Alteryx Lock-Up Expiration Could Send Share Price Downward

Event Overview

Alteryx (NYSE:AYX) made its market debut on March 23, 2017, raising $126 million through its offer of 9 million shares. Shares priced at $14, the high end of its initial price range of $12 to $14, then jumped 10% on its first day of trading. Since then, the stock price has continued to move up. Currently, shares are up approximately 57% from the IPO price and are currently trading at approximately $22. (9.7.17)

The 180-day lock-up period which restricted insiders ability to trade shares will expire on September 20, 2017. At this point, the company's pre-IPO insiders will be able to sell their 40M shares for the first time since Alteryx went public. This represents 68% of the total shares outstanding (see below). If even some of these shareholders decide to sell, it could have a significant downward impact on the stock. Our firms research on price movement around lockup expiration can be found here.

(Click on image to enlarge)

(S-1/A)

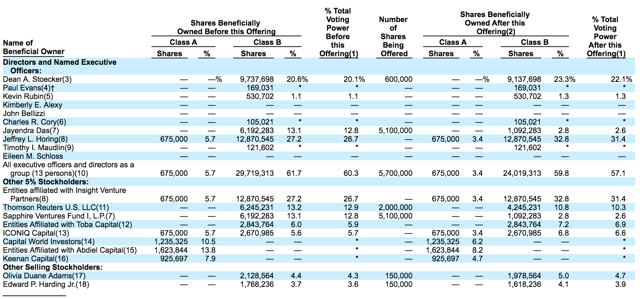

These firms and individual investors will likely be motivated to sell their positions in order to free up capital for other investments as well as cash in on gains. Company insiders include thirteen executive officers and seven outside investors including several notable VC investors (see below). We predict these VC investors will be particularly eager to recognize their large win from the investment and move capital into other projects.

(Click on image to enlarge)

(S-1/A)

Business Overview: Provider of Self-service Data Analytics Platform

Alteryx provides a self-service data analytics software platform that enables companies to improve the productivity of their business analysts thus enhancing business outcomes. It offers:

- Alteryx Designer for data preparation, blending, and analytics that is deployable both on-site and in the cloud;

- Alteryx Server, a secure and scalable product for sharing and running analytic applications in a Web-based environment;

- Alteryx Analytics Gallery, a cloud-based collaboration offering that allows users to share workflows in a centralized repository.

The company serves clients in hospitality, travel, technology, retail, healthcare, consumer goods, and business and financial services across approximately 50 countries. The company has close to 500 employees and was founded in 1997. Alteryx is headquartered in Irvine, California.

Financial Highlights

Alteryx report second quarter earnings on August 2, beating analysts expectations both on earnings and revenue. Highlights from earnings include:

- Revenue of $30.3M, an increase of 52% YOY.

- GAAP gross profit of $25.0 million, or a GAAP gross margin of 83%, an increase compared to GAAP gross profit of $16.2 million, or an 81% GAAP gross margin for the same period last year.

- GAAP loss from operations for the second quarter of $(8.1) million, compared to a loss from operations of $(7.2) million for the same period last year.

Shares jumped 10% on the positive earnings news.

Management Team

Dean A. Stoecker co-founded the company in 1997 and now serves as CEO and Chairman. His previous experience comes from senior positions at Enterprise Solutions for Integration Technologies, Strategic Mapping, and Dun & Bradstreet. Mr. Stoecker holds BS degree in International Business from the University of Colorado in 1979 and Master of Business Administration from Pepperdine University in 1984.

CFO Kevin Rubin has been in his position since April 2016. He has held senior financial positions at MSC Software Corporation, Pictage, DataDirect Networks, MRV Communications, and Arthur Andersen. Mr. Rubin holds a BA in Business Economics with an emphasis in accounting from the University of California, Santa Barbara and is a Certified Public Accountant in California.

Conclusion

After Alteryx’s tremendous market performance, we expect the stock could be poised for a dip. With 68% of shares currently restricted if any of its company insiders choose to sell around the lock-up expiration date, it could overwhelm the market and send Alteryx’s share price spiraling downward. Our firm has studied price movement around lock-up expiration and expect Alteryx shares to fall between 2% to 3% around the lockup expiration date, in line with past movement. We recommend investors who are long the stock, consider selling their position and event driven investors consider shorting the stock before the September 20 date.

Disclosure:

I am/we are short AYX.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more