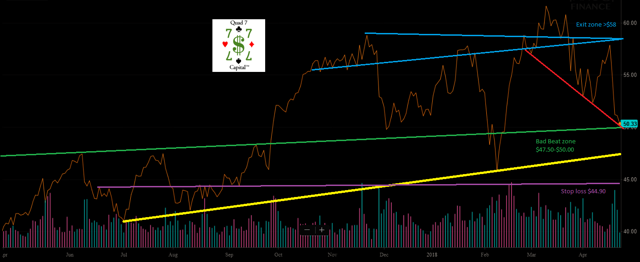

To be clear, we thoroughly like this name under $50. Take a look at the 6 month chart

As you can see, our call was prescient, and even before today the stock was a few points off recent highs. But with today's selling, you can get likely go long again for a few weeks.

China is still an issue in the Street's mind

Doesnt seem to matter that the stock BEAT expectations and guided in line with prior expectations. That wasnt good enough. The selling bringing the stock to under $50 is being justified by future sales concerns that are associated with China. Just what are we talking about here?

Source: China News Daily

So what is the issue with China? Well with the threat of a trade war with the U.S. still a possibility, Chinese officials have continued to push forward a plan to boost their own domestic semiconductor production.

This semiconductor chip development focus out of China is a key component to its "Made in China 2025" initiative. Investors panicked last month, and are using this tired excuse to sell a quality company once again, giving us a fair price to capitlalize on the BAD BEAT Price. Interestingly, our technical zones are still in play from the last trade:

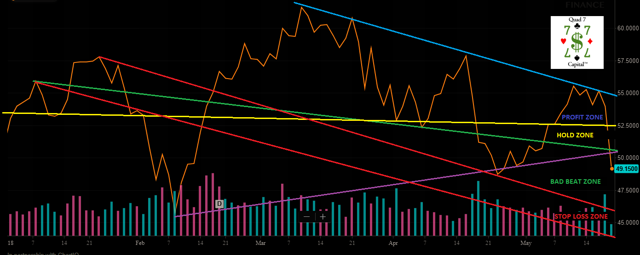

Now let us hone in on that 6 month chart and define some new zones. What we found interesting is that much of the same patterns hold, and in trading, a week can be an eternity for a chart, let alone a month. Here is an updated view:

From what we are seeing, the $49-$47 zone looks like a solid technical entry point driven by this somewhat irrational selling, while profit can be taken at $52 or above. We are keeping a stop loss at $45.50 as dipping below this would be a breakdown.

Performance, not just technicals, support a buy

We have to reiterate that China is way behind the times here when it comes to this space. It is a simple fact that Chinese semiconductor firms are technologically far behind their competitors in the U.S., Japan and Europe. There is little to debate. The Street is trying to say AMAT will falter because of China's efforts, but this would be years from now. Talk about taking early profits!

Essentially, we are not overly concerned with competition here. Competition from Chinese chip makers just isn’t coming anytime soon and so we think this pullback has pushed shares to an oversold level.

This is a BAD BEAT. The company is doing everything RIGHT, and being punished through no fault of its own other than the way the cards and chips are falling. We think the Street is mispricing these assets, and this is a time to consider a trade. Performance wise, the strength is evident.

AMAT has the broadest opportunity across major technology trends, and the markets where it does business are strong, with long-term growth drivers solidly in place. The company posted RECORD revenues of $4.57 billion, up 28.7% year-over-year and blew past the industry average of 11.9%. Adjusted earnings per share of $1.22 was an $0.08 beat from the consensus and a gain of 54% from the previous year. This is exceptional growth folks.

Applied Material's bottom line growth is notable as the company has consistently beat earnings estimates in the last two years.

The company is generating significant cash and returns to shareholders. The company generated $611 million in cash from operations and returned $2.6 billion to shareholders through $2.5 billion in share repurchases and dividends of $105 million.

What about valuation? Well the average earnings per share estimate for 2018 among 19 analysts is currently $4.45 per share which is a 36% increase from the 2017 actual numbers. At this level of 2018 earnings and a $50 price tag, we have a growth stock trading at just 11.0 times forward earnings. That is attractive.

The company itself sees a strong outlook for Q3. It is eyeing a 18% year-over-year increase in revenue at the midpoint $4.33-$4.53 billion and an adjusted earnings per share increase for the next quarter of approximately 36% which would put them between $1.13 and $1.21 per share.

Cash is solid, there's bigger buyback and a boost to the dividend

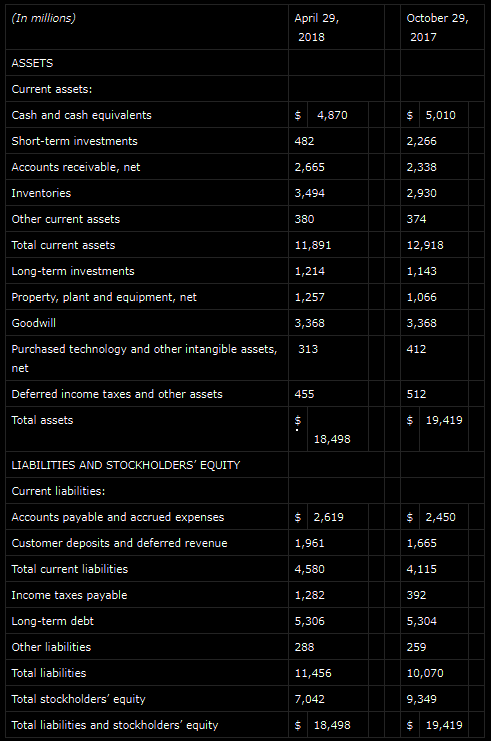

To end the quarter the balance sheet was solid.

Cash is still at $4.8 billion, while long-term debt stands at $5.3 billion. This is of little concern, investors need not stress the balance sheet. In addition, the cash is being put to work.

During the Q1 earnings call, the management reiterated its belief about strong future growth and value creation ability of the company.

The board authorized a $6 billion boost to the former $2 billion share repurchase program. It also and approved a 100% increase in the quarterly dividend, and the first $0.20 quarterly dividend is payable in June.

Risk

Although the China risk is overblown, a lot of analysts have been happy to upgrade the name of late. Target upside for some of them is $70! That is high. The Street believes revenue guidance was light, but this company is a serial guide and beat name. We would only be truly worried if revenues come in BELOW its downside number.

We could see reactionary downgrades which could drive the stock lower in coming weeks. Since the pressure is strong, continued selling could drive the shares below our target zones, thanks to the momentum. While we see this level as attractive, momentum is strong, and could push the stock lower.

In addition, the company depends on a vibrant economy, growing businesses, and advancement of technology. And large changes to the customer base, or losing contracts to competition could weigh. This is where China fears come into play a bit, but for now, the company is firing on all cylinders.

Take Home

We view the stock as a buy here at the $49 level for a trade back to the $52 range, allowing investors to pick up a nice short-term gain. Longer-term, we think the name has much more upside, but are playing this one on a week to week basis.

We are long AMAT

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like the material and want to see more, scroll to ...

more